MOZAMBIQUE WANTS CREDIT SUISSE, PRIVINVEST TO HELP PAY ITS BONDS

MOZAMBIQUE WANTS CREDIT SUISSE, PRIVINVEST TO HELP PAY ITS BONDS

Mozambique wants a U.K. court to order Swiss lender Credit Suisse Group AG, shipbuilder Privinvest and others to share responsibility for repaying a $727 million Eurobond the government is restructuring.

Details of the claims, filed in London’s High Court of Justice in February, are laid out in a 102-page document sent to bondholders and seen by Bloomberg. The so-called consent solicitation memorandum and the High Court filings haven’t been made public before.

The government’s request comes as the country enters the final stages of a three-year process to reorganize its debt amid allegations by the U.S. Department of Justice that a series of maritime projects the loans funded were used to pay bribes.

The memorandum seeks approval from investors to switch the Eurobonds due in 2023 into $900 million of notes maturing from 2028 to 2031. In it, the government tells investors it’s seeking indemnity against any liabilities arising from the existing bonds, the costs of servicing the debt and expenses related to the new issuance.

“Mozambique is claiming indemnification and/or contribution for any liability it may have to the holders of the existing notes and full cost of debt service and associated costs relating to the new bonds to be issued in the current debt-restructuring process,” the Mozambican government said in the memorandum sent to bondholders.

In addition, the natural gas-rich nation asked the court to nullify a government guarantee on a related $622 million loan arranged by Credit Suisse for state-owned ProIndicus. It’s also assessing whether it has any rights or obligations regarding a $535-million loan to Mozambique Asset Management in light of criminal proceedings locally and in the U.S. related to the three debts.

Mozambique’s case is that the loans were all part of a “fraudulent scheme,” the document shows. The government also said it was deceived into restructuring $850 million of so-called loan-participation notes in 2016 into the existing Eurobonds, according to the memorandum to bondholders.

“Mozambique is hoping that the court will pass the responsibility of servicing the restructured debt to others, including Privinvest and Credit Suisse,” said Rodrigo Olivares-Caminal, professor and chairman of banking and finance law at Queen Mary University of London’s Centre for Commercial Law Studies.

The group that represents holders of 68% of Mozambique’s Eurobonds declined to comment. Mozambique’s attorney general’s office, contacted by phone, asked for an emailed query, to which it didn’t respond. Credit Suisse declined to comment.

“Privinvest denies any validity to the claim and the fact that English courts could have jurisdiction over it,” said Philippe Pinsolle, a lawyer at Quinn Emanuel Urquhart & Sullivan LLP, which represents the shipbuilding company. “As to the suggestion that the underlying transactions with the Mozambican entities would be a sham, which relates to the arbitration, it is simply a lie.”

The government has little chance of passing on its Eurobond responsibilities to others, according Mitu Gulati, a law professor at Duke University in Durham, North Carolina.

“I don’t think that Mozambique can plausibly hope to get a court to order the defendants to service the bonds,” he said by email. “Rather, Mozambique seems to be informing the bondholders that it is suing some other people and hopes to recover funds from that litigation. And those funds may or may not be used to service the Eurobond.”

GUILTY PLEA

Questions have lingered as to whether Mozambique should pay the $2 billion of debts racked up through deals done during 2013 and 2014, the bulk of which were concealed from donors. In a December indictment, the U.S. Department of Justice alleged the maritime projects were nothing but a front to pay at least $200 million in bribes and kickbacks to corporate executives, bankers and government officials. Two former Credit Suisse managers involved in arranging the loans have already pleaded guilty in the case.

After one of the managers, Andrew Pearse, accused Privinvest CEO Iskandar Safa of being aware of bribery in the deals, Mozambique started separate civil proceedings against him in the U.K. High Court. Safa said Pearse’s allegations are unfounded and came after months of pressure from U.S. prosecutors, reducing their credibility.

The memorandum that the government sent to Eurobond holders also noted a claim that Privinvest has brought against it and the three state-owned companies involved in the debt scandal in two arbitration cases in Switzerland. The shipbuilder has estimated these to total $800 million, according to the document.

“That would be a very loose estimate,” said Privinvest’s lawyer Pinsolle. It’s too early in the process to say exactly how much the company will claim, he said, declining to comment on the arbitration as it’s confidential.

The case number is CL-2019-000127.

NIGERIA ESCAPES ANOTHER $1.8BN FINE IN OIL DEAL IN US

NIGERIA ESCAPES ANOTHER $1.8BN FINE IN OIL DEAL IN US

Nigeria has escaped another legal judgement against it after a US judge rejected Exxon Mobil Corp’s and Royal Dutch Shell Plc’s effort to revive a $1.8 billion arbitration award. Reuters reports that William Pauley who is a US district judge gave the judgement on Wednesday, September 4.

The case was brought against Nigeria over a 1993 contract dispute with the Nigerian National Petroleum Corporation over extraction of oil. The judge “cited public policy and due process considerations in deciding not to enforce the October 2011 award against the NNPC which was subsequently set aside by courts in Nigeria.” Pauley wrote in his decision that “while this court may have inherent authority to fashion appropriate relief in certain circumstances, exercising that authority to create a $1.8 billion judgment is a bridge too far.

The companies said that the award had grown to $2.67 billion, including interest. Exxon spokesman Todd Spitler said they disagreed with the judgement and now re-evaluating their next step.

Cecilia Moss who is the lawyer of the NNPC said: “NNPC is very pleased with the decision, and was always confident that there was no basis for a U.S. court to confirm the award.” According to court papers “the 1993 contract anticipated that Exxon and Shell affiliates would invest billions of dollars to extract oil from the Erha field, about 60 miles (97 km) off Nigeria’s coast, and share profits with NNPC.” It was however reported that more oil was extracted contrary to the contract.

The judge said Exxon and Shell “executed a contract in Nigeria with another Nigerian corporation containing an arbitration clause requiring any arbitration to be held in Nigeria under Nigerian law, and it then sought to confirm the award in Nigeria.

Meanwhile, former minister of defence Theophilus Yakubu Danjuma revealed that he committed $40 million for the take-off of the energy project which was a contract between the federal government and the Process and Industrial Development Ltd (P&ID).

In an interview with Businessweek Magazine, the former minister said the project was his original idea but that it was hijacked by co-founder of P&ID, Michael Quinn.

The Irish company was awarded $9.6 billion against Nigeria over the failed gas flaring project and Danjuma claimed one of his companies, Ita-Kuru Petrochemicals Ltd, provided the fund to prepare for it.

COURT FORCES SALE OF ARBITRATION AWARD TO PAY LAW FIRM DENTONS

COURT FORCES SALE OF ARBITRATION AWARD TO PAY LAW FIRM DENTONS

A European law firm won Delaware court approval to have a former client’s $92 million arbitration award seized so that it can be paid for its legal services.

Law firm Dentons Europe LLP sued former client Customs and Tax Consultancy LLC (CTC) in June after CTC allegedly failed to pay for legal fees accrued in its arbitration victory against the Democratic Republic of the Congo.

Dentons, in an effort to get paid for its legal fees, asked the Delaware court to authorize arbitration award broker ClaimTrading Ltd. to seize the award and market it on behalf of CTC.

“It’s an interesting case, and interesting relief, but I think you’re right, I can do this,” Joseph R. Slights III, vice chancellor of the Court of Chancery in Delaware, said at an Aug. 26 hearing, siding with Dentons and approving ClaimTrading to market the award.

Dentons filed its lawsuit in Delaware’s Chancery Court because CTC is a limited liability company formed in the state.

UNPAID AWARD

CTC provided consulting work for the Congo for a project in the late 2000’s, but the African country allegedly failed to pay.

Dentons represented CTC in arbitration proceedings at the International Chamber of Commerce’s International Court of Arbitration in 2015. The court ruled that the Congo owed CTC more than $90 million plus fees and interest.

CTC still has not received money from the Congo, Emily A. Letcher of Bayard PA, representing Dentons, told the court Aug. 26.

CTC, which has never disputed it owed Dentons, failed to respond to the law firm’s lawsuit, Letcher said.

Dentons declined to comment further on the case. ClaimTrading declined to comment on the court’s decision. CTC could not be reached for comment.

In a separate but related case, CTC sued the Congo in June in U.S. District Court for the District of Columbia for breach of contract. The firm is asking the court to confirm the $90 million award.

The case is Dentons Europe LLP v. Customs and Tax Consultancy LLC, Del. Ch., No. 2019-0415, Order default judgment 8/26/19.

D.C. FIRM SEEKS TO CONFIRM $1.25 MILLION AWARD AGAINST GABONESE REPUBLIC

D.C. FIRM SEEKS TO CONFIRM $1.25 MILLION AWARD AGAINST GABONESE REPUBLIC

WASHINGTON – A global law firm with an office in Washington, D.C. is seeking to confirm an arbitration award of more than $1 million against a foreign state.

Bryan Cave Leighton Paisner LLP filed a petition to confirm an arbitration award on May 29 in the U.S. District Court for the District of Columbia against The Gabonese Republic.

The petition states the plaintiff and defendant entered into an agreement on Jan. 29, 2016, in which the plaintiff agreed to provide services to the defendant for $1.38 million plus expenses.

The petition states amount of $1.26 million was unpaid as of March 13, 2018, and this sum remained unpaid by the defendant. The plaintiff alleges it submitted a request for arbitration in July 2018 and a panel ruled in April that it was owed $1.25 million and that compliance was to be completed by May 3.

The plaintiff is seeking for the court to enter the award of judgment to confirm the award and the costs of the action. The plaintiff is represented by Rodney F. Page of Bryan Cave Leighton Paisner LLP in Washington, D.C.

THE GAMBIA LODGE FRESH APPEAL IN ROW OVER PLAYER ELIGIBILITY

THE GAMBIA LODGE FRESH APPEAL IN ROW OVER PLAYER ELIGIBILITY

The Gambia Football Federation (Gff) has appealed to the Court of Arbitration for Sport (Cas) over the eligibility of Togo defender Adewale Olufade, who played in an Africa Cup of Nations qualifier between the two countries.

Last month, the Confederation of African Football (Caf) dismissed the Gff’s initial appeal which claimed Adewale does not meet the necessary criteria to play for the Sparrow Hawks.

“We’ve appointed a Belgian lawyer who has vast experience in sports law to defend us at the Court of Arbitration for Sport and we’re hopeful that justice will be served this time around,” Gff’s communications director Baboucarr Camara told BBC Sport.

Caf ruled the Togolese Football Federation was able to prove that Olufade was born in Togo, making him eligible to play.

But African football’s governing body also admitted there had been an administrative error on its Competitions Management System (CMS), which led the Gff to protest that Olufade is actually Nigerian.

“There are people within Caf who are sympathetic to our case but we don’t know why they refused to do the right thing and this has further perplexed us,” Camara added.

Olufade, 24, played for Togo as they drew 1-1 with The Gambia on 12 October last year.

Both countries are currently tied on five points at the bottom of Group D in Nations Cup qualification, with Togo ahead courtesy of their head-to-head record.

Group D after five matches:

Algeria | 10 points (qualified)

Benin |7 points

Togo |5 points

Gambia |5 points

If the Scorpions’ appeal is successful, Caf rules state that Togo will be disqualified and their results annulled, something that could have a big impact on who qualifies from Group D.

The final round of matches sees Benin host Togo while The Gambia, who have never reached the finals of the Cup of Nations, travel to Algeria.

africanews.com

CAMEROON : A 2ND CONTAINER TERMINAL TO BE BUILT IN DOUALA PORT

CAMEROON : A 2ND CONTAINER TERMINAL TO BE BUILT IN DOUALA PORT

Douala Autonomous Port (Port autonome de Douala-PAD), the company in charge of the management of Douala port, is preparing the construction of a second container terminal. This was revealed by the specialized magazine dedicated to structuring projects in the Douala-Bonaberi port.

According to the magazine, this terminal could be funded under a Built Operate Transfer (BOT) scheme, “either on the left bank as an extension to the current container terminal or on the right bank.” Feasibility studies and concession agreements are expected to be completed by the end of December 2019, the source adds.

This project is revealed at a time when the PAD is conducting a process to select a new concessionaire for the first terminal, which is being operated by Douala International Terminal (DIT) since 2005. This company is controlled by the consortium Bolloré-APM Terminals. Candidate to its own succession, the consortium has not been shortlisted at the end of the international call for expression of interest. Five candidates have been shortlisted, two of which have already submitted their offers for the restricted tender procedure.

“This is not an eviction (…) the consortium you are referring to [Ed note: Bolloré-APM Terminals] freely participated in the competition but, it was not in the top five after an appraisal of the candidates ranked, based on strict criteria, by the ad hoc internal commission” formed for this operation, the PAD’s managing director Cyrus Ngo’o explained during an interview with Jeune Afrique.

To understand the reason it was not selected after 20 years at the container terminal, the consortium Bolloré-APM Terminals filed an action before Douala administrative court, official sources indicate.

An authorized source within the consortium explained that in case of unsatisfactory explanations, the grouping could possibly try an international arbitration procedure or even demand the termination of the concession procedure. For the time being, the procedure is being carried out “peacefully,” the PAD indicates.

Meanwhile, Dubaï Port World and Suisse Terminal Investment Ltd, which submitted their offers during the restricted tender process, must prepare to face competition from this second container terminal as of 2021.

Brice R. Mbodiam

Business in Cameroon

TANZANIA: GOVERNMENT CLARIFIES SEIZURE OF ATCL AIRCRAFT

TANZANIA: GOVERNMENT CLARIFIES SEIZURE OF ATCL AIRCRAFT

The government yesterday explained the seizure of Air Tanzania Company Limited’s (ATCL) plane in South Africa, assuring that the aircraft will soon be released.

The government’s clarification comes amid unclear understanding among wananchi over reasons behind the seizure of one of the newly purchased aircrafts to revive the state-owned airline.

Speaking during an interview with national television-Tanzania Broadcasting Corporation- the government’s Chief Spokesperson, Dr Hassan Abbasi said there was misunderstanding over the issue to members of the public.

Many link the confiscation of the aircraft with debts that ATCL owed the South African Airways when the two airlines partnered, he said.

“In fact, our plane has been seized following a court case that existed since the 1980s between a South African national, Hermanus Steyn and the government,” Dr Abbasi clarified.

Mr Steyn had lived in Tanzania and happened to possess huge wealth including lands, livestock and other valuables that were then nationalised. According to Dr Abbasi, Steyn accepted the nationalisation of his properties but subject to compensation.

In 1990s, he reached an agreement with the government over the amount to be paid as compensation and the government paid part of the debt, Dr Abbasi explained.

The claimant has now sought an enforcement of foreign arbitration award in South Africa for payment of the remaining amount. “These are normal legal procedures.

We Tanzania, holding chairmanship of the Southern African Development Community (SADC), we respect legal systems. But, we assure Tanzanians that our aircraft will come back, though I can’t predict dates,” he stated.

The government spokesperson said the remaining six planes of the ATCL were all safe except the one in South Africa. Dr Abbasi explained that though the court ruled on the enforcement of foreign arbitration, the main case is not yet heard on whether the government will bow to his demand or not.

Dr Abbasi said Steyn chose to be heard by the court without presence of the Tanzanian government and that Tanzanian lawyers were currently at work to ensure that the aircraft was brought back to the country.

Bernard Lugongo

All Africa

D.C. FIRM SEEKS TO CONFIRM $1.25 MILLION AWARD AGAINST GABONESE REPUBLIC

D.C. FIRM SEEKS TO CONFIRM $1.25 MILLION AWARD AGAINST GABONESE REPUBLIC

WASHINGTON – A global law firm with an office in Washington, D.C. is seeking to confirm an arbitration award of more than $1 million against a foreign state.

Bryan Cave Leighton Paisner LLP filed a petition to confirm an arbitration award on May 29 in the U.S. District Court for the District of Columbia against The Gabonese Republic.

The petition states the plaintiff and defendant entered into an agreement on Jan. 29, 2016, in which the plaintiff agreed to provide services to the defendant for $1.38 million plus expenses.

The petition states amount of $1.26 million was unpaid as of March 13, 2018, and this sum remained unpaid by the defendant. The plaintiff alleges it submitted a request for arbitration in July 2018 and a panel ruled in April that it was owed $1.25 million and that compliance was to be completed by May 3.

The plaintiff is seeking for the court to enter the award of judgment to confirm the award and the costs of the action. The plaintiff is represented by Rodney F. Page of Bryan Cave Leighton Paisner LLP in Washington, D.C.

Carrie Bradon

Legal Newsline

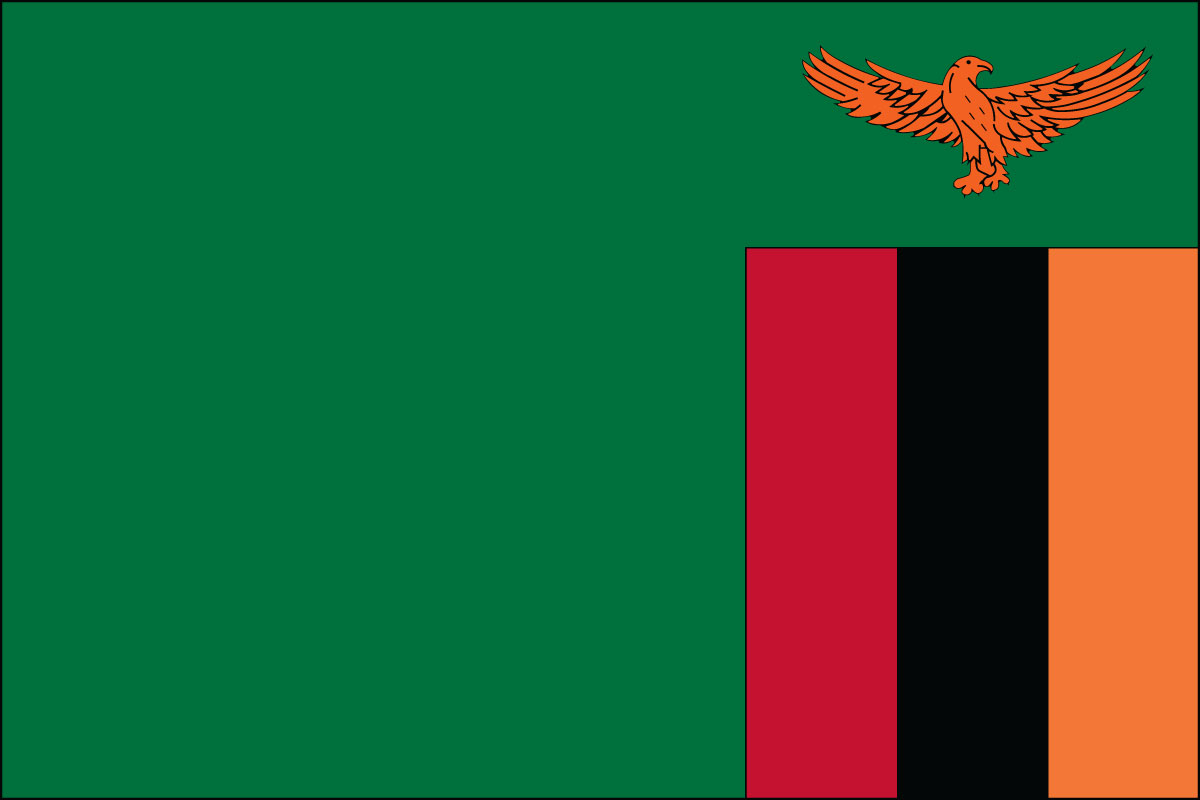

KANSANSHI HOLDINGS LIMITED APPLIES TO HAVE ARBITRAL AWARD AGAINST ZCCM-IH REGISTERED IN ZAMBIA

KANSANSHI HOLDINGS LIMITED APPLIES TO HAVE ARBITRAL AWARD AGAINST ZCCM-IH REGISTERED IN ZAMBIA

Kansanshi Holdings Limited and Kansanshi Mining Plc have applied before the Lusaka High Court that a London court’s final award against ZCCM Investments Holdings should be registered and enforced in Zambia.

In this matter, Kansanshi Holdings Limited and Kansanshi Mining Plc as first and second applicants, respectively, have cited ZCCM-IH as respondent, seeking an order that the arbitral award dated July 9 and made in London, should be registered and enforced against the respondent.

In an affidavit in support of ex-parte originating summons, Kansanshi Mining corporate secretary Joyce Mwansa, explained that Kansanshi Holdings Limited was part of First Quantum Group of Companies (FQM).

She added that Kansanshi Mining’s board was majority-controlled by Kansanshi Holdings Limited and was made up of the chairman and up to 11 other directors of whom two were appointed by ZCCM-IH.

“On December 20, 2001, ZCCM-IH entered into an amended and restated Shareholders’ Agreement with the applicants in which Kasanshi Holdings Limited is the majority (80 per cent) shareholder in Kansanshi Mining Plc and ZCCM-IH is the minority shareholder,” read the affidavit.

Mwansa explained that ZCCM-IH instituted arbitration proceedings against the applicants in London to which it alleged that between 2007 to 2014, cash reserves of Kansanshi Mining did not attract a commercial rate of interest when they were deposited with FQM.

She added that ZCCM-IH referred the dispute to arbitration as per the Agreement and sought permission to commence a derivative claim on behalf of the mining company to maintain claims against Kansanshi Holdings Limited.

“That in summary, the respondent alleged in the arbitration that some time between 2007 to 2014, cash reserves of the second applicant, which had been built up did not attract a commercial rate of interest when they were deposited with FQM (the deposit account), being the first applicants’ treasury entity and that false representation about that deposit account were made to it, namely, the term and uses of the facility,” read the affidavit further.

Mwansa further stated that the arbitral tribunal concluded that ZCCM-IH failed to show falsity of representations and failed to show loss arising from the fact that monies were in the deposit account.

She added that according to the ruling, ZCCM-IH failed to establish a prima facie case as required and was accordingly denied permission to commence the derivative action on behalf of Kansanshi Mining.

Mwansa stated that being dissatisfied with the ruling, ZCCM-IH commenced an action in the High Court of England and Wales, seeking to set aside the ruling on grounds that the arbitral award had been procured by fraud.

She disclosed that on May 22, this year, the High Court of England and Wales dismissed the action by ZCCM-IH on the basis that the ruling was not an arbitral award and, therefore, not subject to being set aside in the manner that an arbitral award can be set aside.

“The said judgement further stated that in any case, even assuming that the ruling was an arbitral award, ZCCM-IH had failed to establish on the evidence that there had been a fraud,” read the affidavit further.

Mwansa stated that on July 9, the arbitral tribunal rendered its final award against ZCCM-IM in which it ordered that ZCCM-IH pays Kansanshi Holdings Limited approximately K9,095,184.36, in respect of its legal fees and disbursements in the arbitration and K1,554,202.84 by way of repayment of its 50 per cent share of the cost of the arbitration.

She disclosed that the sums having been demanded by Kansanshi Holdings Limited of ZCCM-IH, had been paid in full.

Mwansa stated that she was advised that the Final Award, having been made in London, was binding upon ZCCM-IH and had neither been set aside nor suspended in Zambia or London.

She added that she was further advised that the Final Award was capable of enforcement and execution in the United Kingdom.

Zondiwe Mbewe

P&ID GAS PROJECT: BRITISH COURT GRANTS FIRM PERMISSION TO SEIZE NIGERIAN ASSETS WORTH $9.6BN

P&ID GAS PROJECT: BRITISH COURT GRANTS FIRM PERMISSION TO SEIZE NIGERIAN ASSETS WORTH $9.6BN

A British court has given Process and Industrial Development Limited (P&ID) the approval to seek to seize the Nigerian government’s assets worth $9.6 billion.

According to a report by Reuters, the court in a judgement delivered on Friday, August 16, said it would grant the foreign firm the right to seek to seize the federal government’s assets worth $9.6 billion over an aborted gas project.

The newspaper reported that P&ID was awarded $6.6 billion in an arbitration decision over a failed project to build a gas processing plant in Calabar, Cross River state’s capital.

P&ID had reportedly had an agreement with the Nigerian government in 2010 to build a gas processing plant but the deal collapsed because Nigeria did not meet its end of the bargain.

The judge’s decision reportedly converts the arbitration award to a legal judgement, which would allow P&ID to try to seize assets worth $9 billion, interests included.

Commenting on the judgement on behalf of the company, Andrew Stafford Q.C. of Kobre & Kim said: “We are pleased that the court has rejected Nigeria’s objections both to the arbitration process and to the amount of the award and that it will grant permission to P&ID to begin enforcement of the award in the United Kingdom.

“The court has ruled decisively in P&ID’s favour and has comprehensively rejected Nigeria’s efforts to avoid payment of this award of over $9.6 billion.

“P&ID is committed to vigorously enforcing its rights, and we intend to begin the process of seizing Nigerian assets in order to satisfy this award as soon as possible.”

WHAT IS THE DEAL ABOUT?

P&ID, a firm founded by two Irish businessmen, in 2010 entered into a 20-year gas and supply processing agreement (GSPA) with the federal government to build a state-of-the-art gas processing facility in Calabar. Nigeria was to have a 10% stake, according to the agreement.

The plant was to refine associated natural gas into non-associated natural gas to power the national electric grid.

The agreement stipulated Nigeria would receive 85% of the non-associated gas at no cost for electrical generation and industrialisation. P&ID would receive the remaining 15% of byproduct – methane, propane, butane – to sell on the commercial markets, of which Nigeria would receive proceeds from their 10% stake in the company’s ownership, The Cable reports.

Based on the agreement, the government was to supply 150 million standard cubic feet (scf) of the gas per day to P&ID — rising to 400 million scf in the life of the project. The gas was otherwise being flared by the oil-producing companies.

Pensioners applaud Appeal Court judgement outlawing pension for political office holders The GSPA also required the government to build a gas supply pipeline to the P&ID facility.

P&ID said after spending several years preparing for the project, the project collapsed because the Nigerian government did not build a pipeline or secure supply of gas as stipulated in the agreement.

THE LEGAL BATTLE

In 2012, P&ID took the government to arbitration over the reported failure of the deal.

The tribunal was reportedly organised in London under the rules of the Nigerian Arbitration and Conciliation Act as part of the original contractual agreement between parties.

In January 2017, P&ID won the case as the tribunal ruled that Nigeria was liable for $6.6 billion in damages, which was based on what the company could have earned during the 20-year agreement. However, with interest payments over the years, the amount is over $9 billion.

ASSETS TO BE SEIZED

While it is not immediately which assets are eligible to be seized, Reuters said that assets used for diplomatic purposes – such as the Nigerian High Commission building in central London – are not eligible for seizure, but commercial assets are.

Nurudeen Lawal