CONGO LOST $617 MILLION DISPUTE BEFORE APPROVING OIL DEAL

CONGO LOST $617 MILLION DISPUTE BEFORE APPROVING OIL DEAL

An international court ordered the Democratic Republic of Congo to pay DIG Oil Ltd. of South Africa $617 million for failing to honor two oil contracts, weeks before outgoing President Joseph Kabila finally approved one of the deals.

The previously undisclosed ruling is the latest twist in an 11-year dispute over concessions in the central African nation, which may hold as much as 6 percent of the continent’s oil reserves. Kabila’s belated assent to one of the contested contracts suggests the state may be seeking ways to avoid paying the penalty.

The Paris-based International Court of Arbitration said Congo “failed to execute its obligations” by withholding presidential approval of production-sharing agreements signed in December 2007 and January 2008, according to a Nov. 7 ruling seen by Bloomberg and verified by the Oil Ministry and DIG Oil.

DIG Oil sealed the first contract for three blocks in central Congo and was part of a consortium of companies that secured the latter for a single permit in the east of the country. After Kabila didn’t provide the necessary approval for both agreements, it sought to terminate both accords and win damages, rather than have them enforced. One of the contracts was re-allocated to new investors more than eight years ago.

Andrea Brown, executive director of DIG Oil, and Oil Ministry Chief of Staff Emmanuel Kayumba declined to comment on the ICA’s decision.

GERTLER PERMITS

DIG Oil filed its case at the ICA in October 2016, after Kabila transferred the eastern permit in mid-2010 to companies belonging to Israeli businessman Dan Gertler and hadn’t yet certified its contract for the other three licences. The ICA agreed with DIG Oil that Congo unilaterally violated “in an untimely and illicit manner” the first deal by reattributing the block and failed to deliver presidential approval for the other “within a reasonable time.”

The court ruled that Congo must pay DIG Oil almost $598 million in compensation and about $19 million to cover its spending on the permits. The Oil Ministry authorized the company to carry out certain works on both license areas, despite the lack of Kabila’s official approval, according to the ruling.

DIG Oil’s calculations of future economic losses were based on a report prepared at its request by Deloitte LLP and weren’t contested by Congo, according to the decision.

PRESIDENTIAL ORDINANCE

The license in east Congo — Block 1 — continues to be held by two British Virgin Islands-registered companies belonging to Gertler, who was sanctioned by the U.S. in 2017 for allegedly exploiting his friendship with Kabila to make a fortune through corrupt mining and oil deals — a charge both men deny.

Kabila, who stepped down in January after 18 years in office, signed an ordinance approving the other contract — for Blocks 8, 23 and 24 — on Dec. 13, even though the ruling had deemed it “appropriate to grant” DIG Oil’s request for the deals to be terminated and damages awarded.

The approval of that agreement heightened concerns that the world’s second-largest rainforest will be opened up to oil exploration because one of the permits encroaches on territory inside Salonga National Park, a Unesco World Heritage site. Oil exploration and production is currently banned in the reserve.

Former opposition leader Felix Tshisekedi won elections in late December and succeeded Kabila on Jan. 24. DIG Oil wishes to “engage the new administration on the outcome of the hearing and possible solutions,” Brown said in an emailed response to questions.

Tshisekedi has yet to appoint a prime minister or a cabinet.

“We will have to wait for the formation of the new government,” Emmanuel Kayumba, chief-of-staff to outgoing Oil Minister Aime Ngoy Mukena, said when asked how Congo will respond to the ICA ruling.

NIGERIA: ARBITRATION TRIBUNAL AWARDS GOVT $1.69BN OVER DISPUTE ON BRASS, FORCADOS ASSETS

NIGERIA: ARBITRATION TRIBUNAL AWARDS GOVT $1.69BN OVER DISPUTE ON BRASS, FORCADOS ASSETS

An Arbitral Tribunal sitting at the Lagos Court of Arbitration has awarded the federal government a whopping $1.69bn in a dispute between the Nigerian Petroleum Development Company (NPDC) Limited and Atlantic Energy Drilling Concepts Nigeria Limited and Atlantic Energy Brass Development Ltd.

The landmark award in favour of the government came just as reports revealed that the protracted legal battle between a British firm, Process and Industrial Developments Limited (P & ID) and the Nigerian Government has taken a turn for the worst as the foreign firm, which won a staggering judgment, now worth $9 billion against Nigeria is trying to confirm the award in courtrooms in the United States and London, which would allow it (P&ID) to start seizing Nigerian assets in the U.S. and the U.K.

The arbitral proceedings in Nigeria was instituted by the claimants, Atlantic Energy Drilling Concepts Nigeria Limited and Atlantic Energy Brass Development Limited) on August 15, 2016, against the NPDC.

In resolving the dispute in favour of NPDC, the Arbitral Tribunal dismissed Atlantic Energy’s claims and awarded the sum of US$1,690,900,391.39, US$200,000 and N1,500,000 as costs in favour of NPDC.

It directed that the amount be paid within 21 days from the date of the Award for crude oil lifted from OMLs 26, 30, 34 and 42 (Forcados Assets) and OMLs 60, 61, 62 and 63 (Brass Assets).

The tribunal affirmed all the submissions of the lead counsel to NPDC, Professor Fabian Ajogwu (SAN) of Kenna Partners, who held that Atlantic Energy and its sister companies were indebted to NPDC for their failure to perform their financial obligations under the respective Strategic Alliance Agreements (SAAs).

Chika Amanze-Nwachuku and Davidson Iriekpen with Aagency Report

PROFESSOR MENYE TO CHAIR ARBITRATION COMMITTEE FOR G.A.A IMPASSE

PROFESSOR MENYE TO CHAIR ARBITRATION COMMITTEE FOR G.A.A IMPASSE

Accra, March 05, GNA – Professor Aboagye Menye, a former provost, Kwame Nkrumah University of Science and Technology (KNUST), will chair a three-member committee to handle, an out of court settlement for the Ghana Athletics Association (GAA).

Other members of the committee are; Mr. Richard Quarshie, a Sports Administrator and lawyer Akua Pokua Kwarteng, a legal practitioner as members.

The committee, is to submit its report to Professor Peter Twumasi, Director General, National Sports Authority (NSA) within fourteen (14) days of appointment.

The committee acting as an independent body, is expected to resolve the issue and pave way for congress to hold elections, after an Accra High Court directed that, the case should be settled out of their jurisdiction.

It would be recalled that at the last court hearing, the sitting Judge advised the two parties to consider an out of court settlement, since the sport is affiliated to regulatory bodies such as the NSA and the Ghana Olympic Committee (GOC).

A release signed by Mr. Charles Obeng Amofah, Ag. Head, Public Relations Unit, NSA noted that the two parties have been advised to appear before the court on March 26, 2019, if they fail to agree on the final outcome of the out of court arbitration.

Meanwhile the Professor Twumasi led administration have been clamouring for the various associations to set up arbitration committee to handle internal matters.

Emmanuel Asante Attakora

HEDGE FUND JOINS FIRM IN $9BN NIGERIA CLAIM

HEDGE FUND JOINS FIRM IN $9BN NIGERIA CLAIM

A hedge fund managed by VR Capital Group has taken a large stake in Process & Industrial Developments (P&ID), an energy company that won a claim against Nigeria which is now worth $9bn.

P&ID, a small energy company founded by two Irishmen, is trying to make Nigeria settle or allow the company to start seizing assets, according to a report from Bloomberg.

Nigeria did not honour a deal allowing the small natural gas company to harvest hydrocarbons.

Two years ago, P&ID won a decision against the government of Nigeria, with a London arbitration tribunal awarding it $6.6bn while interest of $1m is accruing daily.

P&ID, owned by the hedge fund and a firm called Lismore Capital, has hired lobbyists, lawyers, and a public-relations firm to press for collection of the award.

The legal team is also trying to confirm the award in Washington and London courts, which would allow P&ID to start seizing Nigerian assets in the US and the UK.

The company was founded by Irishmen Brendan Cahill and Michael Quinn, a music manager and oil man who died in 2015.

Cahill told Bloomberg: “It is disappointing that Nigeria chose to repudiate the terms of a deal that would have benefited the country by bringing electricity to millions of its citizens.”

Samantha McCaughren

COURT REFERS ANLCA DISPUTE TO ARBITRATION

COURT REFERS ANLCA DISPUTE TO ARBITRATION

A Federal High Court in Lagos has referred a dispute involving some members of the Registered Trustees of Association of Nigeria Licensed Customs Agents (ANLCA) to arbitration.

Justice Saliu Saidu stayed proceedings in the case, pending the conclusion of arbitration by the parties in accordance with ANCLA constitution.

The judge gave the directive on February 14, after discharging an earlier ex- parte order it granted on January 9, this year.

This is contrary to report that the judge had vacated restraining order on the group’s election.

The directive followed an application by first defence counsel O.A Yakubu and 2nd to 20th defendants’ counsel Dada Awosika, while the plaintiffs were represented by I. J. Olabode.

Justice Saidu held: “If all the plaintiff is seeking for are just interpretation of ANCLA, then there will not be any need for an interim order of this court. I hereby discharge the ex-parte order dated January 19 2019 and by virtue of Section 5 of the Arbitration and Conciliation Act, I stay proceedings in this case, pending the arbitral proceedings by the parties herein in accordance with the constitution of ANCLA.”

In the suit, marked, FHC/L/CS/05/2019, a faction of ANLCA in Lagos led by Batuns International Global Link and Mr Babatunde Adekoya were the plaintiffs.

They sued the Registered Trustees of ANLCA and 19 others, praying the court for, among other reliefs, an order stopping the defendants from conducting elections into the different offices into the Lagos chapter of the association.

Other defendants in the suit are: Mac-Tonnel Nigeria Limited, Mr. Tony I. Nwabunike, Wealthy Honey Investment Limited, Mr. Kayode Farinto, Mickey Excellence Nigeria Limited, Mikhaila Babatunde and 13 others.

Robert Egbe

MINING GROUP AGREES TO WALK AWAY FROM SIMANDOU PROJECT AFTER DEAL WITH GOVERNMENT

MINING GROUP AGREES TO WALK AWAY FROM SIMANDOU PROJECT AFTER DEAL WITH GOVERNMENT

The mining group controlled by the controversial tycoon Beny Steinmetz is to walk away from a massive iron ore project in Guinea as part of an agreement that settles a long-running corruption dispute with the west African nation.

Development of Simandou – one of the world’s biggest iron deposits, containing billions of tonnes of high-grade ore – has been hindered by years of legal wrangling as well as the enormous cost of the required infrastructure, estimated at more than $20bn (£15bn).

Guinea had levelled corruption allegations at Steinmetz’s BSG Resources (BSGR) and stripped the company of its rights to the Simandou blocks and the smaller Zogota concession. BSGR denied any wrongdoing and responded by filing a notice of dispute at the International Centre for Settlement of Investment Disputes.

On Monday, BSGR said it would drop its claim on Simandou after reaching an agreement with the Guinea government in which the two parties will withdraw outstanding actions related to the dispute. The agreement, if implemented, should remove one obstacle to the mine being developed and is expected also to allow investment in the separate Zogota iron ore deposit nearby, in which BSGR remains interested.

In a statement, BSGR said: “Following this agreement, BSGR relinquishes its claims on blocks 1 and 2 of Simandou and both parties waive all outstanding procedures.”

Steinmetz and BSGR have attracted their fair share of controversy over the past five years. Having seen BSGR stripped of its Guinea mining rights is 2014, Steinmetz was arrested in his home country of Israel in 2016 over claims that he arranged for bribes to be paid to gain access to Simandou. Steinmetz has denied any wrongdoing. A company spokesman said he did not know if the Israel investigation is ongoing.

BSGR, which voluntarily entered administration last year to protect itself from legal disputes related to a project in Guinea, also indicated that it hopes to be involved in efforts by new investors to develop the Zogota iron ore deposit in the near future. It refused to comment on whether any future involvement at the Zogota site was part of the settlement agreement or if the company would now come out of administration.

Rival mining firms are also showing an interest in investing in Zogota, possibly as part of a deal involving BSGR.

One of them is Niron Metals, which is headed by Sir Mick Davis, chief executive of the Conservative party and the former boss of the mining group Xstrata.

A spokesman for Niron said: “The announcement [that Guinea and BSRG have agreed to settle their legal claims] has paved the way for the creation of an effective mining partnership between Niron and the government to mine this deposit. The company looks forward to bringing this to fruition subject the satisfactory settlement of all disputes between the parties.”

Guinea’s mines minister, Abdoulaye Magassouba, told Reuters: “We are pleased there’s been an amicable resolution of the dispute with BSGR, particularly since Guinea will recuperate the world-class deposit of Simandou’s blocks 1 and 2.”

Simon Goodley

BABALAKIN EXTOLS ARBITRATION, ADR PUBLICATION

BABALAKIN EXTOLS ARBITRATION, ADR PUBLICATION

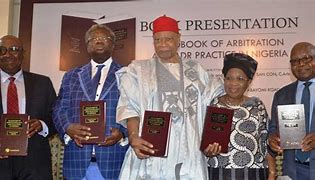

Pro-Chancellor of the University of Lagos (UNILAG), Dr. Wale Babalakin (SAN), has described as timely, book published by two accomplished chartered arbitrators on arbitration and Alternative Dispute Resolution (ADR) practice. Babalakin, who commended the authors said the book is very topical.

The book titled: “Handbook of Arbitration and ADR Practice in Nigeria” was authored by the founding member of the Board of Governors of the Cairo International Centre for Arbitration and the Kigali International Arbitration Centre (KIAC), Chief (Mrs.) Tinuade Oyekunle, and a former Attorney-General of the Federation (AGF) and Minister of Justice, Chief Bayo Ojo (SAN).

Oyekunle and Ojo, both described as Nigeria’s first and second chartered arbitrators, launched the book last Thursday at the Nigerian Institute of International Affairs in Lagos.

The event was honoured by arbitrators, Alternative Dispute Resolution (ADR) practitioners, jurists, senior lawyers, among others.

A former Nigerian Permanent Representative to the United Nations, Chief Arthur Mbanefo recommended that the book “be adopted by all institutions of legal studies and practice in Nigeria as a standard text book for arbitration and ADR practice in Nigeria as well as a useful book for reference purposes.”

Mbanefo, the chairman of the event, said: “The importance of this book becomes clear when one considers the current growth in the practice of commercial arbitration and ADR in Nigeria.”

Mbanefo commended the authors for their contributions to the knowledge of ADR.Director of Research Nigerian Institute of Advanced Legal Studies (NIALS), Prof. Paul Idornigie (SAN), who reviewed the book, praised the authors for bringing their nearly joint 80 years of arbitration experience to bear on the subject matter.

“The authors are very competent to write a book of this nature,” Idornigie said.He noted that the title of the book had been a subject of debate among academics, and that with its 24 chapters and 521 pages, the book drew attention to some lacunae in the Arbitration and Conciliation Act (ACA), such as the non-definition of arbitration. Idornigie, however, observed that while conciliation and mediation were consensual, arbitration was both consensual and adjudicatory.

The professor noted the authors’ views that the rapid expansion of ADR around the world, might one day replace litigation in civil matters.

According to him, government support is imperative.The book presenter at the event was the chairman, Gibraltar Holdings Ltd, Sir Olu Okeowo. Co-author, Oyekunle recommended the book to everyone. She said: “The taste of the pudding is in the eating and, when our colleagues handle the book, read it, I’m sure it will be of great benefit, to everyone, including judges, in-house lawyers, students, etc. The book is very comprehensive.”

Explaining the idea behind the book, Ojo said: “The whole idea is to let people – students, judges – be knowledgeable about the process. For those who are practitioners, it is a ready companion, a ready tool which they can use as a reference from day to day.

“You find that in Nigeria, people hardly write books, we don’t have this book culture, so there is a dearth of books in most areas, so, this is to put something down for the coming generation to learn from, to get inspired and to achieve greater heights.”

Guests at the launch included Justice of the Court of Appeal, Justice Folashade Ojo, Adetunji Fadairo (SAN), Prof Fidelis Oditah (SAN), Kemi Balogun (SAN), Ayodele Akintunde (SAN), Tunde Busari (SAN), Adetunji Oyeyipo (SAN), among others.

Joseph Onyekwere

UGANDA: OIL CASH JUDGMENT SET FOR MAY 31

UGANDA: OIL CASH JUDGMENT SET FOR MAY 31

Kampala — The judgment in the Shs6b oil cash bonanza dubbed “handshake” petition has been set for March 31 at the High Court in Kampala.

Former Uganda Revenue Authority (URA) lawyer Ali Sekatawa sued government through Attorney General, Parliamentary Commission and Parliamentary Committee on Statutory and State Enterprises (Cosase) seeking for a judicial review of the findings and recommendations of oil cash bonanza.

In the same case yesterday the lawyers from Parliamentary Commission, Ms Stina Cherotich and Mr Solomon Kirunda, withdrew their application that was seeking to have the petitioner [Mr Sekatawa] and Attorney General Mr William Byaruhanga cross-examined. This case was filed in September 2017.

ABANDONING CROSS-EXAMINATION

“Following consultation with our superiors, we have decided to abandon the cross-examination of both the applicant and the Attorney General” Ms Cherotich told court.

The presiding judge Andrew Bashaija subsequently fixed March 13 for the applicant to file their scheduling notes and serve the respondents while the respondents file their reply on March 29 and rejoinder on April 5 and then the judgment will be delivered on May 31.

Juliet Kigongo

GFF PREPARES TO TAKE TOGO’S OLUFADE MATTER TO CAS

GFF PREPARES TO TAKE TOGO’S OLUFADE MATTER TO CAS

Gambia Football Federation (GFF) is preparing to take their appeal against Togo over the eligibility of player Adewale Olufade to the Court of Arbitration for Sports (CAS), Director of Communication Baboucarr Camara told our reporter at the Football House in Kanifing.

The country’s football federation protested against Togo for fielding ineligible player Olufade for the bi-annual biggest football fray qualifiers against the Scorpions, last October in Lome.

Mr. Camara said they are still discussing with their lawyers before formally taking the matter to CAS, noting that there is still time left for them to file their appeal, saying they have gathered enough evidence to present to CAS for the appeal.

He called on Gambians to be patient, noting that they will do everything possible within their powers to see justice.

Last week, the Confederation of African Football (CAF) dismissed GFF’s appeal over the defender’s eligibility and upheld the original decision of its disciplinary board. They have earlier dismissed the first protest which claimed that the player, also known as James is not eligible to play for Togo because he does not meet the criteria.

Gambia is currently occupying bottom place in Group D of the 2019 Africa Cup of Nations qualifiers with Togo leading them on better head-to-head record. Both sides are on five points – two adrift of second placed Benin. Algeria has already qualified from the group.

In the final round of Nations Cup qualifier in March, Benin will host Togo while The Gambia will face Algeria.

Arfang M.S. Camara

ICJ: BRITAIN MUST GIVE DIEGO GARCIA BACK TO MAURITIUS

ICJ: BRITAIN MUST GIVE DIEGO GARCIA BACK TO MAURITIUS

In a 13-to-1 decision, the International Court of Justice has ruled that the UK should give the Chagos Islands back to Mauritius, the archipelagic nation that once owned them. The ruling covers Diego Garcia, the strategic American naval base on a British-controlled atoll.

“[The UK’s] continued administration constitutes a wrongful act,” ICJ president Abdulqawi Ahmed Yusuf wrote for the majority. “The UK has an obligation to bring to an end its administration of the Chagos archipelago as rapidly as possible and . . . all member states must co-operate with the United Nations to complete the decolonization of Mauritius.”

Britain captured Mauritius from the French in 1810 and ruled it until independence in 1968. Prior to the advent of Mauritian self-rule, Britain separated the Chagos Islands and designated the archipelago an overseas territory. The UK claims that the islands are its own sovereign territory, but allows that they will become part of Mauritius’ sovereign territory later (once they are no longer needed for defense purposes).

According to the Permanent Court of Arbitration in the Hague, the British decided to keep the Chagos Archipelago in order to accommodate America’s interest in Diego Garcia. The island is an ideal location for a naval station, far from population centers but within reach of multiple theaters in the Middle East, East Africa, Central Asia and the Indian Ocean. Beginning in 1968, the UK and US removed an estimated 1,000-1,500 inhabitants from the island and built a secure military facility, which has served a critical defense function for fifty years. Like the largest Chinese-occupied islands in the South China Sea, Diego Garcia features a military-grade runway suitable for heavy bombers, along with deepwater anchorages, piers, hangars and fuel depots. It is home to a large store of military equipment and munitions stowed aboard Military Sealift Command fleet auxiliaries, part of the Maritime Prepositioning Force program.

In 2017, the UN General Assembly voted to refer the matter of the Chagos’ ownership to the International Court of Justice. ICJ has now ruled in Mauritius’ favor, but its decision is advisory and non-binding, and the UK’s Foreign Ministry said only that it would “look at the detail of it carefully.”

The African Union expressed satisfaction at news of the ruling. “It is unthinkable that today, in the 21st century, there is a part of Africa that still remains subject to European colonial rule,” AU counsel Namira Negm said in a statement. “The full decolonisation of Mauritius, and of Africa, is long overdue. The ICJ has made it clear that this must be accomplished today and not tomorrow. Only then the Africans can be free and the continent can aspire to live free of colonialism.”

MAREX