MINISTERIAL COMMITTEE TO STUDY ARBITRATION CASES AGAINST THE GOVERNMENT

MINISTERIAL COMMITTEE TO STUDY ARBITRATION CASES AGAINST THE GOVERNMENT

The Prime Minister issued Decree 1062 for 2019 to establish a ministerial committee to study the international arbitration cases against the Government and issue its advice in this respect.

The committee will include the Ministers of Investment, the Minister of Justice, the Head of the State Lawsuits Authority, Minister of Parliament Affairs and representatives of the Minister of Interior, Administrative Supervision Authority and the General Intelligence Authority.

The committee will be competent to:

1. Opine on and advise the governmental entities in relation to all commercial or investment international arbitration cases initiated against them.

2. Opine on the appropriateness of the defense strategy and the supporting documents and suggest modifications or amendments to improve the Government’s position in the case.

3. Provide all kinds of legal support that the relevant governmental authority or its lawyers would need.

4. Suggest the amicable settlement of the dispute when appropriate and attend negotiation cession with the counter parties and agree on the main parameters of settlement.

Governmental authorities and government-related entities are prohibited from taking any procedure in relation to any arbitration dispute without taking the advice of the committee.

The decision of the committee will be binding on the relevant governmental authority involved in the arbitration after being approved by the Cabinet of Minister.

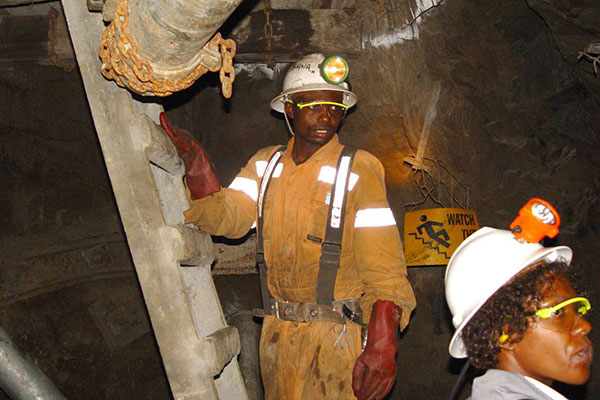

ZAMBIA PRESSES ON WITH LIQUIDATING VEDANTA UNIT ASSETS DESPITE RULING

ZAMBIA PRESSES ON WITH LIQUIDATING VEDANTA UNIT ASSETS DESPITE RULING

Zambia said on Tuesday it was proceeding with the liquidation of Vedanta Resources’ Konkola Copper Mines (KCM) even after South Africa’s High Court granted the firm an urgent interdict halting the liquidation until a final decision is made through arbitration.

Mines minister Richard Musukwa said foreign judgments are not enforceable in Zambia until they are registered in local courts.

“To that effect, it has no effect on the processes that are going on in Zambia,” he said, referring to the South African judgment.

Chris Mfula

NEW YORK JUDGE GRANTS STAY IN ENFORCEMENT CASE OF BILLION DOLLAR AWARD AGAINST NNPC

NEW YORK JUDGE GRANTS STAY IN ENFORCEMENT CASE OF BILLION DOLLAR AWARD AGAINST NNPC

On July 23, Judge Berman of the Southern District of New York has granted the parties request for a stay, until January 14, 2020 at 11 AM while warning that it will be the last stay of the proceedings.

Two international oil companies (IOCs), Chevron and Statoil, began the battle against the Nigerian National Petroleum Corporation (NNPC) in United States of America’s court to force the latter to pay out $1 billion in alleged overpayments on OML 128 where the prolific Agbami field is located, in March 2018.

Statoil and Chevron’s Nigerian branches requested a federal court in New York to uphold an arbitral decision ruled in their favour in March 2015 over their dispute with NNPC.

At the time, an arbitral court based in Nigeria had asked NNPC to pay nearly $1 billion to the majors to cover the excess amount it had earned when redistributing revenue from OML 128, which encloses the giant Agbami field (240,000 bpd), Africa Energy Intelligence reported.

It added that the NNPC motioned an appeal to the Federal High Court in Lagos which issued a counter-ruling in May 2015 stating that Statoil had to pay $1.1 billion to NNPC.

According to Africa Energy Intelligence, Statoil and Chevron didn’t accept the verdict and proceeded to take the battle to the New York court where they are claiming for NNPC to promptly pay the same amount as the March 2015 sentence, namely $1 billion.

This case is but one 3 other cases concerning Nigeria in the Southern District of New York Courts. The cases before Judges Stanton and Kaplan have been stayed, while the cases before Judge William Pauley is proceeding.

The OICs are represented by the law firm, Freshfields Bruckhaus Deringer, but also have the support of Nigerian lawyers, Babatunde Fagbohunlu, a partner at Aluko & Oyebode currently defending Chinese group, China National Offshore Oil Corporation (CNOOC) against Abuja, and Olasupo Shashore, former public prosecutor in Lagos, while NNPC is represented by Chaffetz Lindsey LLP.

More information about the case can be found here.

IARB Africa

NEW CASE FILED AGAINST SAO TOME AND PRINCIPE

NEW CASE FILED AGAINST SAO TOME AND PRINCIPE

The islands of Sao Tome and Principe have been hit by a new contract based arbitration case brought by 3 claimants: 1. National Investment Bank, 2. Superior Investments LLC and 3. Dr. Paulo Miguel Corte-Real Mirpuri.

Although not much public information is available on the case, it has been reported that The National Investment Bank in Sao Tome had its licensed revoked in 2011 and the arbitration may be related to that matter.

The tribunal has already been formed and is composed of Julie Bédard (President of the Tribunal), Eduardo Silva Romero and Valeria Galíndez.

Sao Tome and Principe is represented by Sérvulo & Associados –Sociedade de Advogados and De Juris – Posser da Costa & Associados while the claimants are represented by Vieira De Almeida e Associados.

IARB Africa

LEASING FIRM WINS CLAIM AGAINST TUSHO

LEASING FIRM WINS CLAIM AGAINST TUSHO

Tsusho Capital Kenya has been ordered to repair and refurbish close to 300 vehicles belonging to Vehicle and Equipment Leasing Ltd (Vaell).

A tribunal sitting in Nairobi ruled that Tsusho Capital, the financing arm of Toyota Kenya Group, had reneged on an agreement that it had signed with Vaell in 2013 when the company subleased 285 vehicles for onward leasing to the Government.

Instead of refurbishing the vehicles after the expiry of the lease period as agreed, Vaell said in court documents, the company neglected them to waste away and cannot dispose of them in their current condition.

The leasing firm through its lawyers submitted to the tribunal that the leased units, which included Toyota Land cruisers single and double cabs, are depreciating in value and without proper storage or maintenance.

The units were valued at Sh2.4 billion during the initial purchase.

On June 18, the arbitrator ruled that Tsusho Capital undertake repairs of the units within a month.

“The respondent (Tsusho Capital) be and is hereby ordered to forthwith meet all the return conditions documented in the agreement between the parties dated November 15, 2013, including refurbishing, removing police colours and other paraphernalia, repairing, repainting replacing missing and defective and faulty parts, restoring and returning and/ or surrendering to the claimant/applicant the motor vehicles pending the hearing and determi nation of the arbitration proceedings envisaged in the lease agreement,” said the arbitrator, John M Ohaga, in his ruling.

According to the arbitrator, the order was to be complied with within 30 days, failure to which the claimant was to go back to the court and seek the court’s guidance. Tsusho did not file a response to the claims that Vaell had made before the tribunal. The Government had in the first phase of leasing vehicles leased more than 3,000 units from different auto dealerships mostly for use by the National Police Service.

We are undertaking a survey to help us improve our content for you. This will only take 1 minute of your time, please give us your feedback by clicking HERE. All responses will be treated with the confidentiality that they deserve.

Macharia Kamau

ETHIOPIAN SUPREME COURT REFUSES TO ANNUL A LONDON ARBITRAL AWARD

ETHIOPIAN SUPREME COURT REFUSES TO ANNUL A LONDON ARBITRAL AWARD

The Cassation branch of the Supreme Court of the Federal Democratic Republic of Ethiopia has on July 14, 2019 rejected Agricom International’s (Swiss) plea for the annulment of an arbitral award in favor of the Ethiopian Trading and Business Corporation (ETBC). The final award was made in London by a five-member GAFTA (Grain and Feed Trade Association) Appeals Tribunal on 27 February 2018. The First Tier Tribunal’s final award followed a web of consolidated appeals before the Commercial Bench of the English High Court

Agricom’s annulment petition to the Ethiopian Supreme Court was based on the Supreme Court’s own precedent in the Permanent Court of Arbitration (PCA) Case No. 2013-32 (Consta JV v. CDE). In that case, the Supreme Court annulled an arbitral award for error of the interpretation and application of Ethiopian law. It exercised jurisdiction because the legal seat of the arbitration was Addis Ababa although the case was administered by the PCA and heard in The Hague.

Agricom argued before the Supreme Court that under PCA Case No. 2013-32, the Supreme Court had reaffirmed its constitutional mandate to be the final arbiter of all questions of Ethiopian law regardless of where the tribunal might have been seated. It further argued that because the applicable substantive law in the Agricom case was Ethiopian law, the Court had jurisdiction to review for reversible error. ETBC, on the other hand, argued that the Agricom case is fundamentally distinguishable from the Consta case because, unlike the Consta case, the legal seat of the Tribunal was in London, not Addis Ababa, which gives the English courts the exclusive supervisory jurisdiction. The Supreme Court agreed with ETBC’s position and dismissed Agricom’s annulment petition. This is a remarkable clarification of its own jurisprudence on annulment of arbitral awards in Ethiopia. This annulment petition was the last potential obstacle to ETBC’s enforcement effort.

In this case, both parties were represented by prominent Ethiopian lawyers: Alemu Denekew (who also served as an expert witness in the London judicial and arbitral proceedings) for Agricom, and Dr. Zewdineh Beyene Haile (who also led a group of international lawyers in the London judicial and arbitral proceedings as a part of Addis Law Group) for ETBC.

I-Arb Africa

LIBERIA'S MUSA BILITY WILL FILE CASE AGAINST CAF AT COURT OF ARBITRATION FOR SPORT

LIBERIA'S MUSA BILITY WILL FILE CASE AGAINST CAF AT COURT OF ARBITRATION FOR SPORT

Liberia’s Musa Bility, a member of the Confederation of African Football’s Executive Committee, has said he will file a case at the Court of Arbitration for Sport (Cas).

Bility is unhappy with what he calls the ‘co-operation agreement’ between the Confederation of African Football (Caf) and Fifa.

In a statement he said he will file a case imminently seeking to have the agreement made “null and void with immediate effect”.

The recent agreement will see Fifa Secretary-General Fatma Samoura work with Caf as a “General Delegate to Africa”.

It is a move where he hopes Cas “will give interim orders stopping the hostile takeover of Caf by Fifa and especially the decision to bring Fatma Samoura to head the Caf Secretariat.”

The controversial decision to bring in Samoura was given “almost unanimous” support by Caf’s Executive Committee according to the head of the Nigerian federation Amaju Pinnick.

Pinnick insisted that Samoura’s appointment would help “strengthen our judicial, governance and fiscal discipline”.

Fifa President Gianni Infantino attended the meeting and said he believed the plan would help “significantly improve” football on the continent.

SPORTS COURT SETS DATE FOR AFRICAN CHAMPIONS LEAGUE RULING

SPORTS COURT SETS DATE FOR AFRICAN CHAMPIONS LEAGUE RULING

GENEVA (AP) — Sport’s highest court will rule this month on how to resolve the chaotic African Champions League final which was abandoned in May.

The Court of Arbitration for Sport said Monday it set a July 31 deadline for a final decision after both clubs appealed to be awarded the title.

The second-leg game between Wydad Casablanca of Morocco and Esperance of Tunisia on May 31 was annulled in a dispute provoked by a video review failure.

Wydad walked off in protest in Rades, Tunisia, when its equalizing goal was disallowed for an incorrect offside call.

Players and officials from the Moroccan club demanded a review by the video assistant referee (VAR) system but it was not available. Neither side was told before the game by the Confederation of African Football that the system which should have been installed was not working.

Typically in soccer, any team which refuses to play or walks off the field must forfeit the game.

However, the African confederation’s executive committee decided on June 5 in Paris to order the second-leg game replayed in a neutral country during July.

The controversy is part of a wider crisis for CAF and its president, Ahmad of Madagascar. Ahmad, who uses only one name, has been accused of misconduct by senior administrators who were fired in recent weeks and have filed complaints to FIFA’s ethics committee.

The court, based in Lausanne, Switzerland, said it registered appeals from both clubs to be declared the winner and awarded the prize money.

The eventual winner should represent Africa at the seven-team FIFA Club World Cup in Qatar in December.

The court did not give any details of where and when the hearing will take place. In Paris last month, police were called to the hotel where African officials were meeting to control fans demonstrating in the street.

The teams drew 1-1 in the first-leg game in Rabat, Morocco, on May 24. One week later, home team Esperance led 1-0 when Wydad thought it levelled early in the second half.

After a long delay on the field, Esperance was awarded the Champions League title before that decision was reversed days later in Paris, on the sidelines of FIFA’s annual meeting.

FIFA has said it will send its secretary general, Fatma Samoura from Senegal, on a six-month assignment starting Aug. 1 to oversee managing CAF’s business and governance.

Associated Press

ACACIA SEEKS STAY OF INTERNATIONAL ARBITRATION AGAINST TANZANIA

ACACIA SEEKS STAY OF INTERNATIONAL ARBITRATION AGAINST TANZANIA

Tanzania’s Acacia Mining on Wednesday said it was seeking a stay of international arbitration proceedings, days before a hearing was due to start and two days before a deadline for a buyout proposal by Barrick Gold Corp.

The gold miner has been fighting a bid by majority shareholder Barrick, which Acacia says undervalues it.

The deadline for a firm bid from Barrick, which holds 63.9 per cent of Acacia, is Friday.

That deadline is just ahead of Monday’s scheduled start of international arbitration proceedings against the Tanzanian government, with which Acacia has been locked in dispute over a $190 billion tax bill.

“If the Tanzanian government agrees to the stay, Acacia would expect the arbitration hearing to be postponed to provide time for the government of Tanzania to complete its settlement discussions with Barrick Gold Corp,” Acacia said in a statement.

Tanzanian allegations that Acacia has broken environmental regulations have ratcheted up the pressure on Acacia.

Late on Tuesday, Acacia said the Tanzanian National Environment Management Council issued a notice for Acacia’s North Mara mine to prevent it using its tailings storage facility by 6 am local time on Saturday on the grounds the mine had breached environment rules.

In a statement, Acacia said it was seeking clarification and would request any investigation reports or data upon which the North Mara notice is based.

Acacia’s North Mara mine was issued with an Environmental Protection Order and fine in May 2019 for alleged deficiencies at a tailings storage facility.

But Acacia says it has never received any reports that would justify the decision. It said the North Mara technical team has been working “constructively and collaboratively” with the Tanzanian government.

The miner late Friday announced that it was halting all further gold exports from its North Mara pending an impromptu government inspection of the mine’s current production.

“The Mining Commission (at the ministry) is soon to conduct an inspection of North Mara’s gold production, and export permits for gold shipments from North Mara will be issued following completion of this inspection,” reads the statement.

Acacia recorded a 51 per cent increase in gold output from its three Tanzanian operations combined during the second quarter of 2019, attributing this mainly to an 80 per cent spike in production at the North Mara concession.

REUTERS

KCB WANTS APPEALS COURT TO OVERTURN RULING ON BANK SURETY #6

COURT RESERVES JUDGMENT IN VEDANTA APPLICATION AGAINST WINDING UP ZAMBIA OPERATIONS

JOHANNESBURG – Johannesburg’s high court has reserved judgment in Vedanta Resources’ application for an urgent interim interdict against the Zambian government’s appointment of a provisional liquidator to wind up Konkola Copper Mine (KCM) operations.

The Indian-owned mining company is challenging Lusaka’s decision, through Zambia Consolidated Copper Mines (ZCCM), to appoint provisional liquidator Milingo Lungu after accusing Vedanta of breaching the terms of its licence, failing to exploit the Nchanga underground mine and paying creditors on time.

Vedanta says ZCCM has itself breached the KCM shareholders’ agreement by pursuing winding-up proceedings. It argued in court that the issues raised by ZCCM in its liquidation application before Zambia’s high court were covered by the KCM shareholders agreement, to which it is a signatory.

Vedanta said this was a matter for arbitration, but that process could not happen if the other party was intent on finding a new investor for its asset.

The company said it was clear from statements made by government officials and reports in local and international media that Zambia intended to sell KCM to a new investor in the near future.

The high court in Johannesburg, which heard arguments from Vedanta on Tuesday and from ZCCM on Wednesday, has reserved judgement to July 23.

Should Vedanta’s application succeed and an interim order be granted, the order will remain in place until an arbitration – to be instituted in due course – has been resolved.

AFRICAN NEWS AGENCY