NIGERIA: SHELL SAYS GOVT'S TAX CLAIMS MAY DELAY $10 BILLION BONGA OFFSHORE FIELD

NIGERIA: SHELL SAYS GOVT'S TAX CLAIMS MAY DELAY $10 BILLION BONGA OFFSHORE FIELD

Royal Dutch Shell said on Tuesday that Nigeria’s claims that it was owed billions in taxes could delay the development of a major oil field off the coast of the West African nation. Nigeria ordered several major foreign oil and gas companies to pay nearly $20 billion in taxes it says are owed to local states, industry and government sources told Reuters.

The Federal Government had in a letter sent to the companies earlier this year through the Nigerian National Petroleum Corporation, (NNPC), cited what it called outstanding royalties and taxes for oil and gas production.

Royal Dutch Shell, Chevron, Exxon Mobil, Eni, Total, and Equinor were each asked to pay between $2.5 billion and $5 billion, said the sources, who saw or were briefed on the letters.

Nigeria’s Minister of State for Petroleum Resources, Dr. Emmanuel Kachikwu, had told journalists earlier this month that the Federal Government recovered no less than N1.2 trillion in unpaid royalty from crude oil sales, following the Ministry’s automation initiatives.

With some oil firms yet to remit their royalty to the Federal Government at the expiration of the statutory deadline, the Minister stated that such firms may lose their licences if they fail to make remittances within the extended timeline. Shell, the largest investor in Nigeria, would likely dispute the charges, Shell’s head of upstream, Andy Brown, told Reuters on the sidelines of the International Petroleum Week conference.

“It is something that has gone through the courts in Nigeria, which relates to an original clause within the original PSCs (production sharing contracts),” he said in an interview.”We will have to take it seriously but we think it has no merits,” said Brown, who steps down from his role this year.

The outstanding tax issue will delay the final investment decision (FID) on developing Shell’s Bonga Southwest deepwater oil field, one of Nigeria’s largest with production expected to reach 180,000 barrels per day, Brown said.”We’ll need to resolve that before we ever FID the Bonga Southwest project,” he said.Shell has made progress with the government on some basic terms for operating the field but a decision on its development was now unlikely to be made in 2019. “Bonga Southwest’s FID may slip into next year.” Brown said.

In the Gulf of Mexico, Brown said Shell planned to move swiftly to develop the Whale discovery, which it announced in January 2018. Shell holds a 60 percent stake in the field and Chevron the remaining 40 percent.”We’re going to crack on with the development of this project,” he said, without giving a specific timeline for the development except to say it would be “fast”.He said the field had the potential to be developed into a new production hub for Shell in the Gulf of Mexico.

Shell and many of its peers have been cutting costs sharply for developing large offshore fields to compete with cheaper sources of oil such, as U.S. shale.

Femi Adekoya

DISPUTE RESOLUTION MECHANISM RAKES IN BILLIONS FOR ECONOMY

DISPUTE RESOLUTION MECHANISM RAKES IN BILLIONS FOR ECONOMY

2.9 billion shillings has been injected into the economy following the adoption of an alternative dispute resolution mechanism.

Chairman of the taskforce overseeing implementation of the court annexed mediation process, Justice William Musyoka says this is because of arbitration and mediation.

Speaking while presiding over the mediation roll out in Nakuru, Justice William Musyoka said methods such as arbitration and mediation are cheaper, quicker and less messy alternatives to litigation.

Justice Musyoka said that determinations made through a mediation process were more acceptable to all parties as compared to judgments delivered by judicial officers noting that the time for settling a dispute has reduced from 50 months in Commercial and Tax Division and 43 months in Family Division respectively to an average of 66 days.

Get breaking news on your Mobile as-it-happens. SMS ‘NEWS’ to 22163.

Justice Musyoka, who is also the Presiding Judge at the High Court in Kakamega added that the Judiciary has also given parties in disputes a chance to mend their broken relationships through mediation saying a total of 2.9 billion shillings has already been released into the economy by cases that have been resolved through mediation.

Court Annexed Mediation has already been rolled out in the counties of Mombasa, Eldoret, Kisumu, Nyeri, Machakos, Garissa, Embu, Kakamega and Kisii.

The Constitution of Kenya 2010 endorsed Alternative forms of dispute resolution.

UPDATE ON ICSID CASE AGAINST RWANDA

UPDATE ON ICSID CASE AGAINST RWANDA

American Miners, Bay View Group LLC and The Spalena Company LLC filed a case before the International Center for the Settlement of Investment Disputes (ICSID) against the Republic of Rwanda claiming that Rwanda has unfairly revoked their permit. The case was registered on December 12, 2018 although the claimants filed the lawsuit at ICSID in 2017.

The Republic of Rwanda is represented by the London law firm, Joseph Hage Aaronson and the claimants are represented by Duane Morris LLP. and the groups’ President, Roderick Marshall.

The parties have constituted their tribunal which consists of Ms. Barbara Dohmann, QC appointed by Rwanda, Mr. J. Truman Bidwell Jr appointed by the Claimants and Rt. Hon Lord Phillips KG has been appointed as presiding of the tribunal.

More information can be found here.

IARB Africa

TRIBUNAL COMPOSED IN ICSID CASE AGAINST SENEGAL

TRIBUNAL COMPOSED IN ICSID CASE AGAINST SENEGAL

In a dispute between African Petroleum Senegal Limited and Republic of Senegal instituted at the International Center for Settlement of Investment Disputes (ICSID) regarding Hydrocarbon Concessions, the parties have agreed upon the appointment of the arbitrators after a potential conflict was identified for African Petroleum’s’ previous nominee back in 2018.

The claimant appointed Hamid G. Gharvi, a dual French-Iranian national while the respondents appointed Bernard Hanotiau, a Belgian national. Both parties then appointed Laurent Lévy, a dual Brazilian-Swiss national to preside the arbitral tribunal.

The claimant, African Petroleum Senegal Limited has appointed Betto Serglini from Paris, France as their legal counsel whereas the respondent, the Republic of Senegal, is represented by Agent Judiciaire de l’Etat du Sénégal and Linklaters from Dakar, Senegal and Paris France respectively.

More on the case available here.

STATE COLLECTS ONLY 3.3PC LEVIES FROM OIL EXPLORERS

STATE COLLECTS ONLY 3.3PC LEVIES FROM OIL EXPLORERS

The Sh24, 632,192 has been recovered from Afren (EAX)/Octant Energy which responded to a demand notice that was also sent to other seven companies in 2018.

The ministry is demanding the Sh754 million to Camac Energy, Simba Energy, A-Z petroleum limited, Adamantine Energy Kenya limited, Imara Energy, Rift Energy and Zarara oil and Gas.

Petroleum ministry has recovered only Sh24.6 million or 3.3percent of Sh754 million that eight oil exploration companies owes it in surface and training levy.

The Sh24, 632,192 has been recovered from Afren (EAX)/Octant Energy which responded to a demand notice that was also sent to other seven companies in 2018.

The demand notes were dispatched three years after Auditor General Edward Ouko queried the failure by the firms to pay the levies from 2015.The ministry is demanding the Sh754 million to Camac Energy, Simba Energy, A-Z petroleum limited, Adamantine Energy Kenya limited, Imara Energy, Rift Energy and Zarara oil and Gas.

Two companies, Adamantine Kenya limited which has been exploring on block 11B and Imara Energy which was operating in block L2 have had their licenses revoked.

Energy principal secretary Joseph Njoroge and his Petroleum counterpart Andrew Kamau told Parliament that efforts have been made to engage the companies through telephone conversations and site visits before resorting to issue demand notes for payment.

“Oil and gas exploration is very expensive risk venture. Being a high risk venture explains the reasons why the ministry explores other avenues before resorting to contract termination,” Mr Njoroge told the Public Accounts Committee.

Mr Njoroge and Mr Kamau had been directed by the committee to explain why eight petroleum companies have failed to pay Sh754 million in the last three years.

On Tuesday, Mr Njoroge failed to explain why the companies had not paid surface and training fees as per their production sharing contracts since the financial year 2015/16. He said the ministry wrote demand letters to the firms, most of them international, to pay the outstanding amounts.

He sought more time to produce letters for three firms after he attached a list of five companies that the ministry wrote to on January 5, 2018, demanding payment of outstanding fees.

The companies are Lion Petroleum Corporation, A to Z Petroleum Products, Imara Energy, Rift Energy Kenya Limited and E and P Petroleum Limited.

On Friday, Mr Njoroge told MPs that the chances of companies pumping a lot of capital and getting a dry well is a common phenomenon which has had some companies relinquishing the blocks back to the government.

Mr Njoroge said some exploration companies have left the country after striking dry wells reducing the total number from 16 in 2014 to 11 currently.

He said despite the companies getting dry wells after sinking in billions of shillings, the companies acquire data such as gravity, magnetic, seismic and well data that is at the custody of the National Oil Corporation.

“There is a company that struck a dry well after spending $125 million (Sh12.5 billion) last year. However, despite this, the government gets data on exploration,” Mr Kamau said.

He said the ministry has been relying on information from the exploration firm who are required to pay the levies through the banks.

“In the future, we should ensure they provide a letter of credit (LC) but for now it is an open account. If they default to pay the levies we will cash in the LC,” Mr Kamau told the committee chaired by Opiyo Wandayi.

EDWIN MUTAI

A glimpse into arbitration in Mozambique

Podcast | Africarbitration

By Leyou Tameru (Founder @ I-Arb Africa)

iarb

We’re back with Season 2 and taking you to Mozambique! My guest, Pedro Couto, gives us a lot of great insight on the on-going amendment of Mozambique’s arbitration act, challenges facing arbitration in the country, capacity, legal infrastructure and recent developments towards the harmonization of the different legal instruments and shift of government attitude on arbitration. It’s so good it’s almost like a crash course!

Guests

Pedro Couto, Chairman of Couto, Graça & Associados (CGA) in Mozambique

Host

Leyou Tameru

Music

Ellias Fullmore

Editing

Editing: Tinsae Teferi

An I-Arb Africa Production

AfricArbitration is the podcast about Arbitration in Africa & Africa in arbitration. Produced by I-Arb Africa, it hosts dialogues and debates on arbitration related developments from across the continent through interviews with African arbitration experts

UNION FENOSA SAYS GUARANTEES NOT SUFFICIENT TO RESTART EGYPT LNG PLANT

UNION FENOSA SAYS GUARANTEES NOT SUFFICIENT TO RESTART EGYPT LNG PLANT

CAIRO, Feb 19 (Reuters) – Union Fenosa Gas (UFG) said it had not received sufficient guarantees over a $2 billion payment in ongoing talks with Egypt to restart a liquefied natural gas (LNG) plant which has been idle for several years due to a lack of gas supply.

UFG said in September that it was “in conversations with Egypt to restart the plant as soon as possible”, in an emailed response to Reuters over $2 billion a World Bank arbitration body ordered Egypt to pay the company. It did not elaborate.

Egypt had said it was “taking all necessary steps”, without elaborating, over the money it was ordered to pay to UFG because of a lack of gas supply to the Damietta plant, in which the Italian-Spanish company has a majority stake.

“Progress has been made but the guarantees offered are not sufficient to reach the comprehensive agreement required to bring the dispute to its end,” UFG said in a statement on Monday, adding talks were ongoing.

UFG said in 2013 Egypt was restricting supplies to the plant as it diverted export supplies to its domestic market. The plant has been idle since.

The Damietta plant in northern Egypt is 80 percent owned by UFG, a joint venture between Spain’s Gas Natural and Italy’s Eni , with the remaining 20 percent split evenly between the state-owned Egyptian Natural Gas Holding Company and Egyptian General Petroleum Corporation.

Reporting by Ehab Farouk, additional reporting by Ahmad Elhamy; Writing by Yousef Saba; editing by Emelia Sithole-Matarise

KENYA RECALLS AMBASSADOR OVER BOUNDARY DISPUTE WITH SOMALIA

KENYA RECALLS AMBASSADOR OVER BOUNDARY DISPUTE WITH SOMALIA

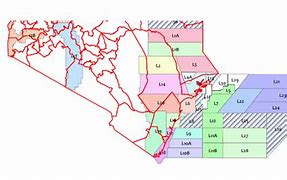

Kenya has recalled its ambassador from Mogadishu and asked Somalia’s ambassador to leave after accusing the Somali government of auctioning exploration blocks within disputed waters.

The two nations have been debating the location of their joint maritime boundary since 2009, when Somalia initiated an arbitration proceeding with the Commission on the Limits of the Continental Shelf. The Kenyan-claimed boundary line runs due east from the seaward terminus of the Somali land border, along a parallel at about 1.7 degrees S, and it dates back to 1979. Somalia seeks an alternate boundary line drawn equidistant from each nation’s shores. In 2014, after the two sides failed to reach an agreement in arbitration, Somalia filed a suit with the International Court of Justice. Kenya disputed the ICJ’s jurisdiction over the case, but the court disagreed and the case is proceeding.

“Somalia has since 1979 recognized and respected the maritime boundary between the two countries along a parallel of latitude. However, in 2014, shortly before filing its case with the Court, Somalia claimed a maritime boundary along an equidistance line, ignoring the 35-year practice of recognizing and respecting the maritime boundary along a parallel of latitude,” said the Kenyan government in a statement.

On Saturday, Kenyan foreign affairs secretary Macharia Kamau accused Somalia of making “a most regretful and egregious decision . . . to auction off oil and gas blocks in Kenya’s maritime territorial area.” Kamau alleged that Somalia had held an “outrageous and provocative auction” in London on February 7, and characterized it as a “act of agression against the people of Kenya and their resources.”

Somalia’s government immediately denied holding an offshore auction affecting Kenyan-claimed areas. “Somalia is not now offering nor does it have any plans to offer any blocks in the disputed maritime area until the parties’ maritime boundary is decided by the ICJ,” Somalia’s foreign ministry said in a statement on Sunday. Somalia added that it wished to “reassure the government of Kenya that it stands by its commitment not to undertake any unilateral activities in the disputed area until such time as the ICJ renders its judgement.”

The dispute with Somalia would directly affect three E&P blocks that Kenya leased to Eni in 2012, and the boundary has bearing on potentially significant offshore oil and gas resources. In 2014, shortly before Somalia filed suit at the ICJ, Pancontinental and BG Group announced a significant find southeast of the contested area. “It is the only offshore oil column ever reported seaward of the eastern coastal margin of the African continent, from South Africa to the northwest tip of Somalia,” said Pancontinental CEO Barry Rushworth in announcing the find. “We believe that this is a play-opening discovery in Kenya’s Lamu Basin.”

Separately, the diplomatic dispute may also complicate the Kenyan-backed joint peackeeping effort in Somalia, which relise heavily upon troops contributed by other African countries. Kenya has supplied about 3,500 soldiers for the long-running operation against Somalia’s al-Shabaab militant group.

Bassey Udo

EGYPT- PETROCELTIC THREATENS INTERNATIONAL ARBITRATION AGAINST EGPC TO SETTLE $30M ARREARS

EGYPT- PETROCELTIC THREATENS INTERNATIONAL ARBITRATION AGAINST EGPC TO SETTLE $30M ARREARS

Petroceltic International, the UK based energy company, announced on Sunday its intention to commence arbitration proceedings in the World Bank-managed International Centre for Settlement of Investment Disputes against the Egyptian General Petroleum Corporation (EGPC), for the breach by the EGPC of its obligations under multiple gas sales agreements, and in particular the EGPC’s inability to pay its debts as they fall due for payment.

Petroceltic’s Chairperson, Angelo Moskov, told Daily News Egypt that the total arrears account for $30m.

‘We do not threaten international arbitration lightly, but we are at the end of our patience with the EGPC: the current situation is totally unacceptable. I would strongly urge the EGPC to rectify its current default without further delay to restore cordial relationships between our two respective companies and to send a positive message to the international investment community,’ Moskov added.

On the other hand, the EGPC responded that Petroceltic abides by its exploration and production concession in accordance with the agreement, and that the authority sent a letter to the company on 7 February 2019 assuring the EGPC’s absolute commitment to all the contracts concluded.

The EGPC added that this is evident by the authority’s payment of $6m worth of arrears in December 2018 to Petroceltic in order for the company to fulfil its obligations under the agreements, and to provide the necessary funds to finance the operations until the completion of the abdication process.

‘We call on Petrolectic to overcome this dispute by fulfilling the mutual obligations of all parties,’ the statement concluded.

MENAFN – Daily News Egypt

NDC SIGNED $46M FERTILIZER DEAL AFTER DEFEAT

NDC SIGNED $46M FERTILIZER DEAL AFTER DEFEAT

It is turning out that the multi-million agreement between the Dr. Stephen Opuni-led COCOBOD and companies of businessman Seidu Agongo for the supply of fertilizers was signed at a time the previous Mahama administration had been defeated embarrassingly and was on its way out of government.

The said contracts with three of Seidu Agongo’s companies were signed on December 19, 2016 but the Ghana Arbitration Centre unanimously held last week that the agro-chemical products did not go through ‘proper testing’ protocols and therefore the claimant is not entitled to the whopping $46.460 million sought as reliefs against the state agency.

The tribunal said the contracts were “separate but substantially identical” and they were all signed on the same day.

The companies involved were Agricult Ghana Limited, which was billed to supply Lithovit liquid fertilizer estimated at $26.5 million, Sarago Limited, which was contracted to supply Duapa Fertilizer worth $14 million and Alive Industries Limited, which had been contracted to supply Acati Power estimated at $5.960 million.

Per the claims filed by Mr. Agongo during the arbitration on behalf of his three companies, COCOBOD had agreed that Agricult Limited should supply 1,000,000 litres of Lithovit Liquid Fertilizer, Sarago Limited should supply 400,000 bags of Duapa Fertilizer and Alive Industries Limited was supposed to supply 200,000 litres of Acati Power Insecticide.

The arbitration tribunal panel was chaired by eminent international arbitrator Nana Dr. S.K.B. Asante, with Mr. Agongo’s arbiter Kizito Beyuo and Justice Francis Emile Short, former CHRAJ boss, as Cocobod’s representative, assisting.

Mr. Agongo was represented by former GBA President Benson Nutsukpui while COCOBOD used prominent lawyer Phillip Addison as its counsel.

The tribunal held that upon the assumption of office of President Akufo-Addo, a multi-party transition team was established pursuant to provisions of Act 845 to perform functions duly prescribed in the said Act 845 for the purposes of effecting a transition of political power and the administration from the previous government to the new government.

Subsequently, the tribunal said evidence was given that sub-committees of the said Transition Team were established and one of the said sub-committees dealing with the agricultural sector conducted preliminary enquires which led to the conclusion that the full testing cycle had not been complied with in procuring the products of the claimants.

“The said sub-committee subsequently recommended to the Transition Team that the new management of COCOBOD should take appropriate action on the said preliminary findings.

The tribunal held that the said recommendation ultimately led to the issuance of letters abrogating the contracts.

“The Tribunal does not find any of the above steps taken by the respondent (COCOBOD) to be improper, illegal, or otherwise actuated by political expediency. The said steps were consistent with the provisions of the Act,” it added.