NEW ICSID CLAIM AGAINST CAMEROON

NEW ICSID CLAIM AGAINST CAMEROON

On May 24, 2019 La Camerounaise des Eaux (CDE), a Cameroonian entity, brought a conciliation case the Republic of Cameroon and Cameroon Water Utilities Cooperation (CAMWATER). The case, brought under ICSID Conciliation Rules, is based on a contract for production, transport and distribution of potable water.

There are no further details available about the project.

The Claimant is represented by El Hajjoujji et Associés from Morocco and the Respondents are yet to announce their representatives.

IARB Africa

NEW INVESTOR-STATE CASES FILED AGAINST TANZANIA

NEW INVESTOR-STATE CASES FILED AGAINST TANZANIA

On April 16, 2019 the Tanzanian government faced an ICSID claim bro itught by Ayoub-Farid Michel Saab, a Dutch citizen. The claim is brought under the recently cancelled Tanzania-Netherlands BIT. The dispute relates to the banking sector. Ayoub-Farid Michel Saab is among the owners of the FBME Bank incorporated in Tanzania.

The Claimant is represented by Quinn Emmanuel Urquhart & Sullivan out of Paris and Madkour Law Firm out of Beirut. The Government of Tanzania is yet to announce its representatives.

Following this case, on May 31st 2019, a new ICSID was filed against the Tanzanian government by Symbion Power Tanzania Limited, Richard N. Westbury and Paul D. Hinks. The case relates to an electric power generation project and is based on the Tanzania-United Kingdom of Great Britain and Northern Ireland.

The Claimant is represented by Omnia Strategy and Lucas Bastin from Essex Court Chambers in London. The Tanzanian government is yet to announce its representatives.

IARB Africa

VEDANTA APPEALS TO SOUTH AFRICAN COURT TO PROTECT ZAMBIAN BUSINESS

VEDANTA APPEALS TO SOUTH AFRICAN COURT TO PROTECT ZAMBIAN BUSINESS

Mining company Vedanta said on Thursday that it is seeking an urgent court order in South Africa to prevent Zambia’s mining investment arm ZCCM from winding up its disputed Konkola Copper Mines (KCM) business. Vedanta is locked in a dispute with the Zambian government, which accuses KCM of breaching the terms of its licence.

Vedanta denies that KCM has broken the terms of its licence and says it will defend its assets in Zambia, Africa’s second-biggest copper producer.

The case has intensified concerns among international miners about resource nationalism in Africa. A ZCCM spokeswoman was not immediately available for comment.

Vedanta said in a statement that it had obtained a temporary order in South Africa’s High Court allowing it to make an urgent request on July 16 for an injunction against ZCCM and a provisional liquidator at KCM. Vedanta holds a majority stake in KCM, with ZCCM holding a minority stake.

“Vedanta will seek an interim court order declaring that ZCCM has breached the KCM shareholders’ agreement by pursuing winding-up proceedings against KCM in Zambia, and directing ZCCM to withdraw those proceedings,” the statement added. Vedanta applied to the South African court because the KCM shareholders’ agreement makes provision for arbitration in South Africa.

CHAGOS ISLANDS: UK REFUSAL TO HAND BACK ARCHIPELAGO DISREGARDS INTERNATIONAL LAW AND ECHOES ERA OF COLONIALISM

CHAGOS ISLANDS: UK REFUSAL TO HAND BACK ARCHIPELAGO DISREGARDS INTERNATIONAL LAW AND ECHOES ERA OF COLONIALISM

Kenya Commercial Bank (KCB) wants the Court of Appeal to set aside a ruling in which the High Court ordered that the dispute between it and a Tanzania agency over bank performance guarantee should be determined by the latter court.

The bank’s lawyer Philip Nyachoti yesterday told Court of Appeal that before his client lodged the appeal on June 2,2015, Justice Mary Kasango on March 15, 2015, found that the dispute between KCB and Tanzania National Road Agency over bank guarantee of Sh700 million the bank issued as a surety for Kundan Singh Construction company had not been fully determined.

“All issues surrounding the contract which was awarded to Kundan Singh Construction to build a road in Tanzania at a cost of Sh2.1 billion was resolved by an arbitration in Stockholm, Sweden in 2009,” said Nyachoti.

The lawyer told the court that Justice Kasango gave the order after the company applied for it at Nairobi’s Milimani court, complaining that despite the dispute having been resolved by arbitration in Stockholm, the issue of bank performance guarantee had not been resolved.

Nyachoti told Justice Daniel Musinga, Justice Agnes Murgor and Justice Gatembo Kairo sitting in Mombasa that since issues in Milimani court were resolved after all parties consented that it be taken for arbitration in Stockholm, all issues touching on bank performance guarantee was also resolved.

He argued that since the arbitration had resolved the dispute, Justice Kasango should have not revisted the matter.

But Tanzania Road Agency lawyer Joseph Munyithya insisted that the dispute over the bank performance guarantee had not been resolved, saying the arbitration resolved issues relating to the contract of construction of the road.

“Yes it is true the issue concerning the contract had been resolved but the issue of bank performance guarantee has not be resolved” said Munyithya.

THE AWARD

Nyachoti disclosed that even the award by the arbitration had not been enforced because a Mombasa court ruled it was against public policy to enforce an award from another country.

A nation’s military and geo-strategic interests cannot, under international law, prevail over the sovereign rights of other states. State sovereignty, self-determination and decolonisation are fundamental legal principles the UK should honour as it refuses, despite widespread international condemnation, to hand back control of the Chagos Islands in the Indian Ocean.

Indeed, Britain’s expressed policy that it will protect its interests at any cost, even at the expense of international law and fundamental human rights, has unwelcome echoes of colonialism and discrimination that should have no place in the 21st century.

On May 22, a UN General Assembly resolution calling for the complete decolonisation of Mauritius by ending the UK’s administration over the islands was voted for by 116 nations. Only six – the US, Hungary, Israel, Australia, the Maldives and the UK – voted against it, with 56 abstaining.

The UK has exercised control and authority over the Chagos islands – which include Diego Garcia, now site of a key US/UK military base – since 1965 when it separated them from Mauritius, named them British Indian Ocean Territory, and evicted their 1,500 inhabitants. The UN resolution is a clear indication that the international community believes this controversial takeover should now be undone. And yet the UK’s permanent representative to the UN, Karen Pierce, maintained after the vote that “the United Kingdom has no doubt about our sovereignty over British Indian Ocean Territory”.

The strategic military significance of the Chagos Archipelago arose out of the Cold War when the US sought, through an agreement with the UK government in 1966, to establish a presence in the Indian Ocean. Today, it is often used for counter-terrorist operations, which have themselves caused controversy.

THE LAW

There are several legal points that must be raised in response to the UK’s selective application of international law, including the principle of self-determination of peoples and the prohibition of forcible displacement, which is today punished as a crime against humanity. First, the UK maintains that:

In this important part of the world, the joint United Kingdom and United States defence facility on the British Indian Ocean Territory plays a vital role in our efforts to keep our allies and friends, including Mauritius, in the region, and beyond, safe and secure.

What the UK overlooks, however, is that it has received no authorisation or mandate under international law to act as the world’s guardian of peace and security. Rather, such primary responsibility is entrusted to the UN Security Council through Article 24 of the United Nations Charter, which the UK was a main architect of.

Significantly, the principle of state equality, which dictates that all states are equal and no state is more equal than another, also prevents any state from acting as an “international policeman”. While there is no doubt that states, individually and collectively, must respond effectively to the serious threat of international terrorism, this must be done in accordance with international law.

Second, the UK insists that the International Court of Justice (ICJ) exceeded its jurisdiction when it ruled in February 2019 that the General Assembly should provide an advisory opinion on the issue. The UK argued that by doing so the court breached the principle of state consent, as the dispute between Mauritius and the UK over the Chagos Islands is a bilateral one.

But the ICJ overwhelmingly concluded that this did not circumvent the UK’s consent, as the issue brought before it was not confined to a bilateral territorial dispute. Instead, it found that the issue fell within the General Assembly’s power under the UN Charter to oversee the fulfilment of self-determination in the colonial context.

Third, the UK argues that it will “cede” the territory when it is no longer needed for defence purposes, invoking the 2015 UNCLOS Tribunal Arbitration Award. In that case, Mauritius challenged the UK’s 2010 declaration of a marine protected area surrounding the Chagos Archipelago as being in violation of the United Nations Convention on the Law of the Sea. While the tribunal concluded that it lacked jurisdiction to consider issues relating to territorial claims as falling outside the scope of the Convention it was called to interpret, it concluded that the UK’s declaration was not compatible with the Convention and it interfered with Mauritius’ fishing rights. Substantially however, the award makes clear that:

In the tribunal’s view, the United Kingdom’s undertaking to return the Chagos Archipelago to Mauritius gives Mauritius an interest in significant decisions that bear upon the possible future uses of the Archipelago. Mauritius’ interest is not simply in the eventual return of the Chagos Archipelago, but also in the condition in which the archipelago will be returned.

Indeed, the return of the Chagos Archipelago was expressly agreed in the Lancaster House agreement of September 23, 1965, between Mauritius and the UK – and its return is not a matter of negotiation.

SELF-DETERMINATION

Significantly, the ICJ also concluded that the detachment of the Chagos Archipelago from Mauritius was not the result of free will and that it breached the right to self-determination as it applied at the time of the detachment. Indeed, the Court drew attention to the fact that Mauritius was still under British colonial control when it agreed the temporary detachment of part of its territory.

The UK relies on the fact that the Court’s Advisory Opinion is not legally binding. Nevertheless, this does not not mean that it lacks, as the UK itself recognises, legal authority. Quite the contrary. The legal findings of the Court, even in the form of an advisory opinion, have compelling significance when it comes to identifying and interpreting the existing rules of international law.

In fact, the Court’s finding that the process of decolonialisation of Mauritius was not lawfully completed is authoritative both in terms of what the law says and what the obligations of states, including the UK, actually are. The UK’s statement that “advisory opinions may indeed, from time to time, carry weight in international law” is essentially an attempt to cherry pick, at will, which international rules it will comply with.

The UK’s selective application of international rules, as reflected by its refusal to respect the right of Mauritius and the Chagossians to self-determination while at the same time defending the right of the Falkland Islanders to self-determination is no longer defensible. The UK must accept that colonialism belongs in the history books, and that it must comply with its obligations under international law, by ending, as rapidly as possible, the control it exercises over the Chagos Islands and by allowing the return of those who were forcibly removed. This is imperative, not least because refusal to comply with international law opens the door to other serious violations committed by other states.

Elena Katselli

IARB Africa

SACU, EU TRADE DISPUTE ERUPTS

SACU, EU TRADE DISPUTE ERUPTS

Gaborone – The European Union (EU) has filed a complaint against the Southern African Customs Union (SACU) for what it says is the imposition of “extra duties on EU chicken” by SACU.

In a formal complaint addressed to SACU Chairman and Lesotho’s Finance Minister, Moeketsi Majoro, the EU said the extra duties being imposed on its chicken by SACU did not comply with the provisions of the Economic Partnership Agreement (EPA) between the EU and the Southern African Development Community (EU-SADC EPA) to which SACU member states – South Africa, the main poultry importer, Namibia, Botswana, Eswatini and Lesotho – are signatories.

The EU states that on 14 June this year, it requested formal consultations – a first step in a dispute settlement process – with SACU over safeguard measures affecting imports of frozen chicken cuts from the EU.

“The EU has on numerous occasions sought an amicable solution to the issue, to no avail.

The EU hopes that both sides can still find a mutually satisfactory solution in the course of the 40-day dispute settlement consultations.

If no solution is reached, the EU will be entitled under the EU-SADC agreement to request the establishment of an arbitration panel,” reads the note in part.

The EU says it considers that the measure adopted by SACU – an extra tariff of 35.3% subject to a progressive reduction over a period of three and a half years – goes against requirements set under the EU-SADC agreement.

“The European Union would like to address in these consultations the safeguard measure approved by the SACU Council of Ministers on 27 June 2018, notified to the European Commission on 18 July 2018 and that entered into force on 28 September 2018,” reads the note.

It says the measure concerns the imports of frozen bone-in chicken cuts from the EU and is based on an alleged increase in the volume of imports into the territory of SACU causing or threatening to cause a disturbance and/or serious injury.

The EU explained that it was addressing the request to SACU pursuant to Article 75 (2) of the EU-SADC EPA, according to which SACU and its constituent states have to act as a collective for disputes which concern collective action of SACU.

The EU said it was concerned that the measure appears to be inconsistent with certain provisions under the EU-SADC EPA.

According to the EU, Article 34 (2) of the EU-SADC EPA requires that safeguard measures may be taken if a product originating in one party is being imported into the territory of another party or SACU in such increased quantities and under such conditions as to cause or threaten to cause disturbances or serious injury in the territory of SACU.

The complaint note was also copied to Habofanoe Lehana, Minister of Trade and Industry of Lesotho, Botswana’s Minister of Investment, Trade and Industry Bogolo Kenewendo, Eswatini’s Minister of Commerce, Industry and Trade, Manqoba Khumalo, Namibia’s Minister of Industrialisation, Trade and SME Development, Tjekero Tweya, and Ebrahim Patel, Minister of Trade and Industry of South Africa.

Willis Oketch

THE COURT OF ARBITRATION FOR SPORT (CAS) DISMISSES THE APPEAL FILED BY THE GAMBIA FOOTBALL FEDERATION

THE COURT OF ARBITRATION FOR SPORT (CAS) DISMISSES THE APPEAL FILED BY THE GAMBIA FOOTBALL FEDERATION

The Court of Arbitration for Sport (CAS) has dismissed the appeal filed by the Gambia Football Federation (GFF) against the Confédération Africaine de Football (CAF) and the Fédération Togolaise de Football concerning a protest filed by the GFF in which it disputed the eligibility of a Togolese player to participate in 2019 Africa Cup of Nations qualifying round matches that took place in October 2018.

The GFF’s protest was first dismissed by the CAF Disciplinary Board in January 2019. The CAF Appeal Board confirmed such decision in February 2019. The GFF then filed an appeal at CAS against the CAF Appeal Board’s decision seeking to have the two previous decisions overturned.

The CAS initiated an arbitration procedure and held a hearing from the CAS headquarters in Lausanne, Switzerland on 14 June 2019 with participants either physically present or participating by videoconference.

At this time, only the decision has been issued. The full award, with the grounds for the Sole Arbitrator’s decision, will be issued at a later date.

CAS PUBLISHES ARBITRAL AWARD IN SEMENYA CASE

CAS PUBLISHES ARBITRAL AWARD IN SEMENYA CASE

PUBLICATION OF THE ARBITRAL AWARD IN THE ARBITRATION BETWEEN CASTER SEMENYA, ATHLETICS SOUTH AFRICA (ASA) AND INTERNATIONAL ASSOCIATION OF ATHLETICS FEDERATIONS (IAAF)

The Court of Arbitration for Sport (CAS) has received an agreement from Ms. Caster Semenya, Athletics South Africa (ASA) and the International Association of Athletics Federations (IAAF) to publish a redacted version of the CAS Award dated 1 May 2019.

The redacted award can now be reviewed Here

As a service to our readers, Around the Rings will provide verbatim texts of selected press releases issued by Olympic-related organizations, federations, businesses and sponsors.

These press releases appear as sent to Around the Rings and are not edited for spelling, grammar or punctuation.

HAMZA GUESSOUS

$9BILLION JUDGMENT DEBT: UK COURT DECIDES NIGERIA’S FATE TODAY

$9BILLION JUDGMENT DEBT: UK COURT DECIDES NIGERIA’S FATE TODAY

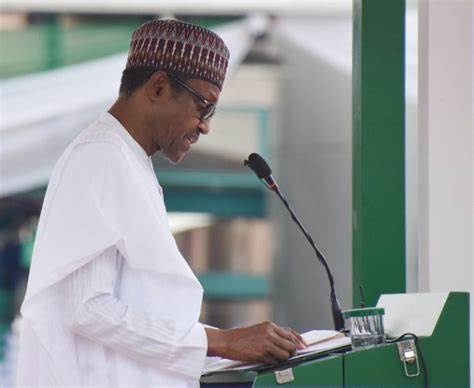

President Muhammadu Buhari: Nigeria at the brink of losing $9billion to British Virgin Island firm on failed gas project in the Jonathan years.

A firm incorporated in the British Virgin Islands will ask a British court today for the right to seize up to $9 billion of Nigerian government assets – some 20 percent of the nation’s foreign reserves – over an aborted gas project in the Jonathan years.

The case highlights a risk to Nigeria’s foreign assets, potentially clouding its appeal to some investors, Reuters reported.

The request is part of a long-running saga over a 2010 deal in which the Nigerian government agreed to supply gas to a processing plant in Calabar, Cross River state that Process and Industrial Developments Ltd (P&ID) – a little-known firm founded by two Irish businessmen specifically for the project – would build and run.

When the deal went south, P&ID won a $6.6 billion award at arbitration, based on what it could have earned during the 20-year agreement. It now says the total owed has ballooned to $9 billon because of interest accrued since 2013 .

Nigeria has tried to nullify the award, saying it was not subject to international arbitration but British courts rejected the argument.

P&ID is now asking the Commercial Court in London to convert the arbitration into a judgement, which would allow them to try to seize international assets.

A source close to President Muhammadu Buhari said they were fully aware of the matter and the government “is not sleeping”, adding they were optimistic the matter could be resolved in the courts. There are also proceedings pending at a U.S. District Court in Washington, D.C.

Buhari, who was inaugurated for a second term on May 29, has not yet appointed cabinet ministers, and officials contacted by Reuters said the lack of an attorney general or petroleum minister made it difficult for anyone to comment on the record.

“This is a problem that the Nigerians are not facing up to in any serious way,” said Andrew Stafford, Q.C. of Kobre & Kim LLP, which is representing P&ID.

Experts said it would be difficult for Nigeria to fully extricate itself.

“Under UK legislation, state immunity does not operate to protect a sovereign state where it has entered into an arbitration agreement,” said Simon Sloane, a partner with UK law firm Fieldfisher.

He added that going after state assets following arbitration had become a well-trodden path over the past 15 years and it would be difficult for Nigeria to avoid paying compensation.

While assets that are used for diplomatic purposes – such as the Nigerian High Commission building in central London – were off the table, commercial assets were up for grabs.

In 2008, a UK court ruled that proceeds of oil sales from Chad held in an international account intended to repay World Bank loans were fair game for seizure.

Experts also said that the involvement of hedge fund VR Group, which has a stake in P&ID, signalled that it is unlikely to let the issue drop.

“They could still come to a settlement,” Sloane said. “As it’s a consensual process the parties can agree to settle, and settle for significantly below the $9 billion figure.”

Pmnewsnigeria.com

COURT TO HEAR APPLICATION AGAINST NCA’S CASE ON ARBITRATION OVER RADIO CLOSURES

COURT TO HEAR APPLICATION AGAINST NCA’S CASE ON ARBITRATION OVER RADIO CLOSURES

An Accra High Court presided over by Justice Olivia Obeng will today hear an application by lawyers of several radio stations that have been closed down by the National Communications Authority (NCA), seeking an order of the Court to strike out a yet to be moved motion of the NCA that accuses the Chairman of the Electronic Communications Tribunal (ECT), Professor Justice Samuel Date-Bah of bias.

According to a motion on notice filed by lawyers of the NCA on the 12th of June 2019, it is the contention of the NCA that the Chairman of the ECT who has tendered in his resignation letter to the Public Services Commission (PSC) and in the letter has accused the NCA of gross neglect of the Tribunal, is likely to be biased against the NCA in the mediation effort. He resignation takes effort from the 1st of July 2019 and a such, the NCA submits that the ECT Chairman should not be allowed to mediate the case involving the NCA while he waits to leave office.

However, in an affidavit deposed to by one Gafaru Ali, in support of their motion on notice seeking to strike out that of the NCA, the embattled radio stations indicate that the “application for prohibition against the Chairman of the Electronic Communications Tribunal from sitting on cases involving the NCA is a subtle attempt to remove the Chairman of the ECT through the backdoor and to bring the work of the Tribunal to a complete stop and into disrepute”.

The affidavit further states that “it is abundantly clear that the instant motion for judicial review in the nature of prohibition has an ulterior motive, series a collateral advantage for the NCA beyond what the law permits, and has been instituted for a purpose for which the law does not recognize as legitimate use of the remedy of prohibition”.

To this end the Radio Stations submit that “the application is a complete abuse of the process and ought to be dismissed with punitive Cost”, the affidavit stated. The Radio stations that have suffered closure by the regulator are XYZ Broadcasting Limited, Network Broadcasting Limited, Adunu Media Limited, Genesis Media Limited and Georichat Company Limited.

Prof Date-Bah to commence UniBank arbitration on Wednesday

Prof Date-Bah to commence UniBank arbitration on Wednesday

A former Justice of the Supreme Court, Professor Justice Samuel Date-Bah, who was appointed by the Commercial Division of the Accra High Court to arbitrate in the case of the uniBank, has written to the parties involved in the matter to appear before him tomorrow, June 19, 2019. The appearance of the 16 shareholders, the receiver of the bank, Nii Amanor Dodoo, and the Attorney-General will allow Prof. Justice Date-Bah, as the sole arbitrator, to determine whether or not the revocation of uniBank’s class-one banking licence by the Bank of Ghana (BoG) was done in accordance with the tenets of law.

The Accra High Court, presided over by Mrs Justice Jenifer Dadzie, referred the matters contained in a counter-claim filed by lawyers for Dr Kwabena Duffour II, one of the 16 shareholders of the bank, for arbitration.

The counter-claim argued that the revocation of uniBank’s licence was illegal.

The court, pursuant to provisions of Act 930, referred the matter of the revocation to arbitration and appointed Prof. Justice Date-Bah as the sole arbitrator on May 17, 2019.

Background of case

The court indicated that its decision to appoint an arbitrator did not, however, stop it from adjudicating on the other counter-claims, and that the presiding judge would hear other reliefs in the counter-claims that did not fall under the ambit of Act 930.

It was the considered view of the court that not all the reliefs in the counter-claim directly challenged the revocation of uniBank’s licence and the appointment of the receiver.

The reliefs included a declaration that the receiver did not have the right to “interfere with the sanctity of any contract or transaction entered into between uniBank and any of its customers or shareholders”.

Another relief is an order for general, punitive and exemplary damages.

The ruling by the court was as a result of an application filed by the receiver urging the court to dismiss the entire counter-claim by the shareholders.

Lawyers for the applicant argued that the counter-claims were an attempt by the shareholders to delay the hearing of a suit filed by the receiver against them and that the shareholders knew that the proper forum for their action was arbitration.

Justice Dadzie, however, rejected the argument that all the reliefs in the counter-claim must be determined by arbitration.

“I reject the assertion of the applicant that because a greater portion of the pleadings and counter-claim of the respondents challenged the appointment of the receiver or the actions of the BoG, the entire counter-claim of the respondent should be struck out,” she held

Suit and counter-claim

On September 4, 2018, the receiver of uniBank sued the 16 shareholders for allegedly breaching their fiduciary duties as directors of the bank and, in the process, making the bank incur a GH¢5.7 billion debt, leading to its collapse.

The plaintiff, accordingly, prayed the High Court to hold the 16 defendants jointly liable for all the loss uniBank Ghana Limited had suffered.

The shareholders include Dr Kwabena Duffuor, HODA Holdings Ltd, HODA Properties Ltd, Integrated Properties Ltd, Alban Logistics Ltd, Starlife Assurance, Bolton Portfolio Ltd and Dr Kwabena Duffuor II.

The rest are Opoku Gyamfi Boateng, Prof. Newman Kwadwo-Kusi, Owusu Ansah Awere, Ekow Nyarko Dadzie-Dennis, Boatemaa Kakra Duffour-Nyarko, Kofi Kyereh Darkwah, Nana Boakye Asafu-Adjaye and Alex Gaddiel Buabeng.

The defendants denied all the allegations, and on October 12, 2018 three of them filed a counter-claim accusing the plaintiff of certain infractions and, therefore, seeking certain reliefs.

Dr Duffuor II, Prof. Kwadwo-Kusi and Ms Duffuor-Nyarko, in the counter-claim, accused Nii Dodoo of issuing a defective report, leading to the collapse of the bank.