CHINA: WE WON’T FUND MAMBILLA POWER UNTIL NIGERIA SETTLES LEGAL DISPUTE

CHINA: WE WON’T FUND MAMBILLA POWER UNTIL NIGERIA SETTLES LEGAL DISPUTE

The Chinese government has asked Nigeria to settle the legal dispute over the $5.8 billion Mambilla power failing which it would not provide the funds for the project.

In 2006, the China Gezhouba Group Corporation of China (CGGCC) and China Geo-Engineering Group Corporation (CGGC) had won the bid for a joint venture to execute the hydropower project with a proposed capacity of 3,050 megawatts — the single biggest power plant in Nigeria.

Meanwhile, in 2003, the ministry of power had awarded the build, operate and transfer (BOT) contract of the project to Sunrise Power and Transmission Company Limited (SPTCL), a local content partner.

This was followed by the signing of a general project execution agreement (GPEA) with SPTCL in November 2012.

However, in November 2017, the ministry signed another engineering, procurement and construction (EPC) contract with Sinohhydro Corporation of China, CGGCC and CGGC to form a joint venture for the execution of the PROJECT — excluding SPTCL.

As a result, SPTCL dragged the federal government and its Chinese partners before the International Chamber of Commerce (ICC) in Paris, France, over an alleged breach of contract.

Leno Adesanya, chief executive officer of SPTCL, claimed the company had spent millions of dollars with financial and legal consultants to raise about $6 billion for the execution of the project, yet the company has suffered a lot over the years “through improper administrative interruptions and interventions”.

Due to the ongoing legal tussle, Nigeria risks $2.3 billion fine over the proposed 3,050-megawatts facility conceived in 1982.

In a letter dated September 18 to Sale Mamman, minister of power, seen by TheCable, He Yongjun, project manager for the the Chinese partners, maintained that the China Exim Bank, which is expected to provide 85 percent of the joint funding, will not finance the project until the legal issues are resolved.

“The Chinese government is showing a positive attitude towards the Mambilla Project. However, according to financing policy of China, the Export-Import Bank of China cannot provide loans to a project with legal disputes, which is the main reason why the project has not entered into substantive financing negotiations so far,” Yongjun said.

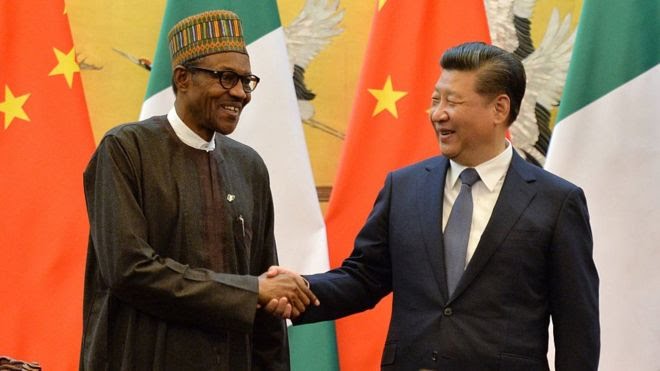

“On 5th September, 2019, Yang Jiechi, Special Representative of President Xi Jinping informed the Nigerian President and Commander in Chief, President Muhammadu Buhari that unless the legal dispute is resolved, conforming out of court settlement funding for the loan will not be accessed.

“A meeting shall be organized by the Ministry of Power for negotiation between the relevant authorities of the Nigeria government, SUNRISE, and the members of the EPC Contractor JV to resolve the legal disputes through amicable negotiations so as to let the plaintiff withdraw the lawsuit.

“Should such negotiation fail, if the Nigeria government considers that the arbitration result is beneficial to the Nigeria government, it is suggested that the judicial department of Nigeria (Attorney General) issue a formal legal paper to the Chinese authority confirming that: the legal dispute has no effect the Mambilla Project.

“And the Nigeria government requests China to start project financing negotiation as soon as possible, financing of the Mambilla Project cannot be stagnant due to legal disputes.

“However, if the Nigeria Government believes that there is a better way to resolve legal disputes, we support it. In any case, the settlement of legal disputes should not be delayed.”

NIGERIA CHARGES TWO BRITONS IN CONNECTION WITH $9BN CLAIM

NIGERIA CHARGES TWO BRITONS IN CONNECTION WITH $9BN CLAIM

Nigeria has charged two British nationals with fraud and money laundering over a failed gas project at the centre of a multi-billion-dollar arbitration award in London, the anti-graft agency said.

Suspect James Nolan appeared in court in Abuja on Monday while co-defendant Adam Quinn was charged in absentia.

The pair were arraigned over “their alleged complicity in the controversial $9.6bn arbitral award to Process and Industrial Development Limited by a United Kingdom commercial court”, the Economic and Financial Crimes Commission (EFFC) said in a statement on Monday.

The agency said the accused – both directors of Goidel Resources Limited – had violated Nigeria’s money laundering laws to help P&ID by failing to submit documents and disclose $125 000 in the firm’s accounts to the authorities.

Both of them pleaded not guilty to the charges, the EFCC said. Quinn was represented by his lawyers.

Presiding judge Okon Abang remanded Nolan in custody until November 20 for further hearing.

The hearing was the latest stage in the long-running dispute between Nigeria and P&ID, widely reported to be registered in the British Virgin Islands, over a 2011 failed deal to build a gas plant in the oil and gas-rich west African nation.

In August, a British court gave the go-ahead for P&ID to seize $9.6bn in Nigerian government assets – a fifth of the country’s foreign reserves –over the botched deal.

The agreement to build a processing plant to refine and supply Nigerian gas between the government and the company, set up in 2010 by two Irish partners, fell through in 2012.

An arbitration tribunal in England awarded the firm $6.6bn (5.9bn euros) in damages in January 2017 but P&ID said it has accrued interest, raising the overall figure to more than $9bn.

A London court in September granted a stay-of execution on the judgement pending an appeal by Nigeria.

Last month, a court in Abuja convicted two local representatives of P&ID over tax invasion and fraud and ordered that the company’s assets be forfeited to the government.

$62BN PSC REVENUE: SHELL BATTLES FG OVER DEMAND FOR $13.65BN

Ade Adesomoju

Shell Nigeria Exploration and Production Company Limited has a share of about $13.65bn in the $62bn which five international oil companies allegedly owe Nigeria following the 2018 Supreme Court’s judgment on Production Sharing Contracts between the country and the firms, SUNDAY PUNCH learnt on Saturday.

The apex court’s verdict enabled the Federal Government to increase its share of income from the PSCs.

Shell is opposing the demand for a total of $13,651,034,052.59 by the Federal Government on the grounds that it was planning to commence arbitration proceedings in respect of the issue.

The firm which accused the Federal Government of unilaterally making adjustments in the PSC in respect of the Oil Mining Lease 118 in enforcing the apex court’s verdict sought a court order stopping the government from taking further action on its demand for the money until its planned arbitration is concluded.

The company filed the suit, marked, FHC/ABJ/CS/154, before the Federal High Court in Abuja, in which it sought an injunction against the government.

The four other IOCs from whom the Federal Government had demanded various sums of money based on the Supreme Court’s verdict filed similar suits at the Federal High Court in Lagos.

Parts of the court documents filed by Shell were seen by our correspondent on Saturday.

The documents indicated that the Federal Government demanded $13,651,034,052.59 from Shell, through a letter dated January 14, 2019, issued on its behalf by Trobell International Nigeria Limited.

Trobell is joined as the second respondent in the Shell’s suit, while the Nigerian National Petroleum Corporation is joined as the first respondent and the Attorney-General of the Federation as the third.

Shell’s suit filed through its lawyer, Ogunmuyiwa Balogun of the Olaniwun Ajayi law firm, is anchored on section 251(1)(r) of the Nigeria Constitution, section 53 of the Arbitration and Conciliation Act, Article 26(3) of the Arbitration Rules, section 11 and 13(1) of the Federal High Court Act and Order 28 Rule 1 of the Federal High Court (Civil Procedure) Rules.

But Trobell, in its response to the suit, had asked the court to dismiss the suit for lack of jurisdiction.

The firm’s preliminary objection filed through its lawyer, Oladapo Agboola was seen by SUNDAY PUNCH on Saturday.

It argued that the matter could not be “re-litigated” after the Supreme Court had made a pronouncement on it.

It also argued among others that the affidavit filed in support of the suit contained extraneous issues which the court could not rely on.

Meanwhile, there are indications that there are ongoing talks aimed at an amicable resolution of the dispute out of court.

The matter was scheduled to come up before Justice Ijeoma Ojukwu on October 15 but the judge did not sit.

Court’s list of cases scheduled for that date showed that the matter was adjourned till November 7 for “report of settlement.”

The Supreme Court had on October 17, 2018, ordered the Federal Government to immediately commence steps to recover all revenues lost to oil exploring and exploiting companies due to wrong profit-sharing formula termed as the Production Sharing Contracts since August 2003.

A seven-man panel of the apex court led by then Chief Justice of Nigeria, Justice Walter Onnoghen, made the order in a consent judgment in respect of a suit filed by three states, Rivers, Bayelsa and Akwa Ibom against the Federal Government in 2016.

The states, through their various Attorneys-General and the Federal Government, through the Attorney-General of the Federation, had on April 6, 2018, filed the terms of settlement which the apex court adopted as its judgment on Wednesday.

The term of the settlement was signed by the Attorneys-General of the three states, Emmanuel Aguma (SAN) (for Rivers), Kemasuode Wogu (for Bayelsa) and Uwemedimo Nwoko (for Akwa Ibom) as well as the lead counsel for the AGF, Mr Lucius Nwosu.

The Permanent Secretary of the Federal Ministry of Justice, Mr Dayo Apata, signed as the witness.

Copyright PUNCH. All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express written permission from PUNCH.

ZIMBABWE: BITUMEN ENGINEERING, CHINA INTERNATIONAL COURT BATTLE RAGES #3 #4

NEW TAX ARBITRATION RULES LOCK OUT KNOWN EVADERS

The Treasury has introduced new rules to guide alternative dispute resolution (ADR) for aggrieved taxpayers that lockout notorious evaders and cap dispute timelines.

Under the regulations that introduce a facilitator, specific legally backed timelines are introduced to prevent the disputes from becoming long-drawn-out for taxpayers.

The Kenya Revenue Authority (KRA) earlier said it had been unable to collect Sh283 billion from big taxpayers, thanks to a slow-paced Judiciary and failure by the Treasury to put in place the tax appeals tribunal (whose disputes are now admissible at ADR) to resolve disputes.

“ADR shall commence upon written communication by the appointed facilitator that a matter is eligible for ADR and shall be concluded within ninety (90) days thereof,” says the draft.

“A dispute shall not be eligible for Alternative Dispute Resolution where it is in the public interest to have judicial clarification of the issue (and) the parties have not complied with the provisions of the relevant tax legislation and there is evidence that the non-compliance is consistent or deliberate.”

KRA Deputy Commissioner Tax Dispute Resolution head Rispah Simiyu said the aim is to firmly anchor dispute resolution in the law by forming subsidiary legislation to be read together with the Tax Procedures Act No 29 of 2015.

“There were previously no ADR regulations, only the ADR Framework, which provides the general guidelines on how ADR is conducted on tax disputes at KRA,” she told the Business Daily.

“The ADR regulations will capture most of the areas highlighted in the framework and shed light on the procedures relating to the ADR process.”

KRA Commissioner-General James Mburu earlier said businesses and individuals aggrieved by tax demands were all too happy to file appeals before a tribunal they knew did not have a quorum or was, at best, moribund.

During this time, the disputed taxes could not be collected and taxman could do nothing. But under the new rules, the matter can be taken straight to courts.

“Defaulters took advantage of this vacuum to lodge cases at the Tax Appeals Tribunal and we could only wait,” said Mr Mburu in an earlier interview with the Daily Nation.

BUS OPERATORS, DRAKE LUBEGA ARBITRATION COLLAPSES

BUS OPERATORS, DRAKE LUBEGA ARBITRATION COLLAPSES

The case was filed by Uganda Bus Operators accusing the two businessmen of illegally erecting buildings at the former Baganda Bus Park.

A case between Uganda Bus Operators Association Investment Limited and Kampala businessmen Drake Lubega and Mansur Matovu has been sent back to High Court after arbitration failed.

The case was filed by Uganda Bus Operators accusing the two businessmen of illegally erecting buildings at the former Baganda Bus Park.

The High Court will now hear and dispose of the case in which Bus Operators accuse the two businessmen, a one Tom Smith Semuwemba and the Commissioner of Land Registration of fraud and trespass on land located on plot 48-52 along Nakivubo Road.

The land which measures approximately 0.550 hectares, is valued at about Shs9b.

Mr Hamimu Sentongo, the Uganda Bus Operators chairman told Daily Monitor after collapse of the mediation session that: “… it is very hard to talk with someone who has already used your land and is in contempt of court orders,” adding: “We want justice to take its course and see the way forward.”

Mr Sentongo claimed Mr Lubega only bought a plot measuring 30X100 on the land in question but, he fraudulently took over the whole chunk.

The complainant filed through Kakuru and Co. Advocates accuses Mr Lubega one of the defendants of fencing off land and constructing commercial buildings, which he jointly owns with Matovu.

Uganda Bus Operators also accuses the two businessmen of transferring its residual leasehold interest on the certificate of title illegally.

Consequently, Uganda Bus Operators Association Investment Limited is seeking court to order the Commissioner of the Land Registration to cancel the certificate of title in the names of the two businessmen, among other claims.

THE DEFENCE

In a written statement of defence, Mr Lubega and Mr Matovu deny all the allegations, noting that at the commencement of hearing of the case, they will raise a preliminary objection to its competence on ground that it is misconceived, frivolous, bad in law and an abuse of court process and shall pray the suit be dismissed.

BRIAN NGUGI

SURPRISE AS MTN DROPS P3.3BN MASCOM DEAL

SURPRISE AS MTN DROPS P3.3BN MASCOM DEAL

MTN’s desertion of the bid came as a surprise as the group has a November date with the Botswana Public Officers Pension Fund (BPOPF) for arbitration in the battle.

Both sides had already lined up lawyers for the arbitration, in which the pension fund was challenging MTN’s decision to sell its 53% stake in Mascom to Econet. The BPOPF argues that a separate shareholder covenant with MTN gives the pension fund the right to make an offer for the stake under a forced sale arrangement.

MTN group chief financial officer, Ralph Mufita told investors yesterday morning that the pan-African mobile giant was throwing in the towel.

“Econet’s unsolicited offer to acquire our 53% stake in Mascom has been terminated following certain conditions of the sale not being met,” he said in a scheduled financial update in Johannesburg.

Mufita did not elaborate on whether MTN was still offering the stake up for sale, while BPOPF officials could not be reached to comment on the state of play.

The P3.3 billion deal hit the headlines in March after Econet, a Zimbabwean mobile mega-corp, announced it had reached terms with MTN to take up the Mascom stake. The deal would have increased Econet’s overall hold in Mascom to 60%.

While Econet and Mascom founder, Strive Masiyiwa buoyantly told a packed youth meeting in Gaborone in April that the deal was a fait accompli, Econet ran into trouble after BPOPF resisted the transaction citing the right of first refusal principle.

Pension fund insiders said the BPOPF was not only wary of the billionaire’s plans for Mascom but believed control of the country’s largest mobile telecomms provider should remain with Batswana who have built up its value over the last 21 years.

Later, lawyers retained by the pension fund reportedly advised that while the BPOPF did not have pre-emptive rights to block the Econet/MTN deal, it did have the right to pursue a forced sale of the shares MTN holds in Deci.

Deci is an investment vehicle which holds 60% of Mascom. BPOPF holds 67% of Deci and MTN the balance, with their relationship governed by a shareholders agreement.

MTN invested in Deci through Mobile Botswana Limited and the shareholders agreement allegedly states that if there is a change of ownership or control, the other shareholder, being BPOPF can initiate a forced sale.

BPOPF insiders yesterday told Mmegi the MTN decision had come out of the blue. “A date for arbitration had been set. This is news to us,” one insider said.

Mascom is comfortably the country’s largest mobile company, holding about 53% of the local mobile phone market’s estimated 3.18 million subscriptions in 2018.

MBONGENI MGUNI

D.C. ARBITRATION THREATENS EGYPT'S ECONOMIC REVIVAL

D.C. ARBITRATION THREATENS EGYPT'S ECONOMIC REVIVAL

An obscure arbitration underway in Washington, D.C., could have a huge impact on the struggling economy of Egypt, a key U.S. ally.

Petroceltic, a U.K.-based global energy company, has initiated arbitration proceedings against the Egyptian General Petroleum Corporation, or EGPC, at the International Centre for Settlement of Investment Disputes. Like a lot of companies that do business in Egypt, Petroceltic says it hasn’t been fully paid by the government for its work there.

Petroceltic is seeking interest on its unpaid balance in addition to the basic arrearage. Egypt says it doesn’t pay interest on unpaid bills. Petroceltic says it must. If the International Centre for Settlement of Investment Disputes, which is part of the World Bank, sides with the company, Egypt’s economic woes could get geometrically worse.

A lot is at stake in this case.

Egypt under President Abdel Fattah el-Sisi is a major American ally and a lynchpin for stability in the Middle East. Egyptian democracy is a work in progress and the U.S. is wise to encourage further political and economic reforms, especially in light of Egypt’s political upheavals and its vital role in the fight against Islamic extremism.

After years of financial doldrums, things are finally looking up in Egypt. The International Monetary Fund predicts that the Egyptian economy is growing at a respectable annual rate of 5.8 percent mostly because of recent economic reforms and a massive, $12 billion IMF loan.

Petroceltic has been active in Egypt for a long time. It bought three concessions for gas production in the Nile delta years ago. The company helps operate extraction facilities through the Mansoura Petroleum Company, a joint venture with the Egyptian government. Petroceltic provides important technical assistance and other services with the laudable goal of making Egypt self-sufficient in gas production.

Petroceltic invested hundreds of millions of dollars in Egypt and employs hundreds of people in the joint venture with the EGPC. It did so confident that Egypt would eventually reverse its faltering economy and become a stable force in northern Africa.

But when it came time for Petroceltic to be compensated for its work, the government was slow to pay. The result: about $5 million in back payments are still due and so is another $51 million – ten times the basic amount – in interest. The unpaid debt has lingered for years, which accounts for the size of the total claim. Petroceltic is seeking the remaining $5 million in Egypt; its claims for interest are being made in Washington.

Petroceltic said that it filed the arbitration reluctantly. But if it wins, Egypt’s liabilities could explode. Other companies similarly situated – and there are a lot of them – could legitimately go after Egypt for billions of dollars in interest payments that it currently doesn’t have.

“We do not think we are being treated fairly and that this is a clear contravention of the Agreements entered into by the UK and Egyptian Governments,” said Angelo Moskov, chairman of Petroceltic (whose parent company recently was renamed Sunny Hill Energy). “The present situation is unacceptable and needs to be resolved as a matter of urgency.”

The Egyptian government counters that it has made some payments and doesn’t have to pay back interest. And who knows? The arbitrators might eventually agree.

But Petroceltic is taking the case seriously. It has gone so far as to challenge the appointment of one of the arbitrators, Brigitte Stern. It complains that she has enough ties to Egypt and the Egyptian government that she has a conflict of interest that cannot be overcome.

Stern disagrees and has declined to step aside. But Petroceltic has an argument. Stern was once a member of a scientific board at the Centre Rene-Jean Dupuy at the University of Alexandria in Egypt. She is an emeritus professor at the Université Paris 1 Panthéon-Sorbonne, which has a major institutional connection with Egypt. Its law department has an office in the University of Cairo, which is a public university there. She also used to teach at the Graduate Institute of Geneva, which has a partnership with the American University of Cairo.

Stern is one of the most often used arbitrators for cases in Africa and tends to be a strong advocate for the government side. Petroceltic believes that advocacy is too strong. At a speech to the United Nations in 2007, she said that governments have a monopoly in the establishment and applicability of the law because they can use armed force to trump private power. She caveated the remarks by saying her view wouldn’t influence her decisions in arbitration. But Petroceltic thinks otherwise.

Whether Stern stays in the case or not, the arbitration is a significant problem for Egypt. It could produce a sea change in the way it does business with overseas investors. If Petroceltic takes its case to the end and wins, Egypt’s recent economic advances could be halted in their tracks.

Gil Kapen

Gil Kapen is a Special Advisor at the American Jewish International Relations Institute and a former staffer on the House Subcommittee on Africa.

JUDGE ANDREWS GRANTS DEFENDANT’S MOTION FOR ISSUANCE OF A LETTER REQUEST TO OBTAIN EVIDENCE IN FOREIGN COUNTRIES THROUGH HAGUE CONVENTION

JUDGE ANDREWS GRANTS DEFENDANT’S MOTION FOR ISSUANCE OF A LETTER REQUEST TO OBTAIN EVIDENCE IN FOREIGN COUNTRIES THROUGH HAGUE CONVENTION

By Memorandum Order issued by The Honorable Richard G. Andrews in Compagnie Des Grands Hotels d’Afrique S.A. v. Starman Hotel Holdings LLC, Civil Action No. 18-00654 RGA (D.Del. July 26, 2019), the Court granted the motion of Defendant for issuance of a letter request to obtain evidence in the United Kingdom of Great Britain and Northern Ireland through the Hague Convention. Plaintiff opposed the motion claiming the evidence sought was irrelevant to the alter ego theory at issue in the matter, more easily obtained from Plaintiff, and that the request was a collateral attack on the International Chamber of Commerce arbitration award. Id. at *1 and 5.

In granting Defendant’s motion for the letter request, the Court noted that (1) both the United States and the United Kingdom are signatories of the Hague Convention; (2) courts “routinely issue such letters where the movant makes a reasonable showing that the evidence sought may be material or may lead to the discovery of material evidence; and (3) it was reasonable to conclude that documents possessed by Travelodge, the Guarantor, would contain information relevant to the alter ego issue – the potential undercapitalization of Woodman. Id. at *1-6.

A copy of the Memorandum Order, which contains a concise and helpful summary of the standards for the issuance of letters of request to obtain evidence in foreign countries that are signatories to the Hague Convention, is attached.

Gil Kapen

NEW TAX ARBITRATION RULES LOCK OUT KNOWN EVADERS

NEW TAX ARBITRATION RULES LOCK OUT KNOWN EVADERS

The Treasury has introduced new rules to guide alternative dispute resolution (ADR) for aggrieved taxpayers that lockout notorious evaders and cap dispute timelines.

Under the regulations that introduce a facilitator, specific legally backed timelines are introduced to prevent the disputes from becoming long-drawn-out for taxpayers.

The Kenya Revenue Authority (KRA) earlier said it had been unable to collect Sh283 billion from big taxpayers, thanks to a slow-paced Judiciary and failure by the Treasury to put in place the tax appeals tribunal (whose disputes are now admissible at ADR) to resolve disputes.

“ADR shall commence upon written communication by the appointed facilitator that a matter is eligible for ADR and shall be concluded within ninety (90) days thereof,” says the draft.

“A dispute shall not be eligible for Alternative Dispute Resolution where it is in the public interest to have judicial clarification of the issue (and) the parties have not complied with the provisions of the relevant tax legislation and there is evidence that the non-compliance is consistent or deliberate.”

KRA Deputy Commissioner Tax Dispute Resolution head Rispah Simiyu said the aim is to firmly anchor dispute resolution in the law by forming subsidiary legislation to be read together with the Tax Procedures Act No 29 of 2015.

“There were previously no ADR regulations, only the ADR Framework, which provides the general guidelines on how ADR is conducted on tax disputes at KRA,” she told the Business Daily.

“The ADR regulations will capture most of the areas highlighted in the framework and shed light on the procedures relating to the ADR process.”

KRA Commissioner-General James Mburu earlier said businesses and individuals aggrieved by tax demands were all too happy to file appeals before a tribunal they knew did not have a quorum or was, at best, moribund.

During this time, the disputed taxes could not be collected and taxman could do nothing. But under the new rules, the matter can be taken straight to courts.

“Defaulters took advantage of this vacuum to lodge cases at the Tax Appeals Tribunal and we could only wait,” said Mr Mburu in an earlier interview with the Daily Nation.

BRIAN NGUGI

COURT DOCUMENT SHOWS BUSINESS HISTORY OF P&ID, WHICH WANTS NIGERIA’S $9 BILLION

COURT DOCUMENT SHOWS BUSINESS HISTORY OF P&ID, WHICH WANTS NIGERIA’S $9 BILLION

The British company that got a $9 billion judgement against Nigeria has a history of business dealings in Nigeria, a court document seen by PREMIUM TIMES shows.

The P&ID is the British engineering firm at the centre of the recent controversial $9 billion arbitral award by a UK court against Nigeria.

The document is a First Witness Statement by the Chairman of P&ID, Michael Quinn, filed before the arbitration tribunal.

In the statement, Mr Quinn gave detailed background to the conception, and negotiation for the gas contract involving top representatives of key government agencies in the oil and gas industry.

Apart from the Nigerian National Petroleum Corporation (NNPC), other agencies’ representatives listed in Mr Quinn’s statement included the Department of Petroleum Resources (DPR), and the National Petroleum Investments Management Services (NAPIMS).

NAPIMS is the NNPC subsidiary responsible for representing all government’s equity investment interests in the joint ventures in the country’s oil and gas industry.

Also, identified as central to the contract negotiations is one of the International oil companies and joint venture partner to the NNPC, Addax Petroleum.

It was from an Addax oil field that P&ID was expected to get the gas required to run the failed gas processing facility.

Following the UK court’s final award against Nigeria a fortnight ago, several top government officials issued statements to reject the award, which they described as a conspiracy by a ‘shadowy firm’ to inflict economic damage on Nigeria.

GOVERNMENT’S DEFENCE

The Minister of information and Culture, Lai Mohammed, said last Thursday in Abuja during a media briefing that the government’s concerns were primarily about “the underhanded manner in which the contract was negotiated and signed.”

“Indications are that the whole process was carried out by some vested interests in the past administration, which apparently colluded with their local and international conspirators to inflict grave economic injury on Nigeria and its people,” Mr Mohammed said.

Also, the Attorney-General of the Federation and Minister of Justice, Abubakar Malami, said conception, signing and execution of the contract to supply gas did not involve either the IOC’s or NNPC.

Equally, the Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, said there was no evidence in the apex bank’s records that the contractor invested about $40 million in the botched project.

“We have gone through our records, we don’t have any information to show this company brought in one cent into this country,” the CBN official said.

QUINN’S BUSINESS HISTORY IN NIGERIA

A detailed review of the First Witness Statement revealed that prior to the controversial gas project, P&ID had undertaken other business contracts in Nigeria.

Apart from being incorporated on May 30, 2006, as a business with address at Tortola, in the British Virgin Islands, P&ID Nigeria Limited was also incorporated on July 21 of the same year In Nigeria, with its registered Nigerian offices at 12, Vaal Street, Off Rhine Street, Ministers Hill, Maitama, Abuja.

PREMIUM TIMES’ findings showed the company handled the manufacturing and installation of the $108 million 5,000 metric tons capacity bulk storage vessels for liquid petroleum gas (LPG) for the NNPC.

The project for gas pressure vessels located in nine sites across Nigeria was executed under the NNPC“Butanisation Project” to prompt domestic use of gas in the country.

Also, findings showed the company was involved in the $57 million contract for the mechanical, engineering and instrumentation installation and commissioning for the onshore aspect of the NNPC Bonny Island Export Terminal at Port Harcourt Refinery.

Other projects P&ID was found to have been involved in include the design, procurement, construction, installation, burial, commissioning and start-up of the Odidi Submarine Power (33 & 11 kV) and Fibre Optic Cable (36 Fibre Bundle) for Shell Western Division.

The $53 million contract entailed 33 km of 33 kV cable and 76 km of 11 kV cable laid through Niger Delta Swamps at depths of between four and 36 metres.

Other contracts include the procurement and construction work for the refurbishment of all fiscalisation, pumping and out loading facilities of Shell-Western Division’s Crude Loading Platform off the coast of Warri. The $18 million contract also includes the replacement of all utility fire and safety facilities and equipment, together with the complete rebuilding of the accommodation and communications module.

The firm also acted as the technical partner in a $16.7 million close-out audit on the $2.97 billion Bonga Field Development on behalf of NNPC and Shell, to determine the reasons for time and cost overruns of more than $1 billion on the project.

OTHER PROJECTS

Mr Quinn said it was due to his company’s track record in projects of this nature, that they were awarded contracts to conduct feasibility studies in various oil and gas projects in the country.

The projects include a feasibility and build-ability study for the $69 million. Cawthorne Channel gas Gathering Project and the associated cable and fibre-optics network by Shell Eastern Division.

A similar project was the feasibility and build-ability study for the cable and fibre-optics network for the Ubie Gbaran Gas Gathering Project.

The $92 million contract by Shell Western Division included the conceptual design of hybrid land and swamp handling, transport, lay and burial equipment.

Again, the company handled $78 million feasibility and build-ability study for the cable and fibre-optics network for the South Forcados Gas Gathering Project for Shell, with special emphasis on overcoming shallow water conditions and narrow waterway channels.

P&ID also handled the $84 million. build-ability study for the cable and fibre-optics network for the Shell Albatross Gas Gathering Project in Gabon, West Africa, including the provision of design services for specialist cable handling and lay equipment and subsequent construction supervision of the local contractor.

HOW CONTROVERSIAL CONTRACT WAS CONCEIVED

Mr Quinn said the contract was conceived during the tenure of the late former President Musa Yar’Adua, who doubled as the Minister of Petroleum Resources.

He said the idea of the project was first introduced to the then permanent secretary at the State House.

The official said he was advised to forward a proposal to the president in his capacity as minister of petroleum resources, while the then permanent secretary in the ministry of petroleum resources also proposed the need to seek a formal meeting with the president.

When P&ID proposal was being considered, Mr Quinn said he identified the Special Adviser to the President on Energy and Strategic Matters then as the late Rilwanu Lukman.

He said he also approached Mr Lukman and discussed the project with him.

On August 7, 2008, he said P&ID wrote to Mr Yar’Adua on a formal proposal for the project to be implemented.

The company was subsequently invited to meet the president, who, he said, directed that a presentation be made to the Minister of State at the Ministry of Petroleum Resources.

He said P&ID made the presentation to Mr Odusina and the Ministry of Petroleum Resources in October 2008.

Following his reappointment as Minister of Petroleum Resources on December 18, 2008, Mr Quinn said Mr Lukman in early 2009 directed P&ID’s proposal be further examined by the government.

P&ID was reportedly invited by the Special Technical Adviser to the Minister, Taofiq Tijani, to represent to the Minister for Petroleum Resources on February 24, 2009.

After the presentation, Mr Quinn said several top-level meetings were held involving the Ministry, NNPC, DPR, NAPIMS and Addax Petroleum to come with the gas sales and purchase agreement.

On January 11, 2010, Mr Quinn said the GSPA was executed by him on behalf of P&ID and Mr Lukman on behalf of the Nigerian government.

However, the setback to the contract, which may have laid the foundation for the dispute and arbitration was the call to Mr Quinn in the final week of June 2012 by Debo Spaine of Addax Petroleum.

Mr Spaine informed Mr Quinn that Addax’s headquarters in Switzerland had unilaterally decided to withdraw their cooperation and wished to “undertake the development of the NAG [non-associated gas] themselves”.

On February 10, 2012, Mr Quinnn said he wrote to the then newly-elected President, Goodluck Jonathan, to solicit his support.

He did not say what Mr Jonthan’s response was.

A similar letter was reportedly written in May 2012 to the then petroleum minister, Diezani Alison-Madueke.