CAF PRESIDENT AHMAD RUBBISHES COMOROS CAS CASE AGAINST CAMEROON

CAF PRESIDENT AHMAD RUBBISHES COMOROS CAS CASE AGAINST CAMEROON

Comoros have approached the Court of Arbitration for Sport (Cas) seeking Cameroon’s expulsion from the 2019 Afcon tournament.

Caf president Ahmad Ahmad says the case filed by Comoros at the Court of Arbitration for Sport (Cas) asking for Cameroon to be kicked out of the 2019 Afcon finals has no merit.

Cameroon was stripped of the 2019 Afcon hosting rights due to ill-preparedness and Egypt has replaced them.

Cameroon will host the 2021 edition.

Michael Madyira

ATHLETICS SA: IAAF BREACHED CONFIDENTIALITY AGREEMENT IN CASTER SEMENYA CASE

ATHLETICS SA: IAAF BREACHED CONFIDENTIALITY AGREEMENT IN CASTER SEMENYA CASE

CAPE TOWN – Athletics South Africa (ASA) has accused the IAAF and its president Sebastian Coe of breaching a confidential agreement regarding their case against the governing body concerning testosterone levels of female middle-distance athletes.

Following the conclusion of the Court of Arbitration (CAS) hearing on Friday 22 February 2019, a verdict was expected by the end of March, but there has been delays in the process with both parties having to supply new information.

Athletics South Africa said confidentiality agreements were entered into by the IAAF, Caster Semenya and ASA ahead of arbitration at CAS.

ASA has accused the athletics governing body of breaking this agreement on a handful of occasions.

The stinging rebuke from ASA follows a statement from Semenya’s lawyers earlier this week condemning Coe’s insensitivity concerning DSD or high testosterone athletes in an interview.

ASA also pointed to the IAAF’s public criticism of a resolution adopted by the Human Rights Council of the UN which supported Semenya’s fight and described the proposed regulations as “discriminatory”.

In another big swipe, ASA added that the IAAF’s lack of empirical evidence regarding the link between testosterone and performance is the reason for the delay in a verdict from CAS.

According to ASA, the IAAF has again failed to provide evidence in the proceedings before CAS and has now sought to amend the original regulations, essentially now saying female athletes targeted by the DSD regulations are in fact “biologically male”.

Michael Madyira

COURT ORDERS DJIBOUTI TO PAY $385M FOR EXCLUSIVITY BREACH: UAE NEWS AGENCY

COURT ORDERS DJIBOUTI TO PAY $385M FOR EXCLUSIVITY BREACH: UAE NEWS AGENCY

Court finds that Djibouti breached DCT’s rights by developing new container port.

The United Arab Emirates said on Thursday that the London Court of International Arbitration had ordered Djibouti to pay Doraleh Container Terminal (DCT), partially owned by DP World, $385 million plus interest for a breach of exclusivity.

UAE state news agency WAM said that the court had found that Djibouti had breached DCT’s exclusivity rights by developing new container port opportunities with China Merchants, a Hong Kong-based port operator.

The government of Djibouti seized the Doraleh Container Terminal from DP World in February over a dispute dating back to at least 2012.

YOUNG CRCICA FORUM LAUNCH EVENT: THE NEW FRONTIERS OF ARBITRABILITY: EXPANSION AND DIVERSITY

YOUNG CRCICA FORUM LAUNCH EVENT: THE NEW FRONTIERS OF ARBITRABILITY: EXPANSION AND DIVERSITY

Wednesday 27 March 2019 marked the birth and official launch of the “Young CRCICA Forum” through an event entitled “The New frontiers of Arbitrability: Expansion and Diversity” hosted at the Cairo Regional Centre for International Commercial Arbitration (“CRCICA”), followed by a cocktail dinner at Hilton Cairo Zamalek Residences Hotel which was sponsored exclusively by Shahid Law Firm (Cairo).

The Young CRCICA Forum is head by its Chairman Amani Khalifa, its Vice Chairman Mohamed Hafez (Counsel and Legal Advisor to the Director, CRCICA) and Vice Chairman Abdallah El Shehaby (Attorney at Law, Egypt)., Similar to youth forums of other international arbitral institutions, Young CRCICA is open to those aged under 40 and provides a variety of opportunities for individuals to gain knowledge, develop their skills and understand arbitral procedure and other dispute resolution services. Young CRCICA will be holding a series of events and seminars that give young professionals the chance to discover and develop best practices, discuss topical issues and network with experienced practitioners.

The Young CRCICA Forum launch event “The New frontiers of Arbitrability: Expansion and Diversity” was met with a great success as it had over 115 attendees diversified with Egyptians, French, Syrians, North and Sub-Saharan Africans, Saudi Arabian and many other nationalities including amongst them legal practitioners, judges, academics, university students, engineers and many other fields.

The program of the event kicked off by an introductory speech given by Ismail Selim, the Director of CRCICA, by welcoming all the attendees to the event and emphasizing the importance of the younger generations in taking the chance to participate in the Young CRCICA Forum. By way of demonstrating such efforts, Ismail Selim introduced the signing of the MoU between CRCICA and the Faculty of Law, British University in Egypt (“BUE”), which was represented by its Dean Prof. Hassan Abdel Hamid who gave a short speech discussing the future collaboration between the Faculty of Law of BUE and CRCICA. This was followed by the signing of another MoU between CRCICA and the Faculty of Law, Cairo University, which was represented by its Dean Prof. Sabry El Senousy who in turn gave a short speech on the futuristic cooperation between the Faculty of Law, Cairo University and CRCICA in the field of arbitration.

Following the signings of the MoUs, the Chairman of the Young CRCICA Amani Khalifa gave an introductory speech officially welcoming all the attendees and emphasizing the excitement attached to the launch of Young CRCICA. As the role of the Young CRCICA Forum, aims to help and aid the younger generations the chance to participate and discuss topical issues and network with experienced practitioners which Young CRCICA shall provide in future events and conferences.

Ismail Selim then requested everyone to stand a minute of silence to mourn the loss of the prominent Arbitrator Professor Ahmed Sadek El- Kosheri who passed away on Sunday 17 March 2019 followed by this. Selim then delivered his keynote speech, where he amplified CRCICA’s role in guiding and helping the younger generations in the field of commercial arbitration and the role of arbitral institutions through periodical courses and seminars, as well as the support of CRCICA to students in participating in Moot Courts. Further, Selim mentioned that CRCICA would support the younger generations and aid them in exploring their talents for assuming arbitral justice and institutional arbitration. To turn these words into action, CRCICA has decided to launch the Together they shall be responsible for organizing future events, seminars and conferences as well as selecting the topics of discussions and speakers. Ismail Selim then moved to introducing the main topic of the event “The New frontiers of Arbitrability: Expansion and Diversity”, where he mentioned the importance of the notions of arbitrability and public policy, being at the heart of arbitration laws, how both notions are inter-related yet diversified. Also, how both notions draw the borders of arbitration and what falls under their realm against how the judiciary’s jurisdiction could be affected by them.

The event was divided into two sessions, the first session’s discussion was on “Arbitrability” and the second session’s discussion was on “Public Policy”. Mr. Abdallah El Shehaby moderated the first session and Dr. Mohamed Hafez moderated the second session. At the beginning of both of sessions, both moderators presented to the audience that they shall address a series of questions relating to the subject of the session, whereby the panelists of each session shall provide their answers and comments relating to the question raised. However, in the aim of keeping the session fully interactive, both moderators requested from the attendees to feel free to stop the panelists at any time, ask as many questions, and provide comments relating to the subject of the session at any time.

Mr. Abdallah El Shehaby moderated the first panel on Arbitrability and its panelists were Ms. Inji Fathalla (Senior Associate, Shahid Law Firm, Egypt), Mr. Fahad Al Dehais (Managing Partner, Al Dhabaan & Partners in association with Eversheds Sutherland International LLP, Saudi Arabia) and Mr. Ahmed Habib (Senior Associate, Leboulanger & Associés, France). Among the many questions raised during this session:

- What is arbitrability or the ability to arbitrate?

- How does the notion of arbitrability affect the investment climate and its limits?

- How does the notion of public policy affect arbitrability and its impact on international disputes?

- Which is the competent authority in identifying matters of public policy and arbitrability, arbitral tribunals or state courts? What if the arbitral award contradicts with court’s judgment on the same matter?

- What is the view of Saudi Arabian courts on public policy and arbitrability? and how does this affect recognition and enforcement of foreign arbitral awards awarded against state entities?

- How is this matter dealt with in relation to administrative contracts in Egypt? and what are their effects on direct foreign investments?

- How does the French courts interpret public policy in light of specific matters subject to arbitrability?

- What are the most important subjects which are debatable as to whether they are arbitrable or not in accordance with Egyptian Law?

Dr. Mohamed Hafez moderated the second panel on Public Policy and its panelists were Ms. Sally Kotb (Counsel, Baker & McKenzie (U.A.E.), Ms. Leyou Tameru (Legal Consultant and the Founder of I-Arb Africa, Ethiopia) and Mr. Mohamed Abdel Rehiem, Senior Associate, Eversheds & Sutherland, U.A.E.). Among the many questions raised during this session:

- What is the definition of public policy under various jurisdictions, including that of the New York Convention of 1958? Can public policy ever have an expansive definition with the diverse seats of arbitration being chosen?

- What are the types of disputes that are considered non-arbitrable on grounds of public policy under various jurisdictions? Has there been any evolution in recent years?

- What is the role of counsel in identifying public policy issues and foreseeing public policy related matters at the very beginning of the arbitration?

- Can an arbitral tribunal decide on a public policy issue if it is raised in an initial jurisdictional challenge (would the ‘competence competence’ principle apply where the arbitral tribunal’s jurisdiction is challenged based on a public policy issue)?

- How has public policy been invoked in the context of enforcement of arbitration awards? Can it be used as a delay tactic or a fundamental risk regarding recognition and enforcement of arbitral awards and how to avoid it?

- Can an arbitral award be recognized and enforced in part if it is partially in conflict with a public policy rule?

The panelists from both sessions provided their answers and comments to the above questions on arbitrability and public policy. The audience was quite lively interactive by asking many interesting questions relating to various jurisdictions on the matters of arbitrability and public policy, which the panelists were more than happy to respond to and comment on.

Finally, Ismail Selim delivered his closing remarks by thanking all the attendees for their lively participation and how the sessions were quite interactive and requesting them to be up to date with all futuristic events to be announced by the Young CRCICA Forum. Again, Ismail Selim requested everyone to stand a minute of silence to mourn the loss of Ms. Suzane Aboul Farag, CRCICA’s long serving simultaneous translator who died tragically in the very recent crash of the Ethiopian Airline Boeing.

The event was followed by a cocktail reception at the Hilton Cairo Zamalek Residences Hotel – Terrace Area by the pool where all the attendees were invited to join for social networking and to discuss topics relating to the topics of the event and the Young CRCICA Forum.

Oliver Chisenga

LAKSHMI MITTAL VS RUIAS: STEEL TYCOONS FIGHT OVER $1.5 BN ARBITRATION AWARD

LAKSHMI MITTAL VS RUIAS: STEEL TYCOONS FIGHT OVER $1.5 BN ARBITRATION AWARD

“Hide all docs,” the email read. In a second message, the employee urged a colleague to conceal a laptop.

A squad of lawyers and computer specialists from ArcelorMittal was at the London offices of a company controlled by the Ruia family’s Essar Group, as part of efforts to seize assets relating to a $1.5 billion US arbitration award. And a team working for Essar scion Prashant Ruia were out to stop them.

Lakshmi Mittal has opened a new front in the UK in a worldwide legal battle with the Ruia family. Set against the backdrop of an ongoing tussle for an Indian steelmaker, the billionaire has accused his fellow Indian tycoons of hiding funds through a series of sham transactions within the Essar Group.

So far not one cent of the US award–owed to ArcelorMittal following the collapse of an iron-ore contract–has been paid. The case has moved to London, with Mittal, on one side, and Prashant Ruia, the eldest son of Essar founder Shashi Ruia on the other, awaiting a judge’s ruling on the legality of the search.

The Ruias must have thought they had “successfully hidden behind the battlements,” ArcelorMittal’s attorney, Anthony Peto, said at a court hearing last week. “They felt they were safe: they were not.”

For ArcelorMittal, Essar’s Lansdowne House offices may be the key to tracing the group’s assets. That’s because a company in the building, just minutes from London’s Ritz Hotel, had acted as a financial controller for various Essar units. Not only was a group server found on the premises, but company accounts pointing to where the money had gone.

But for Essar, which settled another London lawsuit earlier this year where creditors sought the seizure of a yacht and an oil refinery, the case is an example of judicial overreach. A UK court should have no jurisdiction over an American award against a company incorporated in Mauritius, Essar Steel’s attorneys argued.

“This is a case of the English court being asked to act not just as the world’s policeman, but as its detective agency as well,” Essar Steel’s lawyer Daniel Toledano said.

Last week’s hearing “was the first opportunity for those Essar entities (and individuals) to fully argue their position in opposition to them,” a spokesman for Essar said in an email. “Judgment on these matters is still awaited and as such we are unable to comment further.”

ArcelorMittal’s team faced obstacles from the start of their search. One employee, Rupal Popat, sent two emails to Sanjiv Radia urging him to hide documents and a laptop. Radia “reprimanded Popat for sending the email” but Popat then sent the second message anyway, Peto said. Attorneys for Radia and Popat declined to comment.

The employees at Lansdowne House were all “dancing to a tune played by the Ruias,” Peto said, arguing that Popat was unlikely to have acted on her own initiative.

In court documents, the British Essar unit sought to downplay the emails, calling them the work of a junior employee.

“Essar Capital Services does not seek — how could it? — to excuse those suggestions which were quite improper,” Paul Stanley, a lawyer for the U.K. subsidiary, said in his submission. “Her suggestions were not acted on; documents were produced.”

The dispute is taking place alongside a yearlong battle in India, where Lakshmi Mittal, India’s third-richest man, is nearing a $5.9 billion acquisition of an insolvent steelmaker formerly owned by the Ruias. The family is still seeking to challenge the deal in court.

Meanwhile the ruling in the Minnesota arbitration case, which ArcelorMittal is trying to enforce in London, arose out of a terminated contract to supply iron-ore pellets. But Essar Steel Ltd., which had assumed the liabilities of the U.S. contract, has said it couldn’t pay. It now has less than $2.5 million in assets.

One document uncovered in the U.K. search tells a different story, according to ArcelorMittal’s lawyer. Essar Steel’s 2016 filing of its accounts described how the firm reclassified almost $1.5 billion in assets that put them out of reach of any potential creditor, Peto said.

“They couldn’t really cover up the existence of the $1.5 billion lie,” he alleged.

(With assistance from Swansy Afonso)

EGYPT- BRITISH PETROCELTIC FILES ARBITRATION CASE AGAINST EGPC

EGYPT- BRITISH PETROCELTIC FILES ARBITRATION CASE AGAINST EGPC

(MENAFN – Daily News Egypt) British Petroceltic announced on Sunday filing an arbitration case against the Egyptian General Petroleum Corporation (EGPC) at the World Bank Group’s International Centre for Settlement of Investment Disputes (ICSID), according to a statement by the company.

The EGPC reportedly breached its obligations in several gas sales agreements and was not able to pay its debts in time, Petroceltic added, noting that the company’s decision will negatively reflect on Egypt’s global reputation as a good investment destination, especially in the energy sector.

‘It wasn’t easy for us to commence arbitration proceedings against Egypt,’ Petroceltic’s Chairperson, Angelo Moskov, said, adding that the company has deeply studied its decision.

‘We think that we didn’t enjoy a fair treatment which obviously infringes the international agreements between the Egyptian and the British governments,’ he stressed, noting that the current situation is unacceptable and needs an urgent solution.

On 12 February, Petroceltic said that it plans to commence arbitration proceedings in the ICSID against the EGPC for the Egyptian corporation’s inability to pay its debts as they are due for payment.

‘I would strongly urge the EGPC to rectify its current default without further delay in order to restore cordial relationships between our two respective companies and to send a positive message to the international investment community,’ Moskov said in an earlier statement in February.

Petroceltic’s core area of operation in Egypt was in the onshore Nile Delta, where it held a 100% operated interest in eight producing fields in 14 development concessions in the El Mansoura, South East El Mansoura, and Qantara areas, the company’s website mentioned.

The field development operations were managed through a joint operating company, called Mansoura Petroleum Company, jointly owned by Petroceltic and the Egyptian government. In addition, Petroceltic has a 37.5% stake in the El Qa’a Plain exploration concession, operated by Dana Petroleum, the website explained.

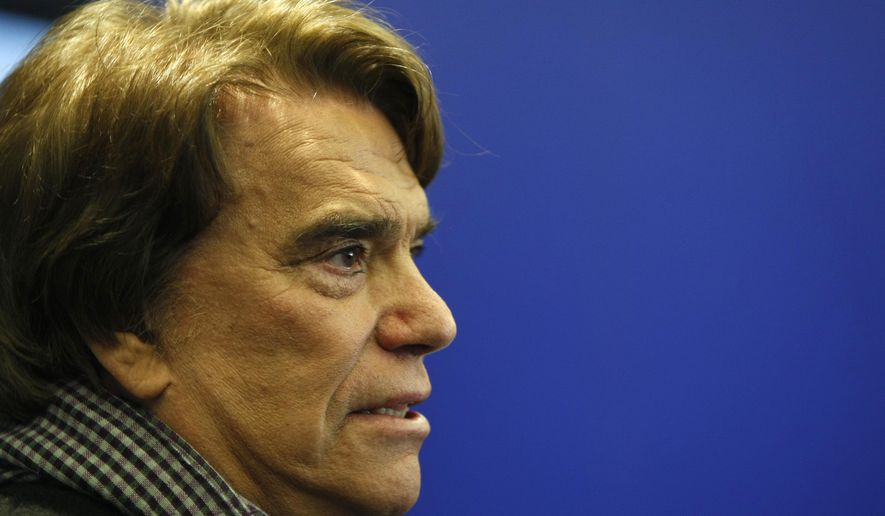

FRENCH TYCOON ON TRIAL OVER $450 MILLION ARBITRATION DEAL

FRENCH TYCOON ON TRIAL OVER $450 MILLION ARBITRATION DEAL

The claimants, General Electric and Mytilineos SA (Société Anonyme) limited have been granted interim measures by an ICC tribunal in a dispute against an Algerian state owned entity. The ICC three member tribunal administered its powers to grant interim measures under Article 28(1) of the ICC Rules of Arbitration. In this way, the court deemed it appropriate to rule on the Claimant’s request for interim arbitration by virtue of signing the Terms of Reference which sets out a clause allowing “ order of any provisional or conservatory measures”.

As it may, in April 2022 the Algerian government was given an opportunity to respond to the request for Interim measures prior to a final decision. Furthermore, the tribunal set forth directions for the Algerian government to suspend any action to collect bank guarantees and in response sought implementation of the guarantees instead.

In a final decision by the ICC tribunal affirmed that difficulties between the Parties pertaining to interpretation or execution of the order for interim measures shall be settled by the Court of Arbitration. Overall, General electric persuaded a New York state court to enforce the aforesaid measures relating to the US$234 million power plant project.

MAMBILIMA URGES PROMOTION OF ALTERNATIVE DISPUTE RESOLUTION

MAMBILIMA URGES PROMOTION OF ALTERNATIVE DISPUTE RESOLUTION

CHIEF Justice Irene Mambilima says litigation is adversarial as it tends to be very acrimonious and often leaving litigants financially and emotionally bruised.

Speaking at Radisson Blu Hotel during the Alternative Dispute Resolution Open Day organised by the Zambian branch of the Chartered Institute of Arbitrators, Chief Justice Mambilima said she had taken keen interest in ADR because it had great potential to resolve disputes in timely and less costly manner.

“In times such as these, when the nature of transactions between commercial entities and individuals is becoming more and more complex, it is imperative to have quicker and dispute resolution mechanisms besides traditional court litigation,” she said.

“As you may be aware, the court processes often take too long to conclude, causing congestion in our judicial system. And in many instances, we have found that not all of these disputes require court intervention. As the Judiciary, we recognised this deficiency and revived court-annexed mediation to decongest courts and speed up delivery of justice. This initiative is ongoing and has been well received by both litigants and counsel.”

Chief Justice Mambilima, however, emphasised that there was still a lot more to be done.

She said there was need to expand the options for dispute resolution.

“It is my hope that through this event, measures to promote ADR as an alternative to litigation can be stepped up so that courts can be left to deal with deserving cases. Globally it is accepted that ADR mechanisms such as reconciliation, adjudication, mediation and arbitration are effective and efficient in resolving disputes. The mechanism provides a much more sustained and mutually beneficial resolution of conflicts through negotiation,” justice Mambilima said.

She said Zambia had embraced mediation in the judiciary through the introduction of the court-annexed mediation in 1997.

Justice Mambilima explained that individuals drawn from various professions were trained as mediators thereafter.

She added that after 2013, a good number of mediators were trained through joint programme between judiciary and the CIArb-Zambia.

Chief Justice Mambilima said mediation was a well-known mechanism with a huge impact worldwide.

“Mediation has been applied in labour-related matters, divorce and other family matters as well as in insurance claims. I strongly believe there is still room to expand the areas of law in which cases can be referred to mediation,” she said.

Chief Justice Mambilima said ADR arbitration was now gaining momentum in Zambia.

She said a lot of agreements include arbitration clauses, which have been enforced by the courts when invoked disputing parties.

“Arbitration is a more predictable dispute resolution mechanism. This is because an arbitration award is final and binding and it can be enforced in much the same way as a court judgment, once it is registered. Another form of ADR is Adjudication. This is a mechanism, which is known for the principle ‘Pay now, argue later’ is widely used in the construction and engineering sector,” said Chief justice Mambilima. “It allows the business to continue with minimal disruption while matters such as disputes over payments are being resolved. In this case the adjudicator is an industry expert and this decision is binding in so far as that dispute is concerned.”

Oliver Chisenga

NOTICE ON TERMINATION BILATERAL INVESTMENT AGREEMENT NETHERLANDS - TANZANIA

ENFORCING FOREIGN ARBITRAL AWARDS IN TANZANIAN COURTS

The Government of the United Republic of Tanzania notified the Government of the Kingdom of the Netherlands in September 2018 of its intention to end the existing reciprocal protection of investment treaty between Tanzania and the Netherlands. Despite efforts to seek a temporary extension of the existing treaty and/or a speedy start of negotiations for a new investment protection treaty no progress has been made so far.

The implication of this development is that as per 1 April 2019 new Netherlands’ investors inTanzania (and new Tanzanian investors in the Netherlands) can no longer rely on the preferential protection that the treaty provided. This means for new investors that they will have to rely onnational legislation and regulations for protection of their investment. It also means that they will have to seek legal redress, if and when needed, through national courts. Access to international arbitration will no longer be possible, unless a new agreement is reached that will cover that option.

However, existing investors should take note of the fact that the treaty’s comprehensive protection for investments made before the date of termination (1 April 2019) continues to apply for a period of fifteen years (until 1 April 2034). In view of the time needed for negotiations and ratification of an eventual new treaty the Embassy expects that it can take up to 3 to 5 years before an eventual new investment protection treaty becomes effective. Potential investors are advised to take this recent development into consideration when preparing decisions on investment in Tanzania.

Please do not hesitate to contact the Netherlands Embassy in Dar es Salaam in case further information is required via EA-DAR@minbuza.nl.

BREAKING EXORBITANT FEES BARRIER FOR DISPUTE RESOLUTION THROUGH ARBITRATION

BREAKING EXORBITANT FEES BARRIER FOR DISPUTE RESOLUTION THROUGH ARBITRATION

The importance of arbitration in resolving disputes in the country cannot be over-emphasised. In recent times, it has helped in decongesting the courts and speeding up the resolution of disputes. As a popular mechanism for resolving disputes, it helps to reduce the exorbitant cost of judicial administration.

The Court of Appeal Rules 2016 encourages ADR in all its ramifications. As a tool for a speedy dispute resolution, members of a community utilise it as a means of preserving peace and enhancing their affiliation with one another. It enables potential rivals to remain friends in spite of individual differences. It is also effective in contracts and in settlement of commercial disputes thereby acting as a key driver of economic development within the Africa sub-region.

But the use of arbitration is being threatened by its high costs. Some of the costs associated with arbitrating dispute include arbitrators’ fees and expenses, administrative cost, expert fees, legal cost and witnesses, management and other logistical costs.

It is, however worrisome that a significant number of arbitrations of home-generated disputes are exported outside Nigeria. So in providing solutions to all these problems, the Nigerian Institute of Chartered Arbitrators Investiture (NICab) recently gathered in Lagos professionals from various spheres of life. They included legal luminaries and expert on arbitration from various part of the country and abroad.

In his keynote address, the then Chief Justice of Nigeria and Chairman, Board of Governors of the National Judicial Institute, Justice Walter Onnoghen said recourse to arbitration as a method of dispute resolution has been on the increase in Nigeria, and of course the nature of the proceedings and the minimal implications were the drivers. Therefore, if the cost of the arbitration fees should be rising, then, the purpose of the institution would be a mirage.

Nigeria is a signatory to the New York Convention on Arbitration acceding to the convention on March 17 1970 and it came into force on June 15, 1970. Arbitration, therefore, is not new in Nigeria, but its practices are new, because Nigerians are overwhelmed with litigation.

According to him, “the recent paradigm shift from litigation to arbitration is predicated on the impression that arbitration is less costly than litigation and this is one of the economic advantages of the mechanism. In reality, looking at the cost involved in the process of arbitrating a dispute and bearing in mind that the cost must be borne by the disputants, we may have a second thought on whether or not arbitration is the right way to solving a dispute at hand.”

The CJN also noted the internal cost to the parties involved in lending support to any dispute resolution process, such as in-house counsel, company witnesses, and other professional or technical support, depending on the type of arbitration selected (institutional or ad hoc).

He said, “ The fees charged depend on the amount involved. The Nigerian Institute of Chartered Arbitrators, Lagos Court of Arbitration (LCA), and others set hourly, daily or ad valorem feels for arbitration. In the International Chamber of Commerce (ICC) arbitrations, administrative costs consist of a non-refundable US$500 fee paid by the claimant when filing the request for arbitration. Once the proceedings have started, the ICC Court will fix additional administrative fees, based on the amount in dispute.”

While speaking on the theme “Rising Cost of Arbitration Fees: a Potential Threat to Arbitration Practice”Onnoghen said Nigerians need to embrace arbitration embrace the mechanism as an alternative to court proceedings.

His word, “Given the complexity of most commercial arbitration cases, the assistance of experts is almost always recommended, if not required. Parties are responsible for these experts’ fees, which can range from a few hundred thousand naira to tens of millions of naira, depending on the complexity of the case and the type of expert. Parties also need to bear the cost entailed in preparing witnesses for written and oral testimony, including travel and accommodation costs.”

The CJN therefore charged the Nigerian Institute of Chartered Arbitrators to urgently do everything possible to save the situation and recommended that the cost of process be affordable.

“Arbitration mechanism has come to stay in Nigeria because we cannot afford to lose the advantages associated with its practice. Therefore, the time to make a choice between encouraging the clients and patronizing the institution and turning down their offers is now. We can encourage them if we make the cost of the process affordable. Conversely, they can lose the appetite if we allow the cost to be rising without control mechanism in place.”

Also, the vice President and member of council, Nigeria Institute of Chartered Arbitrators, Prof. Fabian Ajogwu (SAN) admonished members to promote arbitration, mediation and other ADR.

While saying that the quest to domesticate arbitration in Nigeria continues to drive the activities of this institute, Ajogwu added that the time has come for a reversal of the trend of home-generated disputes being takenoutside the country.

According to him, “With qualified persons in the institute, there should be no excuse to seek expertise outside, except of course in international commercial arbitration; or where the specific circumstances of a case so demands. What remains is for us to work together to reverse the trend of setting aside arbitral awards at the slightest opportunity, and to appointing qualified arbitrators in Nigeria to conduct arbitration.

“We continue to explore ways of maintaining the high standards of training aimed at achieving the highest standards in our membership. We have tried to ensure that arbitrators are not only competent and experienced in field, but are also people of the highest moral calibre and professional competence. This year’s Fellows, Members and Associate members are a testimony to the high premium that we continue to place on this aspect of our institutional objectives and activities.

“Our members rank at par with ADR practitioners elsewhere across other jurisdictions. It is therefore not surprising that many of them handle matters outside the shores of Nigeria. Arbitration is envisaged to be a final way of determining disputes.

“ It is to be done with the highest sense of professionalism and ethics. This is the charge to you today. This institute continues to encourage specialisation within the field by driving sectoral committees within the institute. They include the Banking and Financial Services Committee, Aviation and Transport Committee, Energy and Power Committee, Maritime, Construction and Real estate, Telecommunications, PPP and Concessions, and other committees.

“It is the plan of the institute to build its office and arbitration centre. This however cannot be done without the contribution of our esteemed members, who directly and indirectly, through your friends, associates, and clients will leave a lasting legacy in the Arbitration Centre and office that will house your institute. It is my commitment to lead this initiative with you support and contributions.”

Responding to how exorbitant fees discourage arbitration in Nigeria, the Principal Partner, Taiwo Osipitan &Co, Professor Taiwo Osipitan (SAN) said, generally, arbitration as an alternative dispute resolution mechanism is expected to be speedy in an informal setting and inexpensive when compared to litigation. However, over the years, it appears that the cost of arbitration is on the high side. This will obviously impact the decision of affected parties to embrace arbitration or not.

He said, “In arbitral awards, costs awarded in favour of successful parties against the losing parties are also very high. As a matter of fact, costs are also awarded on indemnity basis i.e. expenses incurred by the winning party in hiring counsel will be totally borne by the losing party.

“Where expensive counsel is hired by the winning party, the losing party bears the cost of hiring such counsel in addition to paying his own counsel. In addition, where arbitral proceedings are conducted outside the places where parties are based, additional costs are incurred as travelling and accommodation expenses. These are the kind of things that are now discouraging people from using arbitration. “

For Mr. Mike Igbokwe (SAN), exorbitant fees will discourage arbitration in Nigeria. He said,”lot of parties to arbitration matters have been made to understand that arbitration is cheaper than litigation and it has more advantages when it comes to the resolution of commercial dispute than when you use litigation to resolve commercially.

“When the arbitrator’s fees are exorbitant they can discourage them. They may begin to look elsewhere rather than go to arbitration. But again I must say that the fees charged are reasonable and fair based on relevant factors. For instance, the special nature of the matter, it may be one that requires specialised knowledge like maritime or oil and gas and if it is very complex and difficult matter, it is also one that requires a lot of money and also looking at the volume of documents that one has to peruse, the time frame it will probably take you between three and six months or thereabout to finalise the work on the arbitration matter.

“One may decide to charge what is fair and reasonable in the circumstance, again, bearing in mind the provisions of arbitration and conciliation act on such areas. So as long as the fees is fair and reasonable, the arbitrator will be right because you do not also expect arbitrators to do the work of arbitration free of charge.

“ It is not a charity job, so they are entitled to fees as long the fees are fair and reasonable you should know they are not exorbitant considering all these factors. What I have found out, is that sometimes despite the fact that even institutions have scale of fees which are deemed to be fair and just in arriving at what will be payable to the arbitrators, some parties still consider these fees to be too high and are unwilling to pay and which sometimes can actually be seen as a misunderstanding of what arbitration is all about.

“ That you have to pay unlike when you go to the courts, you just pay filling fees, you don’t pay the judge for sitting, the state does that but when it comes to arbitration, the sole arbitrator or the panel of arbitrator will have to be paid.

“ This is apart from the administrative cost and also the charges of other persons, maybe experts etc that may be used during the arbitral process.”

The duo of Osiptan and Igbokwe also dealt with how the fees paid by parties to their arbitrators could be justified. Osipitan noted that it greatly depends on the status and numbers of the arbitrators who conduct the arbitral proceedings.

According to him, “arbitral proceedings by a single arbitrator will generally be less expensive than that conducted by three arbitrators. Similarly, arbitral proceedings conducted by fellows of various institutes of arbitrators and chartered arbitrators who are more experienced in arbitral proceedings are likely to be more expensive than proceedings handled by non–fellow and non-chartered arbitrators.

“Fees paid to arbitrators also include the cost of hiring of venue of arbitration, payment made to registrar and supporting staff for their services, transportation and accommodation expenses of arbitrators where proceedings are to take place outside the residence of arbitrators.”

Igbokwe expatiated, “I have mentioned some perimeters earlier, the fees of arbitrators are different from administrative fee or the fees of whoever will act as the secretary to the arbitral panel, who will take minutes and also arrange maybe the seat or the venue of the seating of the panel and also to write, or if they are outside the jurisdiction or perhaps an institution, make arrangements for hotel, transportation, maybe from airport to venue and also back, make arrangement for security where it is necessary.

“ All these things are different from the fee of the arbitrator. They are cost that will have to be borne by the parties and they are incidental to the arbitral process.

“The basis of arriving at a reasonable and fair arbitrators fee are what I have indicated that could guide in arriving at what is sometimes stipulated by an institution, it may be hardly negotiable because you just go by what the institution has indicated since they are the ones that chose the institution and the rules of the institution apply to what they are doing. But both parties can deliberate the arbitral fee with the institution in charge in order to come up with a fee that is acceptable.”

He analysed the role of arbitral institutions in reducing the rising cost of arbitration, saying, “if you look at the Rules of Professional Conduct 2007, there is a particular clause there that says ‘use the parameter to determine what is fair and reasonable fee chargeable by a lawyer should be decided upon’ and if you look at the Legal Practitioners Documentation Order of 1990.

“There is also something almost similar to the RPC (Rules of Professional Conduct) for legal practitioners, this gives the parameters for what is fair and reasonable fee chargeable by a lawyer handled in court or charged by legal practitioners when handling matters in court or when they are preparing document for client and as such, it should be different from arbitrators who have to sit like judges. The truth of the matter is that this can still give a fair or some parameters that can be used to arrive at something that is fair and just.

“If it’s looked at clearly, you can also realise that many of those who sit as arbitrators, it is easy for institution to use that as a basis of drawing up what should be applicable. What has always been obtainable is the scale of fees, depending on the amount of money involved, i.e they scale it, and which I think it’s not out of place, ICC (International Chamber of Commerce) does it and other arbitration bodies. They use this scale to determine how far they can go and how low they can go and you have to discuss something that fair.

“This now depends on the party, any party that wants to adopt the rule of any arbitral institution should take time to look at those rules and determine whether the scale of their fees for arbitration will be too high or not too high for them before they proceed in picking what will govern the arbitral process.”

On the arbitration institute looking at the fees currently charged given the country’s economy and the purchasing power of Nigerians, he said it was possible.

“However, do not forget that the exchange rate of what would be charged in naira is lower compared to what the value in naira terms would be if charged in dollar terms. There is no doubt about the fact that if it is exorbitant, it would discourage users. But the question is what would be exorbitant?

“Whatever is fair and reasonable cannot be regarded as exorbitant when you consider the complex nature of the matter, the centralised nature, the questions involved, also, the time spent, the number and volumes of documents that would be involved, and other things that the panel would have to do. So, exorbitant might be a relative term, for some people who are well to do, they can pay, they would understand but for poor people, they may not be able to meet up.

“Also, we can conduct a comparative analysis on what institutions abroad charge and also what other institutions in Nigeria charge in fee. But again, it is not something that will be successful if it is done by only one institution, all the institutions in Nigeria would have to be involved in order to achieve the right result.

“Again, you have to bear in mind that there are some arbitrators that if they feel the amount involved in the matter is too low for them, they would turn it down and we would end up not getting seasoned arbitrator. So, it has to be something that is attractive to them and use it to justify all the time and effort put into it for them to be encouraged to take it up.

“In as much as you want to reduce arbitration fees, you must also ensure that you do not compromise standard or cut down the quality of the experience of those who will be handling those arbitral matters.

Yetunde Ayobami Ojo