GERALD GROUP UNIT SEEKS ARBITRATION AGAINST SIERRA LEONE OVER IRON EXPORTS

GERALD GROUP UNIT SEEKS ARBITRATION AGAINST SIERRA LEONE OVER IRON EXPORTS

SL Mining, a mining company owned by U.S. commodity trader Gerald Group, said it plans to seek arbitration in an international court against the Sierra Leonean government in relation to a dispute over iron ore exports.

The government banned exports from SL Mining’s Marampa mine last month because it said the company had failed to keep up the mine’s agreed work schedule or make royalty payments, a claim SL Mining denies.

In a letter to the company dated Tuesday and made available to Reuters by the government, Mines Minister Foday Rado Yokie said that “as a sign of good faith” he would be willing to lift the export ban should SL Mining pay a $1 million bond for uncompleted work, among other fees.

Responding a day later in a letter to the minister, made available to Reuters by the company, SL Mining director Alejandro Skidelsky described the offer as “an attempt at extortion” and said that the company “has already served notices of disputes in respect of its rights to bring matters to international arbitration”.

SL Mining estimates that its Marampa concession holds about one billion tonnes of iron ore with the potential for production to run for the next 30 years.

The license was previously held by Timis Mining Corporation, run by Australian-Romanian businessman Frank Timis. Timis relinquished the concession in 2017 after having failed to meet minimum activity requirements. (Additional reporting by Pratima Desai in London Editing by Edward McAllister and Alexandra Hudson)

Cooper Inveen

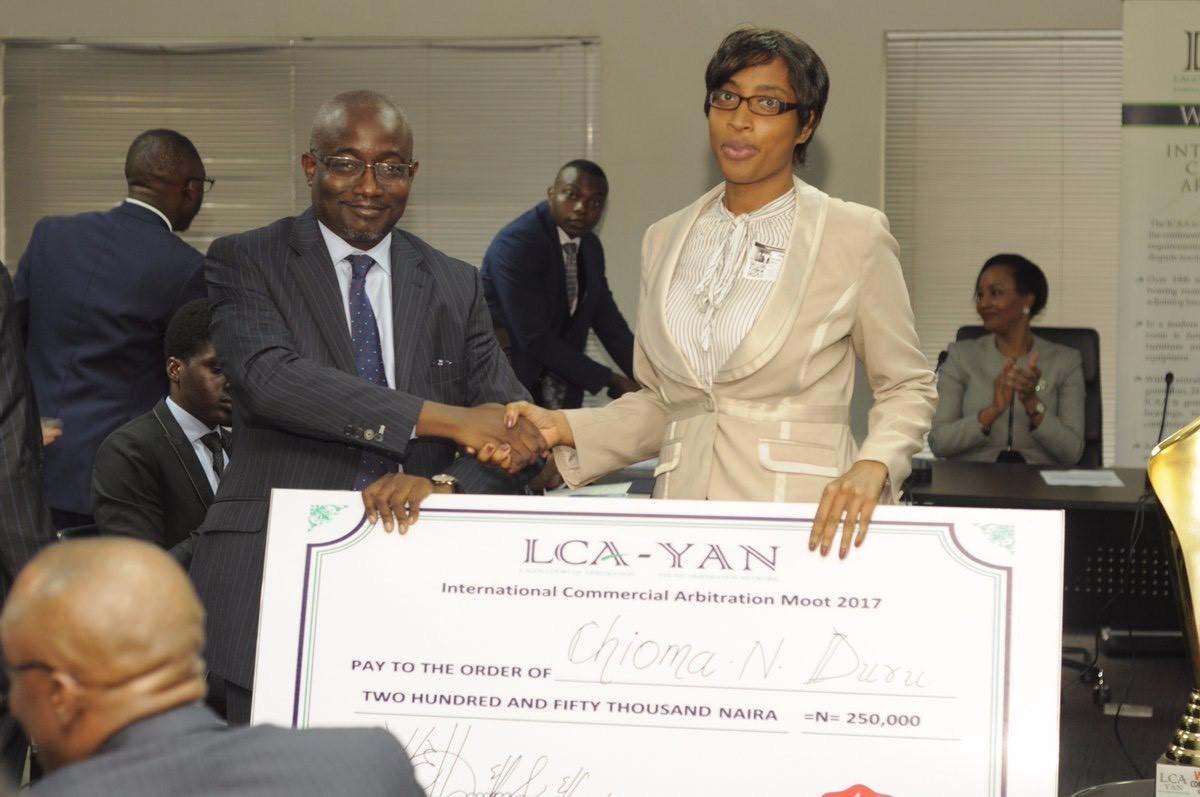

LASU WINS LCA-YAN MOOT ARBITRATION CONTEST

LASU WINS LCA-YAN MOOT ARBITRATION CONTEST

Faculty of Law, Lagos State University, has been adjudged the winner of this year’s International Commercial Arbitration Moot Competition organised by the Lagos Court of Arbitration-Young Arbitrators Network.

LASU beat University of Lagos; University of Ibadan; and Obafemi Awolowo University, Ile-Ife to the $1,000 prize.

This was as Strachan Partners emerged winner in the law firm category.

Strachan Partners beat Olisa Agbakoba Legal; Babalakin & Co; and Banwo & Ighodalo to pick the coveted prize.

The competition, which held at the Lagos Court of Arbitration, Lekki, Lagos, last week, also saw Efemefuna Iluezi-Ogbaudu emerge as the Best Advocate in the law firm category, while Babajide Olusegun claimed the corresponding prize in the university category.

An executive member of the LCA-YAN, organisers of the contest, Oluwaseun Philip-Idiok, said it aimed “to expose young professionals to international arbitration practice and provide them with a platform to exchange views on issues of international arbitration.”

Philip-Idiok said the contest, which was in its third edition, was getting richer as it had resulted to the University of Lagos representing Nigeria this year at the Willem C. Vis International Commercial Arbitration competition in Vienna, Austria.

A member of the panel of judges, Mrs Funke Agbor (SAN), who said she was involved in the competition for the first time, said she was proud of the performances of the participants.

“It was impressive listening to young people dissecting cases and trying to persuade the arbitral tribunal on the decision they should take,” Agbor said.

Oladimeji Ramon

LEGAL BATTLES AS SOUTH SUDAN DEALS GO SOUR

LEGAL BATTLES AS SOUTH SUDAN DEALS GO SOUR

Kenya has become a battleground for firms reeling from business deals gone bad with South Sudan.

Increasing court cases involving the South Sudan government have exposed difficulties in doing business with Juba as several firms keep claiming losses stemming from valid contracts.

Stanbic Bank is currently fighting a Sh1.4 billion claim from Nairobi-registered Air Afrik Aviation Limited, which has accused the lender of dishonest banking.

COMPENSATION

This spat is also under probe by the Central Bank of Kenya, following a complaint by Air Afrik Aviation Limited.

In its suit, Air Afrik claims Stanbic has given two contradicting stories to justify an allegedly illegal reversal of Sh720 million that the flight operator received from South Sudan as payment for a tender.

Air Afrik has now accused Stanbic of producing fraudulent entries in its bank statements. The two entries on May 30, 2016 were made to show that Air Afrik wired the Sh720 million in dispute back to South Sudan.

The flight operator expected the money as payment from South Sudan for charter services to Juba’s Defence and Veteran Affairs ministry.

The flight operator says Stanbic first blamed the reversal on an attachment order against South Sudan’s bank accounts in Kenya, before arguing that the Sh720 million had been remitted in error.

Air Afrik holds that Stanbic’s story changed after a threat to sue, which the flight operator now insists is evidence of dishonest banking.

The attachment order in question stemmed from a long-drawn battle between Khartoum-based Active Partners Group and the South Sudan government over a botched electrification contract.

In 2015, an arbitration panel ordered South Sudan to pay Active Partners Sh4.2 billion as compensation for pulling the plug on the contract.

TRANSACTION

Active Partners then asked the Milimani High Court to allow it attach South Sudan’s accounts in Kenya, and an order was granted on February 9, 2016.

A day earlier, Stanbic had remitted Sh720 million in Air Afrik’s account on the strength of a credit advice note — a document from a customer instructing his or her bank to pay someone else — from South Sudan.

Stanbic says the credit advice note was not backed by any funds, and that it deposited its own money in Air Afrik’s account.

South Sudan last year withdrew all money it had in Kenyan banks and deposited in undisclosed offshore accounts to avoid further attachment.

At the time, Active Partners had attached nearly Sh2 billion that South Sudan held in Stanbic and Citibank.

However, Stanbic has denied Air Afrik’s claims, saying the Sh720 million was deposited in error.

The lender says it was not legally bound to use its own money to settle dues owed by South Sudan, and that Stanbic was within its rights to recover all funds involved in the transaction.

BRIAN WASUNA

SWISS COURT MAKES A U-TURN ON CASTER

SWISS COURT MAKES A U-TURN ON CASTER

Caster Semenya’s hopes of defending her 800m title at the IAAF World Championships in Doha, Qatar, later this year have suffered a serious knock.

A judge of the Swiss Federal Supreme Court on Tuesday reversed prior rulings that had temporarily suspended the IAAF’s regulations pending the outcome of Semenya’s appeal against the Court of Arbitration for Sport (Cas) award.

According to the statement issued by the athlete’s legal representatives on Tuesday night, “a single judge of the Swiss tribunal” reversed with immediate effect the initial ruling that had ordered the IAAF that it cannot apply its rules while Semenya’s appeal was ongoing.

“This ruling will prevent Caster from defending her title at the World Championships in September 2019,” read the statement.

Dorothee Schramm, the lawyer leading Semenya’s appeal, said the middle distance star remains steadfast in her defiance of the controversial IAAF regulations that require female athletes with naturally elevated testosterone levels to undergo hormonal drug intervention in order to compete in international competitions.

Said Schramm: “The judge’s procedural decision has no impact on the appeal itself. We will continue to pursue Caster’s appeal and fight for her fundamental human rights. A race is always decided at the finish line.”

The statement quoted Semenya as saying: “I am very disappointed to be kept from defending my hard-earned title, but this will not deter me from continuing my fight for the human rights of all the female athletes concerned.”

The Doha global track and field meeting runs from September 27 to October 6 and Semenya was expected to defend her title over the two-lap event, which she has dominated for a decade.

Last month the Swiss Supreme Court temporarily suspended the IAAF rule that requires “classified athletes” to reduce their testosterone to below five nanomole per litre for at least six months if they wished to compete internationally at all distances from 400m to a mile.

Semenya has refused to take hormone medication and instead lodged a landmark legal case against the IAAF at Cas earlier this year, who sadly ruled in May in favour of the athletics body.

The IAAF has been criticised for the rules – which came into effect on May 8 – with many expects within the international community arguing that the regulations were ethically dubious and poses unknown but serious medical side-effects.

The IAAF had said in a statement that it would only comment once the Swiss tribunal “makes its reasoning public”.

Daniel Mothowagae

ESPERANCE DECLARED AFRICAN CHAMPIONS AFTER LEGAL BATTLE

ESPERANCE DECLARED AFRICAN CHAMPIONS AFTER LEGAL BATTLE

Officials of american airport security company “Securiport” do not intend to give in to intimidation by beninese authorities. They are determined to complete the procedure in order to be restored to their right.

Since the decision of Paris International Room of business (PIRB) in the legal dispute between Benin and the American company “Sécuriport”, the company’s managers have taken every precaution to ensure that the verdict of the said court is respected. According to the daily newspaper “Matin libre”, this is not the time for triumphalism in American society.

We are concentrating on enforcing the verdict of the Paris International Chamber of Commerce, even if we are not closed to the possibility of entering into discussions with Benin. “We only want one thing, to be restored in our rights in this country,” confided a company official, according to statements reported by our source.

The summons of their representative in Benin by the Economic and Financial Brigade (EFB) is perceived by the company’s officials as a provocation to delay the execution of the court decision. It should be recalled that BEF officials wanted to know how the company obtained the documents displayed in front of the International Chamber of Commerce in Paris. But these manoeuvres do not make Securiport lose its serenity. The leaders still hope that the Beninese authorities will show openness by embarking on the path of sincere negotiations for the good of the country’s image.

UPDATE 1-AUSTRALIA'S FAR LTD SEES RULING ON SNE ARBITRATION BY 2019 END

UPDATE 1-AUSTRALIA'S FAR LTD SEES RULING ON SNE ARBITRATION BY 2019 END

Australian oil and gas explorer FAR Ltd on Wednesday said that a tribunal ruling is expected by the end of 2019 for its arbitration with Woodside Petroleum Ltd over the latter’s stake in the SNE oil project off Senegal.

FAR is currently in arbitration over the sale by ConocoPhillips of a 35 percent interest in the SNE project to Woodside for $350 million in 2016.

FAR had contended that it should have had pre-emptive rights over the ConocoPhillips stake, which was sold for what it considered a cheap price. Woodside maintains the claim has no merit.

SNE is a deep-water oil field discovery with Cairn holding 40% participant interest, Woodside 35%, FAR 15% and PETROSEN the rest.

The arbitration outcome is key to lining up project financing for the $3 billion SNE project and making a final investment decision (FID).

“The joint venture project financing, led by Societe Generale in London, is also progressing and expected to be finalised to facilitate a 2019 FID decision,” FAR said in a quarterly report.

Woodside Chief Executive Peter Coleman told analysts in June that the arbitration was slowing down efforts to line up funding, as project financiers want to know who is actually in the joint venture.

“That’s important for them because that then pertains to the risk that they have for their financing … If Woodside’s not in the joint venture, then they’ll find it very difficult to project finance the project. That’s key for us at the moment,” he said at an investor briefing.

Aby Jose Koilparambil in Bengaluru, additional reporting by Sonali Paul in MELBOURNE; editing by Richard Pullin

Reuters

COURT RULES NOSTRA TERRA OIL AND GAS IN DEFAULT OF EGYPT JV PAYMENTS

COURT RULES NOSTRA TERRA OIL AND GAS IN DEFAULT OF EGYPT JV PAYMENTS

Nostra Terra Oil and Gas said an arbitration court had ruled against the company regarding sums outstanding for the East Ghazalat joint venture in Egypt with North Petroleum International.

The London Court of International Arbitration Tribunal found that a wholly-owned Nostra Terra subsidiary, Nostra Terra Inc., was in default of the venture’s joint operating agreement (JOA).

The default was for the non-payment of November and December 2015 cash calls to North Petroleum of around $1.06m, plus interest estimated at $125k.

Non-payment could culminate in the transfer of Nostra Terra’s 50% interest in the concession to North Petroleum, which currently holds the other 50% stake.

‘The East Ghazalat asset is considered non-core to Nostra Terra, which is focused on the Permian Basin, and East Texas, US, where it operates,’ Nostra Terra said.

‘The board is considering its next steps with its legal advisers, including seeking damages in favour of Nostra Terra Inc., in respect of alleged breaches of the JOA by North.’ At 2:03pm: [LON:NTOG] Nostra Terra Oil Gas Company PLC share price was 0p at 1.8p

DP WORLD SLAMS DJIBOUTI GOVERNMENT’S ATTEMPT TO OVERTURN PORT RULING

DP WORLD SLAMS DJIBOUTI GOVERNMENT’S ATTEMPT TO OVERTURN PORT RULING

Dubai’s DP World condemned the government of Djibouti over its decision to challenge previous rulings in the Doraleh Container Terminal case as the long-running legal battle continues.

The Djibouti government has decided to apply later this week to the country’s high court to rule all previous international adjudications as null and void. The global ports operator on Wednesday said it is a “complete disregard for, and contravention of” the legal system and existing contracts.

“The move is proof of Djibouti’s complete disregard for recognised legal practice and respect for contracts calling into question any investment in the country both now and in the future,” DP World said.

A panel in London in March awarded substantial damages to a DP World affiliate over the Djibouti government’s seizure of the country’s most advanced container terminal.

The UAE-backed venture was kicked out despite holding a 30-year concession to operate the port, triggering legal battles over its rights to control.

The London Court of International Arbitration ordered the African nation to pay $385 million (Dh1.41 billion) plus interest for breach of the Doraleh Container Terminal holding company’s exclusive rights.

Deena Kamel

STEINMETZ TO FIGHT GUINEA CORRUPTION CHARGES IN SWISS COURT

STEINMETZ TO FIGHT GUINEA CORRUPTION CHARGES IN SWISS COURT

“His defense is simple, he absolutely contests all the charges against him. They have no basis in the facts or in law,” Beny Steinmetz’s Geneva lawyer told “Reuters.”

Israeli billionaire Beny Steinmetz will appear in court to fight the Swiss corruption charges against him his Geneva lawyer has told “Reuters.” Steinmetz rejects the charges that he paid bribes to win mining licenses in Guinea.

In February, Steinmetz’s mining company Beny Steinmetz Group Resources (BSGR) reached a settlement with Guinea’s government and abandoned the large Simandou iron ore project. The affair seemed over until the Swiss prosecutor announced an indictment yesterday.

Geneva prosecutor Claudio Mascotto said he is seeking prison sentences of two to 10 years for Steinmetz and two associates over the alleged payment of $10 million in bribes for mining licences between 2005 and 2010.

Steinmetz’s Geneva lawyer Marc Bonnant told “Reuters,” “His defense is simple, he absolutely contests all the charges against him. They have no basis in the facts or in law,” he said.

Steinmetz’s two associates who are also being charged are Frederic Cilins, a French former adviser to BSGR, and an unnamed Belgian woman.

The trial will not begin for months, “Reuters” reports.

The prosecutor accused the three of “having promised in 2005 and then paid or had bribes paid to one of the wives of former Guinean President Lansana Conte”, so as to have mining rights in Simandou allocated to BSGR.

“Just as the Guinea government has backtracked on its claims, here too it will be proven that there was no wrongdoing in Steinmetz’s activities,” Steinmetz’s spokesman told “Reuters.” “It should be emphasised that the investigation was launched in Switzerland at the request of the Guinea government, and under international arbitration Guinea has retracted its claims, which is why these are baseless charges.”

Guinea’s mines minister, Abdoulaye Magassouba, told “Reuters” that the government was not involved in trying to prosecute Steinmetz, given February’s agreement. “We have signed specific agreements with Steinmetz and we will fully respect the terms of the agreement. It is not possible for a hostile action against BSGR to come from the government,” he said.

Steinmetz, a former resident of Geneva who moved back to Israel in 2016, attended questioning sessions by the prosecutor, Bonnant said.

“He has given all the indications he could and all the documents to which he had access,” Bonnant said. “And of course he will attend the trial.”

Steinmetz denies the actions attributed to him, and is entitled to the presumption of innocence.

Globes, Israel business news

CAS RULING REINSTATE PHAR RANGERS BACK IN DIVISION ONE

CAS RULING REINSTATE PHAR RANGERS BACK IN DIVISION ONE

The Court of Arbitration for Sports (CAS) has ordered the Ghana Football Association (GFA) to reinstate relegated lower division side, Phar Rangers into the National Division One League, after they were deemed to have been wrongfully relegated from the second tier of Ghana Football.

The decision came after Phar Rangers lost a legal tussle to Okyeman Planners at the local football governing body.

Being dissatisfied with the decision and the legal framework of football administration, Phar Rangers headed for redress at CAS.

CAS verdict ruled that GFA’s initial decision should be reviewed and Phar Rangers reinstated as a division one side in the next National Division One league.

The then division one side were sacrificed alongside Okwawu United FC from the zone 3 of the Division league despite several appeals and legal tussles with the Ghana Football Association.

“The decision of the Appeals Committee of Ghana Football Association of 23 February 2018 is set aside and replaced by this award. In the game between Phar Rangers FC and Okwawu United of 16 July 2017, Phar Rangers FC is declared the forfeit winner by 3:0, Phar Rangers FC, therefore, remained in the GFA Division I League in the next football season,” he said.

“The costs of the arbitration, to be determined and served to the parties by the CAS Court Office, shall be borne by the Ghana Football Association. The Ghana Football Association is ordered to pay an amount of CHF 6,000 to Phar Rangers as a contribution to the costs and expenses incurred by Phar Rangers FC in connection with these arbitration proceedings.”