GOVERNORS TAKE ON UHURU GOVERNMENT OVER MONEY

GOVERNORS TAKE ON UHURU GOVERNMENT OVER MONEY

Governors have firmed up a “monumental case” against President Uhuru Kenyatta’s Jubilee administration amid a protracted revenue sharing standoff.

With county governments staring at a complete shutdown without money two weeks into the new financial year, the county chiefs on Monday launched one of the boldest and aggressive campaigns targeting the national government.

They accused the Kenyatta regime of presiding over a rogue National Assembly determined to suffocate devolution.

The governors outlined five points of contention that they want the David Maraga-led apex court to arbitrate.

They want the Supreme Court to determine the input of the Senate in protecting counties at the Legislature, the legality of the IFMIS system and the formula for allocation of grants.

The devolved units’ chiefs want the apex court to decide the legality of vote heads held by the national government yet relevant functions are devolved.

Further, they want the Supreme Court to pronounce itself on whether MPs can deviate from the recommendations by the Commission for Revenue Allocation on the shareable revenue.

The governors mobilised county assembly members to join Senate leaders in a symbolic protest march in Nairobi that culminated in the filing of the case at the Supreme Court.

The Supreme Court asked the petitioners to submit written submissions within three days and serve the respondents before the case is mentioned on Friday, July 19.

It is unusual for governors, who are heads of devolved units to hold protests, but yesterday the over 30 governors, deputy governors, Speakers of county assemblies and dozens of MCAs held a procession from the Intercontinental Hotel to the Supreme Court.

The county bosses were in an unfamiliar territory chanting “Haki Yetu (Our right) as they walked under tight security following the impasse on the Division of Revenue Bill 2019,

“In this second term, devolved governance is being attacked by denying county governments their resources. The National Treasury continues to hold counties hostage by always deviating from the Commission of Revenue Allocations recommendation by constantly denying disbursement of funds to counties,” CoG chairman Wycliffe Oparanya said.

The governors ignored an appeal by Deputy President William Ruto who had on Sunday asked them not to file the case as the Division of Revenue Bill, 2019 impasse would be resolved amicably.

Parliament wants the 47 counties to be given Sh316 billion, up from the Sh310 billion they had approved while senators want the devolved units to be given Sh327 billion, a compromise from the Sh335.7 billion set by CRA.

The mediation between the senators and MPs collapsed, triggering the stalemate that now threatens to sink counties into a deeper financial crisis.

The forum was attended by most of the governors, Senate Majority leader Kipchumba Murkomen and his Minority counterpart James Orengo. Both fully backed the governors on the court case.

As we speak counties cannot operate. It is shameful for the national government and they should take full responsibility for this situation.

Kisii Governor James Ongwae

“If we leave the national Assembly to operate the way it is doing in the next two years, Kenya will be worse than the one-party Kanu regime. We are fully behind governors on this,” Murkomen said.

In their constitutional reference petition, the governours want the Supreme Court to declare itself on the role of the Senate in the legislative function of Parliament amid claims it is being muzzled by the National Assembly.

Crucial bills, especially those concerning county governments, are never forwarded to the Senate for consideration, debate and approval, the governors argue.

“Where this is done, the input of the Senate is often disregarded. The most crucial of the bills is the annual Division of Revenue Bill. The National Assembly has totally declined to consider the input of the Senate on the quantum of the equitable share of county governments,” the governors said.

They argue that the situation has resulted in the under-funding of county governments while the allocation for the national government has since 2013 continued to increase.

The petition says that despite the constitutional role of the Senate in protecting devolution, the National Assembly does not regard the Senate as an arm of Parliament.

The county bosses have also advanced the issue of financial vote heads for devolved units amounting to billions of shillings being held by the national government.

They state that a large portion of the national government budget comprises allocations that are supposed to be channelled to county governments to follow devolved functions.

They named the national government ministries responsible for health, regional development, agriculture, water, environment, roads, and natural resources as among those getting huge allocations in the annual Division of Revenue Bill and budget yet most of the functions they undertake are devolved.

In their reference petition at the Supreme Court, the governors also want the court to declare that conditional or unconditional grants sent to the counties by the national government should be allocated from the national government’s equitable share.

The governors have taken on the Jubilee administration over deduction of grants from the counties’ shareable revenue.

Governors, for instance, say that Treasury officials continue to run conditional grants meant for the counties even when the money has been deducted from the counties’ shareable revenue.

Some of the grants include funds for free maternal health care, leasing of medical equipment and grants for Level-5 hospitals.

They say the money appear merely on paper as conditional grants in the annual Division of Revenue Bill yet they are managed by accounting officers of the national government.

“Ideally, conditional grants should appear first as outright allocations to the national government before being netted off as conditional or unconditional grants to the Counties,” the governors said in the petition.

Governors say that the Constitution implies that counties are the ones to manage and account for the conditional funds in accordance with the conditions set if any.

“Therefore, there is a need for the Supreme Court to offer an advisory to ascertain whether the allocation of conditional grants in the annual Division of Revenue Bill is made in accordance with Article 202(2) of the Constitution,” the governors submitted.

They want the apex court to rule on issues about late exchequer releases to counties.

They accused the National Treasury of having joined the National Assembly in killing devolution by starving counties of resources.

“The exchequer releases are not predictable. They are made at the discretion of the National Treasury. In addition, the releases are often made at the end of the financial year. This makes it impossible for county governments to implement projects and discharge their constitutional mandates,” the CoG’s petition says.

The devolved units accuse the Treasury of holding them hostage by running a deeply problematic IFIMS system which it “shuts down and opens” at its discretion.

The CoG argues that there is a need for the Supreme Court to clarify whether IFMIS as currently constituted and administered violates the Constitution on the institutional autonomy of the county governments by impeding the performance of county governments and their expenditure.

Regarding the thorny issue of the Division of Revenue, governors want the Supreme Court to clarify if the National Assembly or the Treasury can disregard the Commission for Revenue Allocation recommendations on the shareable revenue.

300 JOBS ON THE LINE AS NANDI GOLD MINE SHUTS DOWN LOOMS

300 JOBS ON THE LINE AS NANDI GOLD MINE SHUTS DOWN LOOMS

Up to 300 gold miners in Nandi County are facing job losses after the Kabere Gold Mine shut down its operations in the wake of a dispute with the owner of the nine-acre land on which its plant stands.

The company recently laid off its employees after the land owner, Cheseret arap Korir, declined to renew its 10-year lease after it lapsed in January.

The parties are now locked in a legal tussle over whether either of them has the right to terminate or renew the lease.

The row at Kabere comes soon after Kilimapesa Gold, which has operations in Migori County, also shut down its mine after failing to raise new capital to finance operations of the plant.

The gold mine closures are happening at a time when the price of the commodity has rallied to a six-year high of $1,400 (Sh141,000) per ounce, underlining the missed opportunities for investors and the government, which earns royalties from the companies.

Kabere, formed in 2008, has been producing gold with a value of about Sh800 million per annum. The company, owned by a group of Kenyan citizens and institutional investors such as Maris Africa and Dutch investment fund FMO, signed a 10-year lease agreement with Mr Korir on June 12, 2009.

The rent was set at the rate of Sh3,000 per month per acre amounting to Sh324,000 per year and increasing at five percent per year.

Kabere wrote to Mr Korir six months before the lease expired, informing him that the company wished to renew it for another 10 years.

The landlord rejected the notice and directed the company to vacate the property upon expiry of the lease in January.

The mining firm went to court which, on March 1 2019, ordered the company to cease operations and further directed the parties to resolve their dispute through arbitration as provided for in the lease agreement.

“The plaintiff (Kabere) is also restrained from carrying on any activity on the suit parcels of land pending the outcome of the arbitration,” Judge Antony Ombwayo of the Environment and Land Court at Eldoret ruled on March 1, 2019.

Kabere, which says it risks suffering a huge loss after investing a cumulative Sh1 billion in the mine, won in the arbitration process but the decision has been challenged in court by Mr Korir.

The arbitrator, Anthony Githinji Kimani, said that the mining company had a right to renew its tenancy for a further 10 years according to clause 2.2 of the lease agreement.

“The lessee shall have the option to extend the term by notice in writing given to the lessor six (6) calendar months prior [to] the end of the term for a further period of ten (10) years on the same terms and conditions as this agreement (save for any amendments and/or variations agreed between the parties) and the rent payable shall be agreed between the parties at least one calendar month prior to the expiry of the term,” the clause says.

The arbitrator accepted Kabere’s argument that it has invested heavily in development of the land and its business in reliance on the provisions of the clause.

Mr Kimani said that the company “therefore had a contractual and legitimate expectation that the respondent would renew the lease term for a further 10 years upon expiry of the initial 10-year term.”

The company says the lease dispute has also held up its mining licence since it is now a requirement that it receives consent from every land owner within its designated mining area before its licence can be renewed.

COURT DISMISSES RECEIVER’S CASE AGAINST UNIBANK, ORDERS PARTIES BACK TO ARBITRATION

COURT DISMISSES RECEIVER’S CASE AGAINST UNIBANK, ORDERS PARTIES BACK TO ARBITRATION

A High Court in Accra has dismissed a case brought before it against the shareholders of uniBank by the Receiver, Nii Amanor Dodoo.

The presiding judge, Justice Jenifer Dadzie, ruled that Mr. Amanor Dodoo did not have the capacity to issue a writ in his own name in the manner that it was done.

The judge also dismissed an injunction which had stalled the arbitration process, being presided over by former Supreme Court judge, Dr. Justice Dateh- Baah.

Justice Abena Dadzie, who is presiding over the case in which the Directors of uniBank are contesting the revocation of the bank’s license earlier appointed Justice Dateh Baah as the sole arbiter to determine whether the decision to place the bank into receivership breached the law.

She has since directed all parties to continue with the arbitration process.

The Directors of uniBank, which was one of five banks merged by the Bank of Ghana (BoG), into the Consolidated Bank Ghana Limited, are contesting the revocation of the bank’s license, which they have described as unlawful.

This decision by the judge is the latest in a series of crucial decisions for the bank’s directors after an order was secured from the court to join the Attorney General to the original suit.

The Receiver had earlier filed an application asking the court to dismiss the counterclaim from the lawyer of the bank’s directors, Yaw Oppong, for the restoration of the license, arguing that it was “frivolous” and “lacked merit”

He also argued that the proper forum to address matters relating to revocation of licenses under Act 930 is an arbitration forum and not regular litigation.

The lawyer for the bank’s Directors, however, opposed this, stating that even if an Arbitration was the right forum to address their concerns, it does not warrant the dismissal of the case.

The Judge sustained this argument by the lawyer, agreeing that arbitration does not oust the jurisdiction of the commercial court in the matter.

“Where the law admits a preference for arbitration proceedings, any proceedings before the court should be stayed pending the determination of arbitration proceedings upon an application…,” she said.

The judge observed that the matters for arbitration fall within section 141 of Act 930 and includes the matter of revocation of uniBank’s license mentioned in the counterclaim.

The ruling added that “ in such matters, the authorities are clear; the court is to stay proceedings in respect of the issues that fall under the ambit of the provisions of Act 930 while the parties attempt to resolve those particular issues through arbitration.”

The judge stayed proceedings on the matter at the commercial court pending the determination by the arbiter.

REVOCATION OF LICENSE

Announcing the consolidation of uniBank along with the other banks on August 1, 2018, the Governor of the BoG, Dr. Ernest Addison said reports from the official administrator, KPMG stated that uniBank was balance sheet insolvent.

“Among other things, the bank’s interest income and other sources of income are insufficient to cover the associated cost of funds of underlying borrowings and liabilities, as well as overheads of about GH¢0.31 billion per annum.”

These claims have, however, been challenged by the bank’s directors.

WAR AS ARBITRATION CENTRE DRAGS GOV’T TO COURT OVER NEW COMPETITOR

WAR AS ARBITRATION CENTRE DRAGS GOV’T TO COURT OVER NEW COMPETITOR

The Center for Arbitration and Dispute Resolution (CADER) Uganda has dragged the Attorney General to court seeking government to do away with its competitor, the International Centre for Arbitration & Mediation in Kampala (ICAMEK), which was launched in April this year.

CADER’s petition is the 11th in the series of petitions against ICAMEK.

CADER is the statutory body with jurisdiction over arbitration matters in Uganda has tasked government to protect its jurisdiction from the alleged infringement by ICAMEK.

ICAMEK is an independent, not-for-profit organisation, dedicated to advancing Alternative Dispute Resolution in Uganda and across East Africa. ICAMEK is the first private sector Led institution focused on delivering the benefits of world-class Alternative Dispute Resolution to businesses, professionals, governments and communities alike.

ICAMEK was officially launched by the Minister of Justice and Constitutional Affairs the Hon. Major General Kahinda Otafiire (rtd) on April 25, 2019, having been registered officially by Uganda Bankers Association (UBA) and Uganda Law Society (ULS) together with other partners on July 26, 2018.

CADER’s petition comes at the time when some lawyers under ULS are questioning the registration of ICAMEK in Uganda, claiming they were not consulted.

The lawyers opposed to ICAMEK want the following questions to be addressed:

Who authorised the use of ULS as a subscriber and how! Where is the instrument?

Who appointed Gimara Director?

Isn’t appointment of Gimara as first director as ULS President emeritus conflict of interest?!Is it even ethical?

Have its accounts in Stanbic been scrutinised by assembly or even auditor general?

Can statutory body actually create private company? (That’s if its members consented?

Why are ICAMEK positions not advertised yet they say ULS participates? Is ULS for a few?

Who appointed private law firm to register this company? Was there ever Annual general meeting of (AGM) of bankers body and ULS? When and where?

Have individuals hijacked statutory ULS for personal gain?

That aside, in May, a section of lawyers petitioned court challenging the legality of ICAMEK, saying it is a privately owned company operating without the consent of the members.

In the case filed before the Civil Division of the High Court, city lawyers; Nelson Walusimbi and Andrew Wambi sued ULS and ICAMEK).

It is alleged that by subscribing as a member to ICAMEK, the ULS is modifying its statutory mandate to circumvent the limits imposed on it by statute and to aid private profit initiatives against the general public of Uganda.

Among others, they wanted court to declare that; the administration and dispensation of justice is, by virtue of the Constitution of the Republic of Uganda, a preserve of the government and therefore a private entity such as the second defendant (ICAMEK) is prohibited by law from setting up a parallel and competing system of justice and judicial administration from that which is endangered by the state.

However, in early June, ULS executives in a rebuttal asked court to dismiss the case. Through its lawyers, ULS claimed the case did not disclose a cause of action, barred by law and an abuse of the court process.

Simon Peter Atwiine

PARTIES IN ARBITRATION MUST ABIDE BY ERRORS THEY MADE — S/COURT

PARTIES IN ARBITRATION MUST ABIDE BY ERRORS THEY MADE — S/COURT

The Supreme Court has held that since parties in a contract are bound by the terms of their contract, they must also be bound by errors and mistakes they made, condoned and invariably waived.

The apex court made the pronouncement while delivering a judgement in an appeal emanating from an arbitration dispute between Dr. Charles Mekwunye and Christian Imoukhuede wherein the Court of Appeal had nullified an arbitrary award, a tenancy arbitration agreement between the parties on the basis of an error in the agreement.

Dr. Mekwunye had in 2006 dragged Imoukhuede before an abritration panel over a tenancy dispute between them. After the arbitration panel delivered its judgment in favour of Mekwunye, Imoukhuede approached the High Court of Lagos to nullify the arbitrary award which the High Court refused.

He further approached the Court of Appeal seeking to nullify the decision on several groundings including that there was an error in the arbitration agreement.

Imoukhude through his lawyers contended at the lower court, that while part of the arbitration clause in the tenancy agreement had stipulated that any dispute between parties must be settled by Chartered Institute of Arbitrators London, Nigeria branch, there was no such known body as the only Arbitration body then was Chartered Institute of Arbitrators, UK, Nigeria branch.

In its decision, the Court of Appeal giving a literal meaning to the interpretation of the clause, allowed the appeal and reversed the earlier decision of the arbitration panel affirmed by the High Court. But the Supreme Court in a unanimous decision by all five Justices held that since parties in a contract are bound by the terms of their contract, they must also be bound by errors and mistakes they have condoned and waived. In her concurring judgment, Justice Mary Peter-Odili said: “I agree with the interpretation given by the trial court and I stand by it.”

Henry Ojelu

INTERNATIONAL COURT OF ARBITRATION FOR SPORT APPOINTS MOROCCO’S KARIM ADYEL

INTERNATIONAL COURT OF ARBITRATION FOR SPORT APPOINTS MOROCCO’S KARIM ADYEL

Rabat – The Court of Arbitration for Sport (CAS), an international body that settles sports-related disputes, has appointed Moroccan lawyer Karim Adyel as an arbitrator.

Adyel becomes the first Moroccan lawyer ever to be appointed as a CAS arbitrator.

Although he pursued a career in law, the Moroccan judge is passionate about sports and was a tennis player in the 80s.

“My passion for sports law and my specialization in the field stems from my love for sports, and particularly as I was a tennis player in the 80s,” Adyel told Maghreb Arab Press agency (MAP).

He added that the arbitrator must have several qualities, namely “neutrality, confidentiality, discretion and professional competence.” He further specified that an arbitrator must also have impartiality in his relations with all sports components.

Karim Adyel is also a professional mediator, international consultant, as well as a member of the International Association of Football Lawyers (AIAF).

The Court of Arbitration for Sport (CAS) is an institution independent of any sports organization. It was established to settle sports-related disputes through arbitration or mediation, by means of procedural rules adapted to the specific needs of the sports world.

Founded in 1984; the CAS is placed under the administrative and financial authority of the International Council of Arbitration for Sport (ICAS).

The Court has nearly 300 arbitrators from 87 countries, chosen for their specialist knowledge of arbitration and sports law. Around 300 cases are registered by the CAS every year.

Morocco World News

ACACIA GIVES BARRICK 10 DAYS TO MULL COMPETENT PERSONS REPORT

ACACIA GIVES BARRICK 10 DAYS TO MULL COMPETENT PERSONS REPORT

(Alliance News) – Acacia Mining PLC said Tuesday a competent persons report, prepared by an industry consultant, has valued its shares at 271 pence each.

Shares in the miner closed 1.6% higher in London at 181.30p each.

Acacia is currently facing a takeover offer from Toronto-listed gold mining giant Barrick Gold Corp.

Barrick owns 64% of Acacia and has offered USD285 million for the rest, though the two have not yet come to an agreement.

Barrick is offering 0.153 new Barrick share per Acacia share, valuing Acacia at USD787 million, giving Acacia shares an implied value of 146p.

Following the report, Barrick requested an extension to the deadline to make a firm offer for Acacia – which was Tuesday at 1700 BST.

Acacia has requested the deadline be extended by 10 days, to July 19.

“The board continues to believe that, subject to the price offered being fair and commanding the necessary support from shareholders, Barrick acquiring the remaining shares in Acacia it does not currently own would be an attractive solution for key stakeholders,” added Acacia.

The report carried out by SRK Consulting included a site visit to all of Acacia’s operating mines and an assessment of Acacia’s 2018 mineral resource and ore reserves.

SRK’s value scenarios assumed constant real commodity prices of USD1,300 per ounce for gold and long term prices of USD17.25 per ounce for silver and USD2.97 per pound for copper.

These scenarios, which Acacia said supports its own life of mine plans, value the company at between 271p and 281p per share. The lowest value scenario, which Acacia considers “highly conservative” values the company at 203p per share.

Acacia has been under a cloud ever since the Tanzanian government in 2017 banned all exports of metal concentrate in an effort to keep processing activities in the country. This has been problematic for Acacia as all three of its producing mines – Buzwagi, Bulyanhulu and North Mara – are located in Tanzania.

Acacia, which is not party to the talks, said the Tanzania government has warned it will not sign any resolution if Acacia is one of the counterparties to the agreements.

On Tuesday, Acacia said: “As stated consistently over the course of the last two years, Acacia’s preferred outcome remains the achievement of a negotiated settlement of its disputes with the government of Tanzania (howsoever negotiated or achieved), this being a settlement that would allow for the lifting of the export ban and resumption of full operations at Bulyanhulu, whilst continuing to operate at North Mara and Buzwagi in the ordinary course.

“Acacia’s desire for a negotiated settlement is part of the company’s long-term commitment to support Tanzania, its people and the mining industry going forward. In this regard, in the event that the transaction committee of the board were in a position to recommend, in due course, that the Acacia minority shareholders vote in favour of a Barrick offer, Acacia would seek to discuss appropriate steps for a stay of the arbitration with Tanzania and the arbitration tribunal.”

By Paul McGowan

NEW ICSID CASE AGAINST MOROCCO

NEW ICSID CASE AGAINST MOROCCO

On May 20th 2019, Impressa Pizzarotti & C. S.p.A., an Italian construction company, brought a claim under the Morocco-Italy BIT.

The Claimant is represented by Gugliemo Verdirame, Paolo Busco, Simon Olleson, and Fillipo Fontanelli from the United Kingdom, Kettani Law Firm from Morocco and Drew & Napier from Singapore.

There are no further details available about the project, however according to media reports the Claimant was involved in the Bouregreg Valley project and construction of tunnels in Oudayas in Rabat.

Recently Morocco has had similar claims by Corall, Calyle and Sholz at ICSID.

IARB Africa

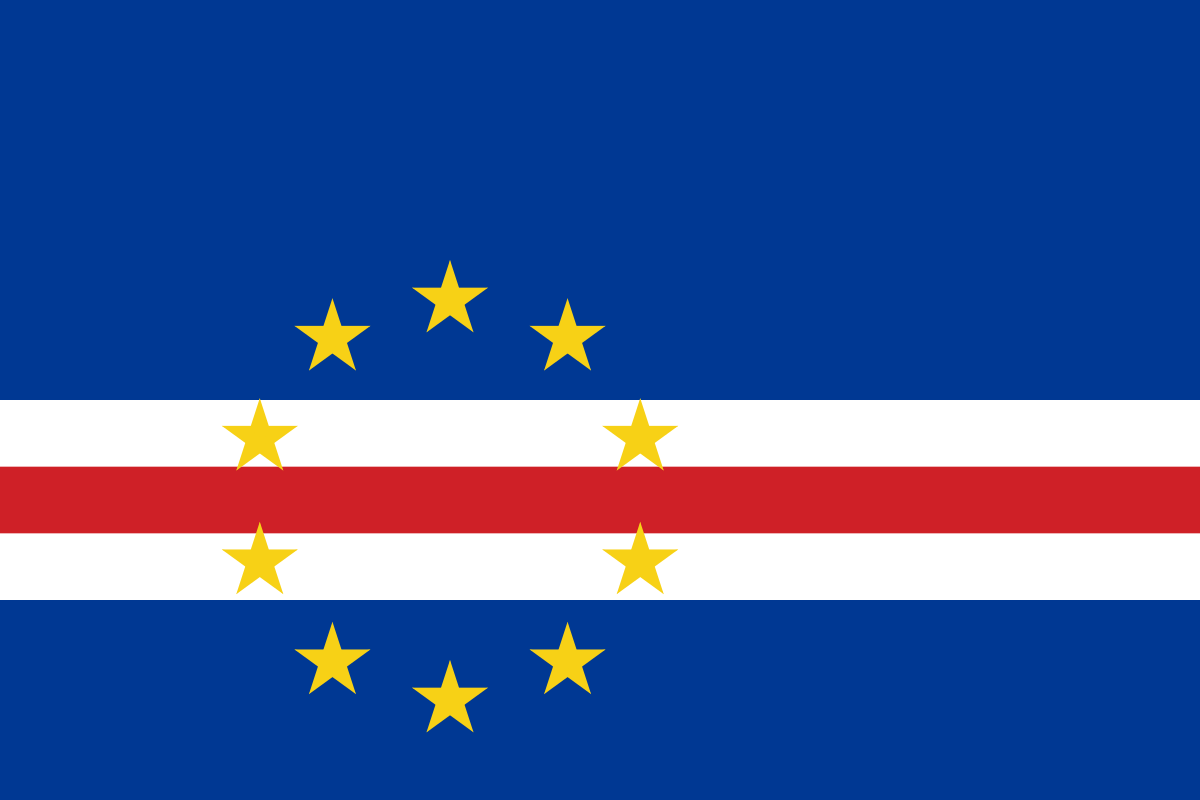

CABO VERDE SETTLES ICSID CLAIM

CABO VERDE SETTLES ICSID CLAIM

In a Telecom case brought by PT Ventures, a Portuguese company, against it under the Cabo Verde – Portugal BIT in 2015, the government has settled with the claimant. On March 26th 2019, the parties informed the Arbitral tribunal that they were negotiating a possible agreement and requested the suspension of the procedure and through a letter dated May 22nd 2019, the parties informed the tribunal that they have reached an agreement and wish to discontinue the procedure.

On June 10th 2019, the Arbitral tribunal issued a procedural order taking note of the discontinuance of the procedure, which brings an end to the case that was filed in 2015.

The Arbitral tribunal was composed of Fernando Mantilla-Serrano, Colombian national appointed by the Claimant, Benfeito Mosso Ramos, Cabo Verdean national appointed by the respondent and Juan Fernández-Armesto, a Spanish national appointed by the parties.

PT Ventures was represented by Vieira de Almeida & Associados from Portugal and the government of Cabo Verde was represented by Gide Loyrette Nouel from Paris, J.G. Assis de Almeida & Associados from Brazil, José Manuel Gomes Andrade and Oliver Melo Araújo from Cabo Verde.

IARB Africa

UPDATE: CLAIM AGAINST RWANDA AT ICSID

UPDATE: CLAIM AGAINST RWANDA AT ICSID

On May 24th counsel from Joseph Hage Aaronson LLP, a law firm based in London, submitted two memoranda on behalf of the Rwandan government. One of the memoranda covered preliminary objections and the other is a counter-memorial.

The case was brought by Bayview Group LLC and The Spalena Company LLC against the government of Rwanda based on the Rwanda-US BIT, filed on June 22nd 2018. The dispute relates to the cancellation of a mining concession earlier last year.

With regards to preliminary objections, counsel argues that the tribunal lacks jurisdiction:

Ratione temporis: some of the claims pre-date the coming into force of the Rwanda-US BIT and that claims related to expropriation, violation of the FET and MST,MFN and NT standards are out of time.

Ratione personae: the claimants has not sufficiently proven that they own or control the mining company whose license has been revoked in Rwanda not have they shown financial loss arising from the alleged breaches

Ratione materiae: the claimant’s Investment does not qualify as such under the Rwanda-US BIT or ICSID rules.

Ratione Voluntaris: the claimant has not respected the dispute settle process under the Rwanda-US BIT which requires

On June 28th, the tribunal would has issued a decision on the Respondet’s request to address its objections as preliminary objections, and as such the proceedings on the merits have been suspended. The tribunal will therefore make a decision on these objections prior to reviewing the merits of the case.

The Claimant’s are represented by Duane Morris out of USA. The tribunal is composed of J.Truman Bidwell JR appointed by the claimanr, Barbara Dohmann appointed by the respondent and Nicholas Phillips.

IARB Africa